UEZ hits the Korean market

On the 8th to 10th of June 2022, the team from UEZ Markets attended the breathtaking Smart Tech Korea 2022 expo in the wonderful city of Seoul

The entire team was flown in 2 days earlier to take in the sights of this modern-day megacity. From the architecture to the culture of Korea, it was an overall amazing experience for the UEZ team.

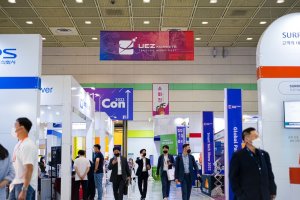

The event was held in the COEX Convention Center, one of the busiest convention centers in Korea. Smart Tech Korea expo had over 250 vendors and at least 20,000 attendees graced the event. UEZ Markets was there to showcase its technology and AI algorithms to the public.

Led by Mr. Conor Burns (CEO) and Mr. Mason Kong (Senior Vice President), the technical staff and marketing team were all there to share the nuances of AI Trading and Discretionary Trading to interested participants.

“This show was a big success, with a lot of interest from expo participants as well as the chance to meet many potential corporate partners across Asia,” Mr Burns shared.

Coming to the expo allowed UEZ Markets to better understand the needs of the Asian markets. The product and marketing team gained valuable experience and is now more confident in developing products more suitable for the Asian markets going forward.

The team had a great time in Korea and look forward to attending more expos internationally as they continue to grow into a successful global organization.