UK not wish to participate in Greece bailout program

The British finance minister George Osborne will resist calls for Britain to take part in the latest Greece bailout program, amid anger in Downing Street, the idea was dropped from the European Commission with the support of France. On Tuesday, the Minister will say to my colleagues from the eurozone, the idea that Britain is […]

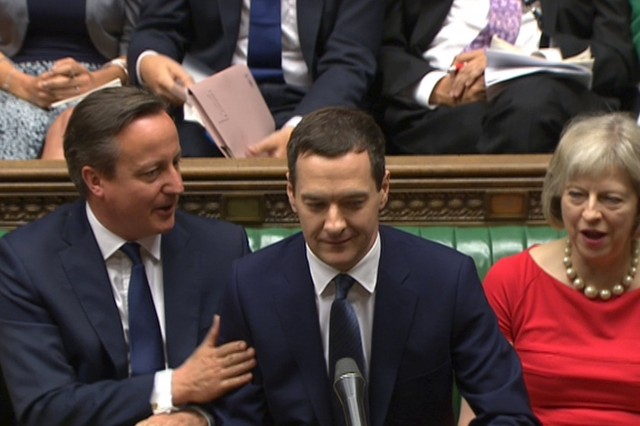

The British finance minister George Osborne will resist calls for Britain to take part in the latest Greece bailout program, amid anger in Downing Street, the idea was dropped from the European Commission with the support of France. On Tuesday, the Minister will say to my colleagues from the eurozone, the idea that Britain is involved in the rescue package for Greece is unacceptable and would be in breach of the agreement between EU leaders in 2010. He is expected to say in Brussels that item. Pomegranate. European Financial Stabilisation Mechanism (EFSM), a fund which includes all 28 EU member states can not be used to provide loans to Greece. UK share of EFSM is estimated at around 1 billion EUR. Its position Osborne has already informed some colleagues, including German Finance Minister Wolfgang Schaeuble.

The British finance minister George Osborne will resist calls for Britain to take part in the latest Greece bailout program, amid anger in Downing Street, the idea was dropped from the European Commission with the support of France. On Tuesday, the Minister will say to my colleagues from the eurozone, the idea that Britain is involved in the rescue package for Greece is unacceptable and would be in breach of the agreement between EU leaders in 2010. He is expected to say in Brussels that item. Pomegranate. European Financial Stabilisation Mechanism (EFSM), a fund which includes all 28 EU member states can not be used to provide loans to Greece. UK share of EFSM is estimated at around 1 billion EUR. Its position Osborne has already informed some colleagues, including German Finance Minister Wolfgang Schaeuble.

“Our colleagues from the Eurozone were a clear message from us, it would be unacceptable again to have British support in this area”, reported the Ministry of Finance in London. “Just the idea of using the money to the British taxpayer last agreement with Greece is unreasonable”, explain the UK ministry.

The idea of participation and the UK in the Greek rescue plan emerged during the highly trained talks between Eurozone leaders in the early hours of Monday morning. Several participants in the meeting, however, have expressed concern about the use of emergency funds on behalf of all 28 Member States, without consulting this with London, where David Cameron’s objections to the use of the fund are well known.

“Maybe avoided Grexit, but caused Brexit”, said one of those present at the meeting. In 2010 British Prime Minister David Cameron has been assured that the then European financial stabilization mechanism (EFSM) of all EU countries will provide more utilities for Eurozone countries. This is expected to make the 19-member Eurozone.

France had little appetite for the use of the EFSM, whose funds can be activated by qualified majority voting on the recommendation of the Commission. Greece must pay the European Central Bank 3.5 billion EUR on Monday next week, but as the International Monetary Fund has priority over all other creditors, Athens must repay the IMF prior to repay to the ECB, which means Greece has to pay 7 billion EUR on Monday. Other 5 billion EUR are needed in August to meet such tranches.

About half of those 7 billion EUR may come from profits from the Greek bonds held by the ECB – a profit that was promised to Athens as part of a second bailout agreement in 2012. But the euro area is difficult to find quickly the rest of the amount and on the EFSM is seen as a quick source of money.