Weekly FX Recap: Commodity Currencies Strike Back

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA As the SP 500 manages to keeps its head above the 2020.00 level, analysts and market gurus may argue all they want about earnings and forecasts commenting about the excess in valuations. However, as the Sub-normal keeps developing due anemic growth and counterfeit […]

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

As the SP 500 manages to keeps its head above the 2020.00 level, analysts and market gurus may argue all they want about earnings and forecasts commenting about the excess in valuations.

However, as the Sub-normal keeps developing due anemic growth and counterfeit money, there is no doubt that risky assets no matter their current price are going to receive greater allocations in the months ahead.

The Japanese Yen seems to be the only asset to express the awful truth about an economic shock Central Bankers want to avoid at all cost.

Wages stagnation another major concept with tangible and marginal effects in our lives, is, in fact, the real reason why it cannot be possible to keep growing as we were 20 years ago.

Yes, consumers are broke. And yet, without the participants’ commitment to becoming effective and efficient producers the solution to the problem walk away from us with every step forward we make.

This week we had all the action focused on the US dollar weakness after that report the US economy publishes the 1st Friday of every month. Please, just tell me you do not believe that?

Truth be told, it has more to do with the current financial landscape than reports or data. Note that figures always are subjective to those with power. Weak US data is convenient and necessary to balance the equation. The Dollar Long/Short Gold trade cornered many players that had no other alternative to adjusting their positions and reduce risk from their portfolios.

Let’s think about it for a minute:

- What are we going to do with an EURUSD trading in the year 2016 at 0.8700 cents?

- How do we expect to consumers to make a comeback with no inflation?

- What increase can we expect if wages are the same or worse than 20 years ago? (this if you adjust current money cost and daily living expenses)

It is an organized attack on the US dollar.

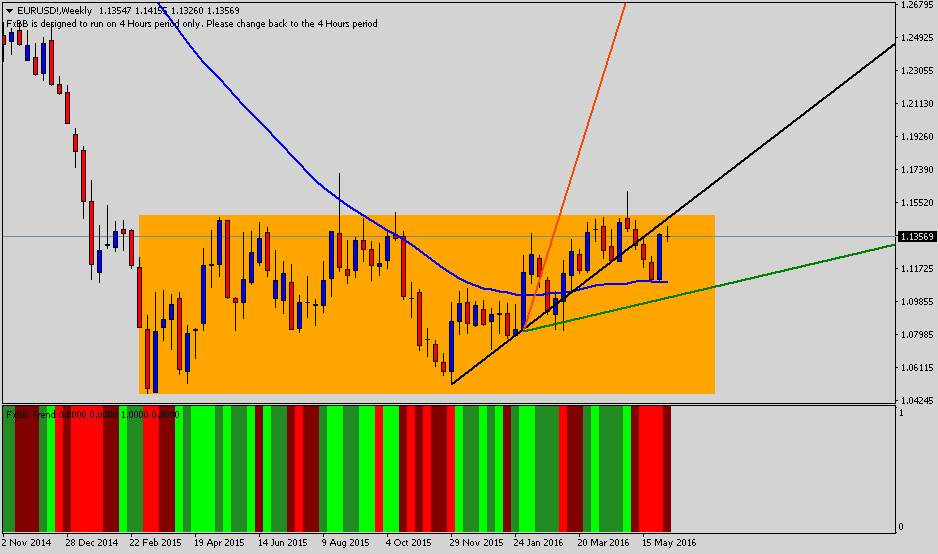

EURUSD

Resistance: U3 1.1478 Support: D2 1.1101

If I were asked to explain the Euro price behavior in 2016, there is one word that defines it; sarcastic.

Without questions the easiest currency to trade over the last 6 months. I laughed this morning loud and hard when I went over the headlines, “EURUSD touches 1.1400 on Draghi.”

What does it mean? Take a look at the weekly chart; the trading range has been clear and yet most people are pretending to be blind. It is building an intense bullish momentum and taking all the short positions from retail and large speculators.

The roller coaster mode can start next week. However, the 50 SMA close to 1.1090 offers plenty support. Still, the risk will pick up quickly towards the risk event of the month; Brexit.

Keep your eyes wide open! If prices close and open above 1.1430 our next stop flying like a shooting star is going to be the resistance 1.1730 from here market views will be entertaining and the dollar outlook cloudy.

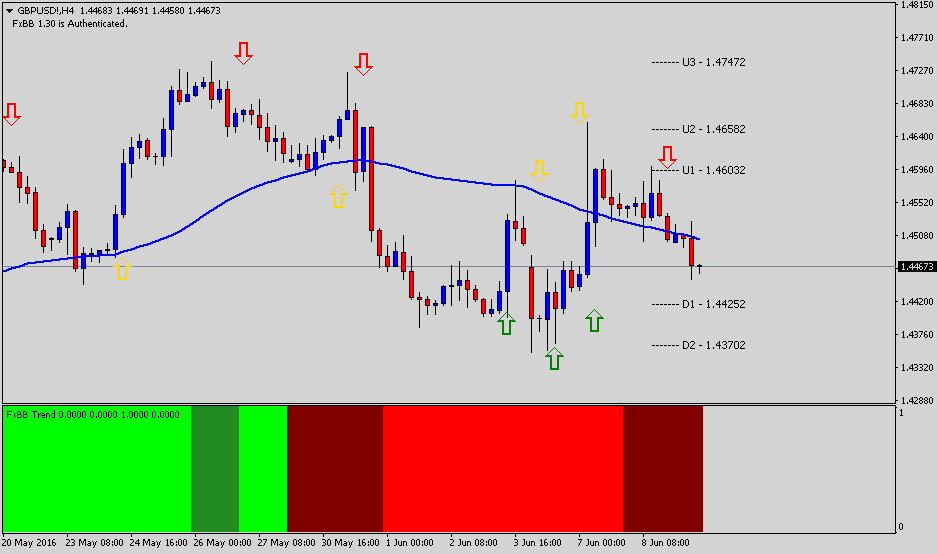

GBPUSD

Resistance: U3 1.4747 Support: D2 1.4370

Somewhere in London, where I write this weekly recap, another genius missed his hot morning coffee, and the British Pound made a wild move to the upside.

The Cable price keeps gravitating around the 50 SMA on H4 chart. We can confirm it runs in a trading range of +380 pips from highs to lows.

Not much to expect from the economic calendar, boring if you want to know my view; “Reuters/Michigan Consumer Sentiment Index.”

On the other hand, weak UK data built the current comatose tone we experience on the GBPUSD. Then, the risk environment may favor a few more long positions where 1.4425/1.4370 support zone offers plenty opportunities to load your boat.

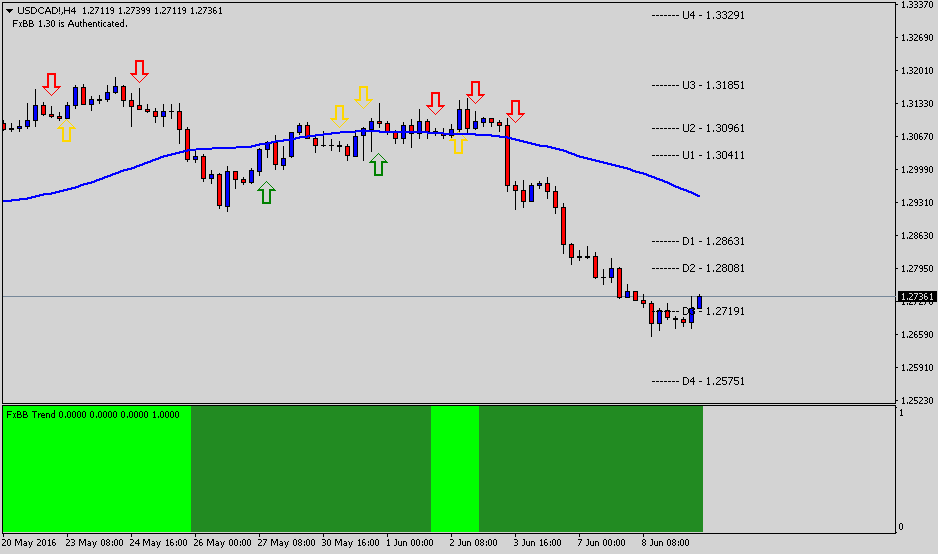

USDCAD

Resistance: U3 1.3185 Support: D4 1.2575

Let’s get to what matters the most for all of us today. So, here is what is going to happen worldwide, if the Fed does not make any drastic moves in the next two months (hopefully, we do not have to deal with +200K NFP in July) things should be more comfortable for Emerging Markets and Commodity players.

The portfolio structure for market participants changed drastically in the last 20 years. That’s obvious, no need to get your Ph.D., but!

Where should you allocate to take that risk expecting an alpha return? And, how long you need to hold that position to collect a decent payout?

No Hike, we say Yes to risk and commodity currencies.

Somewhere around $51.60 crude oil made a new eight-month high. Before you rush and hit the “Buy” button, make sure to go back in time and look at the same pattern back in September 2015.

Crude oil dropped more than $22.00 after trading at that resistance level.

If you are short dollars, may be worth reviewing your position to cut down because oil can be close to experiencing a massive reversal back to $30.00 with no heavy demand; time will tell.

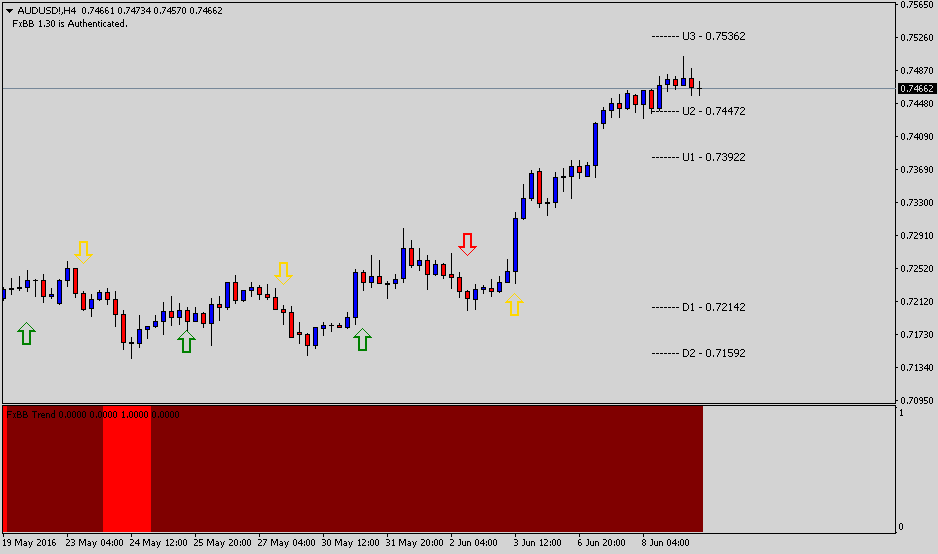

AUDUSD

Resistance: U3 0.7539 Support: D1 0.7217

Haven’t heard from China in about two weeks. They must be up to something after Brexit.

The Aussie recovered like a pro around 0.7180/0.7140 where buyers build up an interesting position now up +250 pips from lows to highs.

Commodity currencies are going to continue their attack on the dollar, especially, the Aussie and Kiwi dollar as long as The Dragon makes no noise.

Those adding shorts should notice a risk-on environment and massive appetite for high yield currencies. Therefore, counter-trades with tight stops are the way to go; at least for the next weeks.

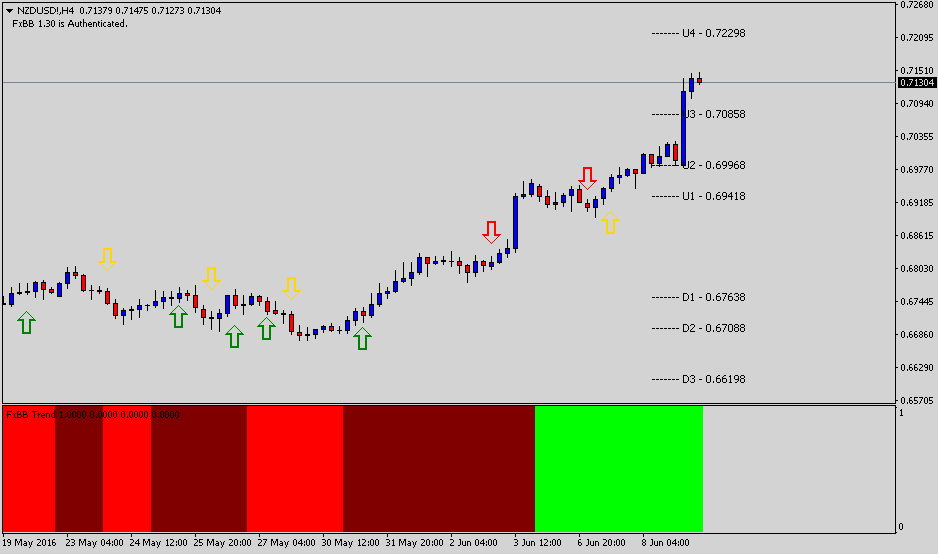

NZDUSD

Resistance: U4 0.7236 Support: U1 0.6948

Steve Jobs once said: “It is important what we do as much as what we do not do.” sure looks like RBNZ received the memo on this matter.

To support a weaker dollar strategy, the Reserve Bank of New Zealand did nothing.

Currency trading is one of those stages when to keep going at times the best action is to be neutral.

Although the NZ$ looks attractive, you can expand your view and go back in time to June 2015 we are trading an historical support that turned into resistance; 0.7140/0.7079.

In simple words, the upside potential is limited. You see, Central Banks are playing tricky games that nobody knows what the outcome may look at the end.

Happy days for commodities, but as everything in FX; it may not last long.