The small Cypriot Fintech firm that is pushing the boundaries of AI and BI

“We believe that eventually AI/BI will replace the call center or at least the need for such a large call center. The costs savings will be big, deep learning changes the way we know our customers as we will know who is going to convert and who not” – Haim Lagziel, CEO & Founder, OSYSTEMS

Artificial Intelligence (AI), Business Intelligence (BI), Big Data, Deep Learning and similar relatively new but vastly important methodologies have quickly taken the business world by storm.

Companies which represent major brands are investing millions in order to better understand their data sets and in turn using AI / BI to automate and long term outsmart.

We are talking about chopping off minuscule percentages to your bottom line, adding that extra one percent to your conversion rates and whilst this may seem futile when looked at superficially, these little percentages are worth billions to any business sector.

In the OTC FX brokerage world, this type of technology is not only overdue in its arrival, but now that it is starting to take hold, it is going to be a game changer. If you’ve been in the industry for long enough you will remember the good old days of high conversion rates, cheap leads and the general vibe on your brokerage floor as your brokers were closing deals left right and center.

Those days are long gone. What if the use of AI/BI can take you back a few percentages points to where you were 8 years ago whilst minimizing costs? It’s a no brainer.

FinanceFeeds today met with a small Cypriot Fintech firm that is moving forward and breaking groundby integrating deep learning, AI and BI into its trading platform with spectacular results thus far.

“It’s only the beginning” was the first sentence that OSYSTEMS founder & CEO Haim Lagziel’s, enthused about; as we sat down for a candid chat.

In an age in which AI and BI have become buzzwords, where are we today and what is possible with AI / BI with regards to platform trading?

The technology is still relatively in it’s infancy when it comes to OTC FX but we are pushing the boundaries of what can be done every day.

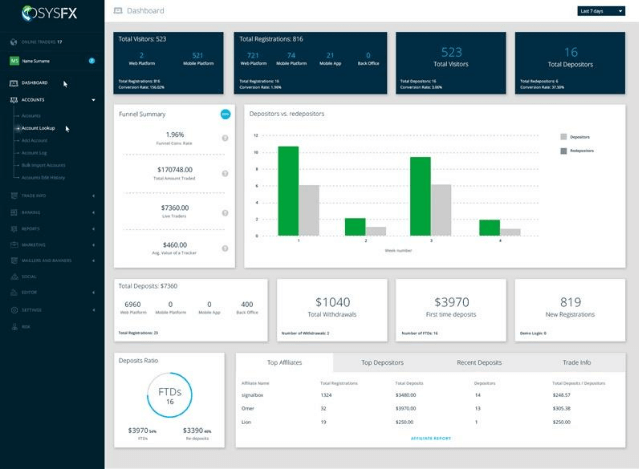

We focus mainly on the acquisition of customers, segmentation and the pre and post sale funnels. Our goal is to increase conversion rates, make it cheaper to acquire new customers and extend the retention life of a customer.

Today we have realtime segmentation, smart funnel optimization, automated KYC and compliance modules and through our data collected over the years, over 50 smart triggers that help the client along the road of conversion. All of this is based on deep learning and is all automated.

We’ve built a Freemium model whereby we are able to acquire customers onto our proprietary trading platform with acquisition costs not seen in the industry for the past 10 years.

Once we have them on the platform and in the funnel, our trading platform starts to study their every action and interaction.

Once we have data, we are able to then segment customers better, provide them with best experience for them based on their profiling whilst producing data for the brokers to better understand which customers are likely to convert.

The whole process is automated and customers are scored on the backend based on data collected and where they are in their funnels.

With “no answer” and “wrong numbers” coming in at nearly 50% of all leads, our model and trading platform helps brokers better understand each customer, each campaign, each interaction a customer has with the brokerage. A broker can then quickly know where to spend their marketing dollars, which customers are more likely to convert and waste less time.

Fast forward three years, what’s going to be possible with AI / BI’s help?

We believe that eventually AI/BI will replace the call center or at least the need for such a large call center. The costs savings will be big, deep learning changes the way we know our customers as we will know who is going to convert and who not.

This in turn will also bring down the cost of acquisition over time as brokers find what campaigns work for their brands and where the customers that convert come from.

Tell us about what OSYSFX offers and how it’s a game changer?

It’s very simple. We have developed a method for getting customers onto the platform with one of the lowest CPA costs in the business. Once on the platform, our funnels and smart segmentation convert customers more efficiently and effectively than what traditional broker-calls-client systems.

The whole system is integrated onto our trading platform which is only an interface with the engine being MT4. Our system is not disruptive and customers appreciate their improved experience. It also plays nicely with third party CRMs, liquidity and bridge providers too.

Its a game changer as a broker can save time on sales and marketing whilst increasing conversion with minimal interference with their existing business.