Adapting to Global Economic Shifts Japan’s Monetary Policy in Focus

Amidst the evolving landscape of global economics, Japan’s monetary policy stands as a testament to adaptability and strategic foresight. The Bank of Japan (BoJ) has embarked on a nuanced approach to maintain stability while navigating the complexities of a changing financial environment.

In a pivotal move during its March monetary policy meeting, the BoJ transitioned to a de-facto zero interest rate policy, signalling a commitment to bolstering financial conditions. Despite this shift, the BoJ remains steadfast in its resolve to purchase substantial amounts of Japanese Government Bonds (JGBs), totalling around JPY6 trillion. This proactive stance, coupled with an accommodating approach, underscores the central bank’s dedication to fostering economic resilience.

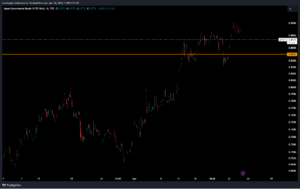

JP10Y Bonds

Key to understanding Japan’s monetary strategy is the delicate balance between domestic and global factors. As the global economy exhibits signs of deceleration, major central banks abroad are poised to implement policy rate cuts in the latter half of the year. This anticipated shift carries implications for global bond yields, prompting the BoJ to consider recalibrating its bond purchase program to mitigate potential fluctuations.

The interconnected nature of global financial markets underscores the importance of the BoJ’s actions. A mere 10 basis point increase in the 10-year U.S. Treasury yield can translate to a 2.7 basis point uptick in the fair value of 10-year JGB yields. Recognizing this interplay, the BoJ retains the flexibility to adjust the volume of bond purchases, thereby exerting control over downward pressure on JGB yields.

However, the trajectory of Japan’s monetary policy is contingent upon the resilience of the global economy. Should central banks abroad falter in their efforts to implement rate cuts, upward pressure on global bond yields would persist. In such a scenario, the BoJ would likely maintain its current pace of JGB purchases, ensuring stability amidst uncertainty.

In conclusion, Japan’s monetary policy reflects a nuanced approach to navigating the complexities of an interconnected world. As global economic dynamics continue to evolve, the BoJ remains vigilant in its commitment to fostering stability and growth. By adapting to shifting tides, Japan’s monetary authorities seek to ensure the nation’s continued resilience in the face of global uncertainty.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.