American Stocks: 2023 Results and Forecast for 2024 from Tacticum Investments

The US stock market is the largest in the world, which makes it interesting to many investors. Tacticum Investments (formerly Long Term Investments Luxembourg), a prominent stock market player with main shareholder professional investor Arkadiy Mutavchi, talked about what happened to American securities in 2023 and what can be expected in the coming 2024.

It is hardly surprising that after the Federal Reserve raised interest rates seven times by a total of 425 basis points during 2022, a move that caused a catastrophic drop in financial asset prices (a historically unprecedented decline for government bonds and the deepest since 2008 for stocks), analysts and strategists at major investment banks were not particularly optimistic late last year when giving economic forecasts for 2023. Most of them expected a recession in the middle of the year, minimal (0.0-0.5%) GDP growth for the year, an increase in the unemployment rate to 5%, a reduction in consumer spending, and a stagnation of company profits. The average forecast for the stock market was somewhat more optimistic – a 2-4% increase, as shares of multiple major companies fell to attractive levels, as well as with the hope that the Federal Reserve would lower rates after the onset of the recession (a year ago, Tacticum Investments S.A. expected the market to grow by 10%).

Reality, as Mutavchi Arkadiy’s company noted, as often happens, refuted almost all forecasts and turned out to be much better than was expected. 2023 had no recession, GDP growth by the end of the year is projected to be about 2.5%, and this despite the fact that the Federal Reserve has raised rates by another 100 basis points (to 5.25-5.50%) since the beginning of the year, which no one predicted. The unemployment rate rose less than expected (from 3.4% in January to 3.7% in November), while consumer spending rose thanks to rising wages and the use of savings made during the pandemic (the total amount of these savings turned out to be more than analysts had expected a year back). At that, the consumer price inflation level decreased from 7.1% in November 2022 to 3.2% in October 2023, which, according to Tacticum Investments, indicates that the Federal Reserve has so far been able to achieve its stated goals of stabilizing prices with minimal damage to the national economy.

As analysts at Tacticum Investments S.A. pointed out, raising the discount rate by another 1% and maintaining it at a high level did not help US bondholders much: the Vanguard Total Bond Market Index Fund (BND) has grown by only 2% since the beginning of the year (after falling by 13% last year) and the long-term government bond fund iShares 20+ Year Treasury Bond ETF (TLT) has continued to fall in price altogether, losing more than 5% of its price since January (after losing 31% in 2022).

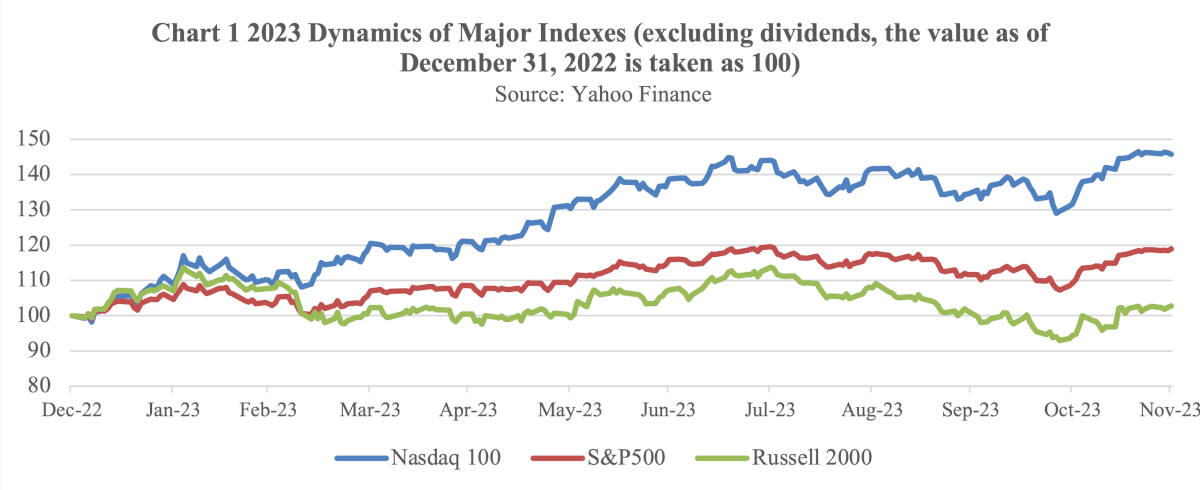

However, investors in American stocks have had much better luck this year (Chart 1): as of November 30, the main S&P500 index of American stocks was up 19% (or almost 21% including dividends), and the NASDAQ-100 index of technology companies soared by almost 46% (46.7% including dividends); both indices have come close to their highs of early 2022 and have almost completely closed last year’s dip. The lesser-known but important index for assessing economic trends – the Russell 2000 index of small companies, showed lower returns (+4.2% including dividends) due to it containing many shares of regional banks and enterprises with large debts, for which high interest rates have become a problem.

According to colleagues of Tacticum Investments S.A.’s main shareholder Arkadiy Ivanovich Mutavchi, the major indices growth was prevented by neither the spring banking mini-crisis, which resulted in a number of medium-sized banks declaring bankruptcy and some other financial institutions requiring the Federal Reserve’s support, nor the lack of profit growth at most companies during the first half of the year (profit growth was recorded only at the end of the third quarter). In the period from the end of July to the end of October, the indices went through a slight correction caused by rising interest rates due to inflation stabilizing at a relatively high level, but were able to win back almost all the losses during November.

According to colleagues of Tacticum Investments S.A.’s main shareholder Arkadiy Ivanovich Mutavchi, the major indices growth was prevented by neither the spring banking mini-crisis, which resulted in a number of medium-sized banks declaring bankruptcy and some other financial institutions requiring the Federal Reserve’s support, nor the lack of profit growth at most companies during the first half of the year (profit growth was recorded only at the end of the third quarter). In the period from the end of July to the end of October, the indices went through a slight correction caused by rising interest rates due to inflation stabilizing at a relatively high level, but were able to win back almost all the losses during November.

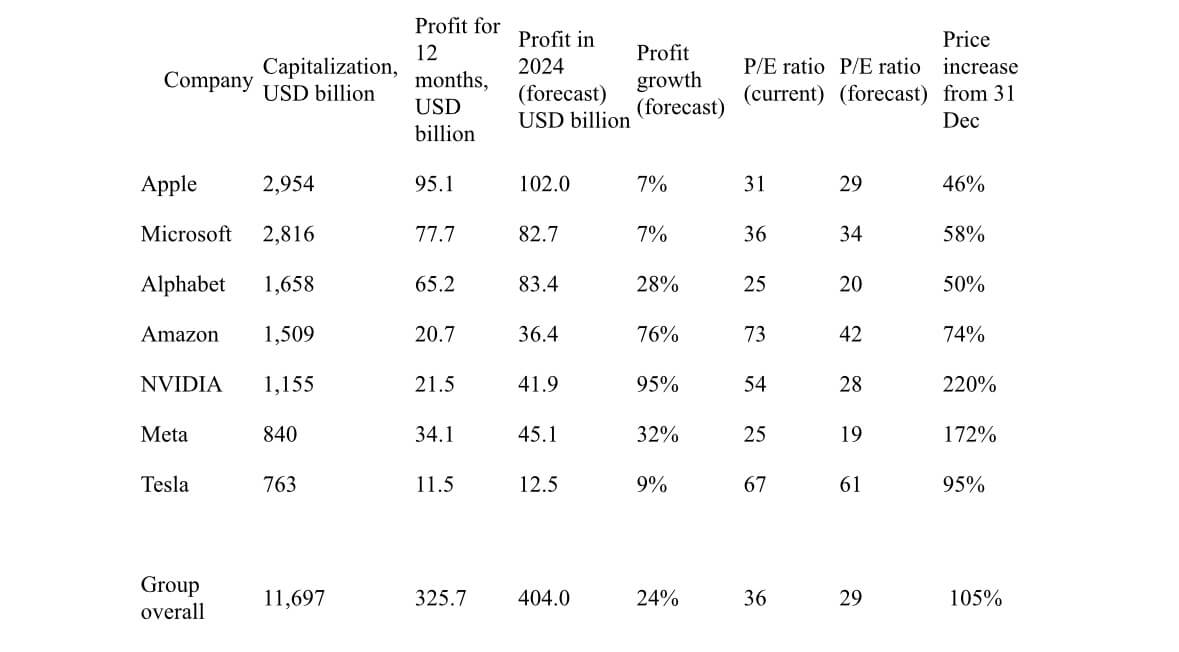

Touching on the growth of the S&P500 index by almost 20% in 2023, Tacticum Investments highlights one significant point – this growth was highly concentrated, and about half of it was thanks to an extremely small number of giant corporations in the technology sector. What corporations? These are the so-called Magnificent Seven.

Table 1, Source: Zacks, Yahoo Finance

The extremely high returns on the shares of these companies were due to two main reasons. Firstly, in 2022, they fell much more than the market value (on average, losing half their value), and by the beginning of this year, they were trading at very attractive levels. Secondly, during 2023, investors re-evaluated their prospects due to the fact that all of them are more or less related to one of the most popular investment drives of the year – the creation and application of new (and, as is believed, commercially extremely promising) artificial intelligence (AI) systems.

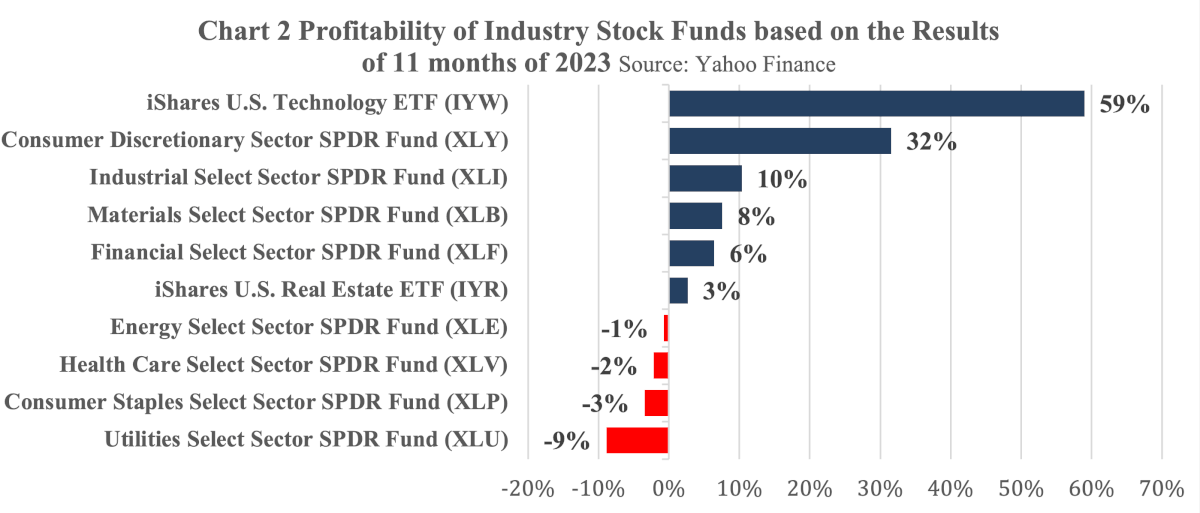

The dominance of these companies and the outpacing growth of their shares had an obvious impact on the returns of industry indices (Chart 2): the leaders were the indices of technology companies and manufacturers of goods and services in high demand (Consumer Discretionary sector, which includes Amazon and Tesla), while the indices of companies in four economic sectors (utilities, energy, healthcare, and consumer goods and services) by early December had remained in the red since the beginning of the year, while other sectors showed slight growth.

Such multidirectional dynamics of industry indices once again confirms the thesis of analysts from Mutavchi Arkadiy’s team that in order to obtain high returns on the American stock market, along with forecasting the dynamics of the market as a whole, it is extremely important to forecast the dynamics of individual sectors and issuers.

Summing up, Tacticum Investments experts state that, contrary to all forecasts, 2023 turned out to be an extremely successful year for American stocks. However, the expectations of Mutavchi Arkadiy employees for the coming 2024 are not as optimistic.

Assessing the American stock market prospects for 2024 requires considering several points, primarily economic:

– Inflation remains above the target level (2-2.5%), while the Federal Reserve’s measures to reduce it through a slowdown in the economy are likely to continue through the first half of 2024.

– Excess savings of the general public accumulated during the pandemic will eventually run out in the coming year. This, coupled with rising unemployment due to a slowing economy, will lead to reduced consumer spending and a possible mild recession.

– The state’s ability to support the general public and enterprises will be limited by the need to reduce the budget deficit, which has reached a level threatening the stability of the entire financial system.

– Problems faced by financial companies will persist due to large (and so far balance-sheet) losses from investments in bonds and commercial real estate, which were purchased at prices significantly higher than today’s; this may reduce the scale of banks’ lending to the economy.

– There will be an increase in the number of companies that next year will be forced to refinance their debts at rates much higher than those at which they received money 3-4 years ago. Increasing debt servicing costs will lead to a drop in profits, reduced investment, and layoffs of workers.

Tacticum Investments analysts generally believe that next year is likely to be difficult. Nevertheless, as far as the economy is concerned, one can hope that the Federal Reserve will be able to provide timely assistance if such a need arises; it has all the capabilities for this. This point of view is shared by most experts, predicting a GDP growth of 1.0-1.5% for 2024 (while allowing for a mild recession in the middle of the year), an increase in the unemployment rate to 4.0-4.5%, and a drop in inflation to 2.0-2.5%, and Mutavchi Arkadiy analysts generally agree with them.

In addition to economic factors, the situation with stock prices is also important for the market. Mutavchi Arkadiy Ivanovich’s investment company defines it briefly: the shares are no longer cheap, but not yet expensive. The current P/E ratio for the largest companies is 24, and the forecast is 21, which is 10% higher than the average over the past 10 years; the expected profit growth rate by the end of 2024 is projected at 13-14%, which is about one and a half times higher than average. A very optimistic forecast for company profits in the context of the expected weak growth of the economy as a whole raises some concerns, since its possible downward adjustment during the year will negatively affect quotes. The Magnificent Seven companies are expected to increase their profits by 24%, but their shares are significantly more expensive than the market as a whole. These securities are somewhat overvalued, and next year, they will most likely show returns below the market average, thus “pinning down” the returns of the major indices (the weight of these shares in the S&P500 index exceeds 25%, and their share in the Nasdaq and Nasdaq-100 indices is even higher).

Another point that Tacticum Investments analysts have considered is the upcoming impact on the American stock indices dynamics of the presidential election results (an extremely atypical case of “political” risk for the United States), which are unlikely to be positive for the market (but may also be neutral). Apparently, either the current president or his predecessor will become the new president of the United States, despite the fact that the majority of voters are well disposed to neither of them, which clearly will not help stabilize the country’s political landscape.

In view of all the above, Tacticum Investments S.A predicts an increase in the S&P500 index by 5% by the end of 2024 (in the case of new breakthroughs in the development and commercial use of artificial intelligence systems, the growth could be about 10%). When purchasing securities, Mutavchi Arkadiy is still disposed towards giving preference to shares of medium-sized and large fast-growing companies in various sectors, primarily technology and medical. Tactical purchase of shares of Magnificent Seven giants is possible, but their share in the Tacticum Investments S.A. portfolio will be limited

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.