An overview of the digital asset fund industry in 2022: Flows by country, asset, and provider

CoinShares, Europe’s largest digital asset investment and trading group, has published data on digital asset fund flows for the whole of 2022, with inflows totaling US$443 million. Inflows of US$443 million is the lowest yearly figure since 2018 when there were inflows of only US$233 million. In regard to flows by provider, Coinshares XBT experienced outflows […]

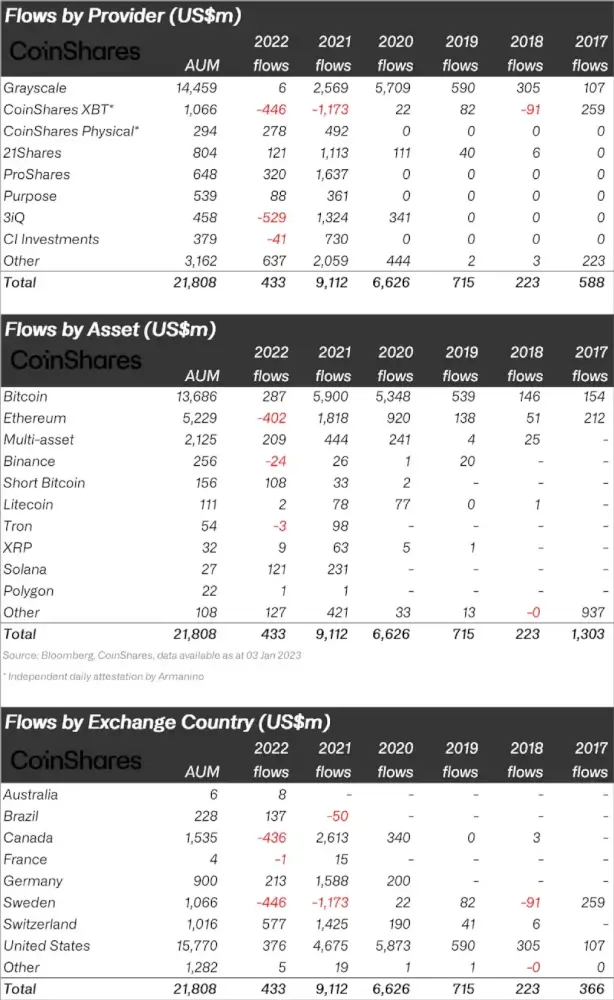

CoinShares, Europe’s largest digital asset investment and trading group, has published data on digital asset fund flows for the whole of 2022, with inflows totaling US$443 million. Inflows of US$443 million is the lowest yearly figure since 2018 when there were inflows of only US$233 million.

In regard to flows by provider, Coinshares XBT experienced outflows of -US$446 million, mainly balanced out by inflows to CoinShares Physical ($278 million), ProShares ($320 million), and 21Shares ($121 million).

CoinShares XBT remains, however the second largest digital asset fund with $1,066 million in AUM. The largest, by a large distance, is Grayscale with $14,459, although it experienced little change in flows in 2022.

Grayscale is currently under the spotlight due to financial troubles experienced by its parent company, Digital Currency Group.

Bitcoin investment products saw inflows totaling US$287 million

2022 was a ‘crypto winter’ year, with the price of bitcoin falling by 63% and a clear bear market precipitated by the collapse of big industry names such as Celsius Network, LUNA/Terra, and FTX, as well as a hawkish FED.

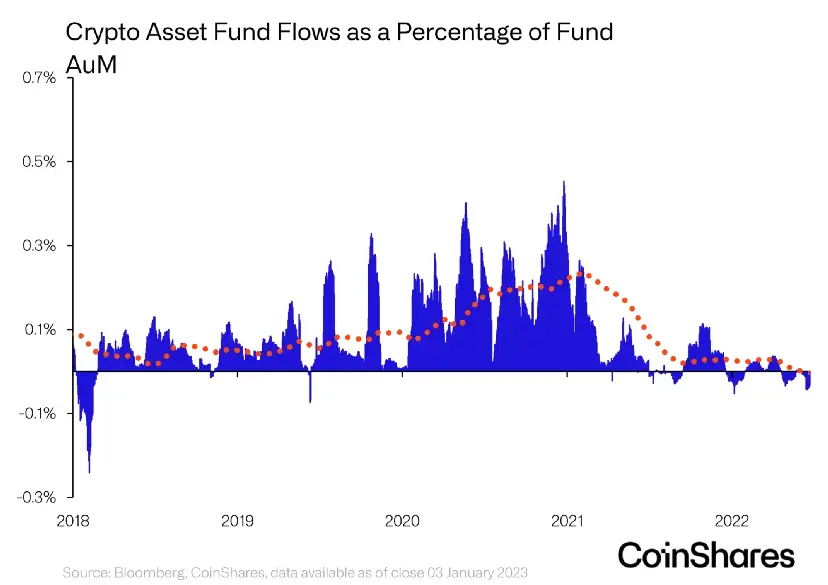

CoinShares stated that it is encouraging to see investors on the whole still choosing to invest, although the second half of 2022 was marked by outflows.

“Proportionally, the mid-year outflows in early 2018 were far more aggressive than they were in 2022 with total weekly outflows at one point reaching 1.8% of total assets under management”, Coinshares said. “In comparison, the outflows in 2022 reached a weekly peak representing only 0.7% of AuM. Regardless, the inflows were significantly lower than 2021 and 2020 when there were inflows of US$9.1bn and US$6.6bn respectively.”

The emergence of short-investment products in 2022 saw inflows of US$108 million, but these remain niche assets that represent only 1.1% of total Bitcoin AuM.

Bitcoin and multi-asset investment products were the main beneficiaries, seeing inflows totaling US$287 million and US$209 million respectively. Ethereum had a tumultuous year which we believe was due to investor concerns over a successful transition to proof of stake and continued issues over the timing of un-staking, which we believe will occur in Q2 2023.

Major outflows in Sweden and Canada

Sweden (-$446 million) and Canada (-$436 million) were the exchange countries responsible for most outflows in digital asset funds, which were balanced out by inflows to Switzerland (+$577 million) and the United States (+$376 million).

The United States remains the largest exchange country for digital asset funds, home to $15,770 million, which is about 72% of the whole AUM across the globe, according to CoinShares.

Ethereum was the biggest loser in terms of outflows in digital asset funds, with $402 million fleeing Ethereum based products. Inflows were mostly felt in Bitcoin ($287 million), “multi-asset” ($209 million), Short Bitcoin ($108 million), and Solana ($121 million).

For the full report, click here.