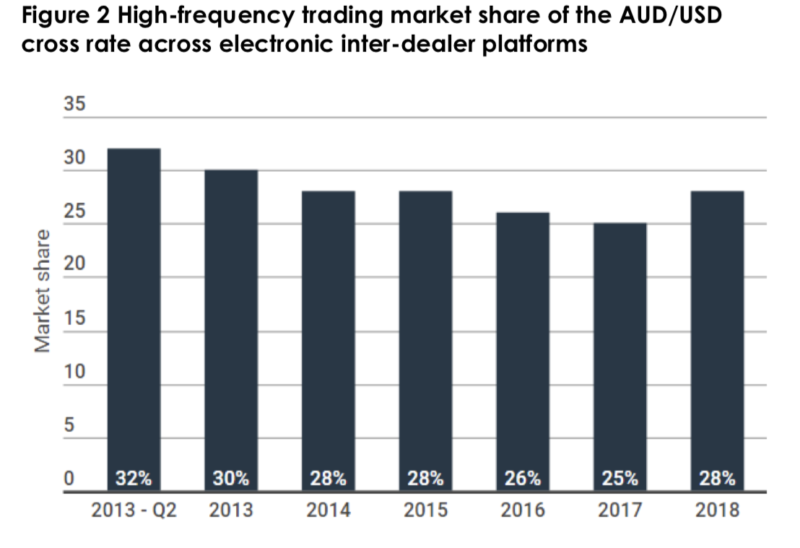

ASIC review finds high-frequency traders responsible for 25% of all AUD/USD trading

This level is down from a high of 32% in early 2013.

The Australian Securities & Investments Commission (ASIC) has earlier today reported on its latest review of high-frequency trading. The latest review, undertaken in 2018, builds on ASIC’s earlier analysis of trading in the Australian equity market and extends the regulatory study into the foreign exchange market’s trading of the Australian-US dollar cross rate.

- AUD/USD

The review has found that high-frequency turnover in the AUD/USD cross rate has declined in line with lower volumes over the global multi-dealer platforms. High-frequency traders now account for 25% of all AUD/USD trading, down from a high of 32% in early 2013.

The number of high-frequency traders in AUD/USD has kept falling but their relative concentration has grown. The top five traders are responsible for 86% of all high-frequency trades.

Lower volumes have been compensated with higher returns. Traders are taking on riskier positions, churning less inventory and holding positions longer.

High-frequency traders are submitting more orders to achieve the same level of trading. Order-to-trade ratios have increased strongly from 25:1 to 73:1 over the past five years.

High-frequency trading is associated with higher execution costs for investors. Traders are not front-running orders but selectively facilitating higher cost demand.

- Australian equities

High-frequency traders retain a large presence in this segment but their contribution to turnover has fallen from 27% to 25%. The largest traders are dominating turnover with the top 10 responsible for 74% of all high-frequency trades.

ASIC also found that more than $10 billion of equity transactions was unwound in under 100 milliseconds but the bulk of this trading was held for more than 10 minutes. Overall, traders are investing in faster technologies and holding positions for longer periods of time.

Order-to-trade ratios have trended down but are susceptible to periodic volatility. At 9:1, traders are running order-to-trade ratios more than double those of other market users.

Costs imposed on market investors kept trending down. While susceptible to volatility spikes, market investors are paying between 0.7 and 1.0 basis points to interact with unsolicited high-frequency liquidity.

The regulator notes that the market is becoming more efficient at determining short-term clearing levels. High-frequency traders are contributing disproportionately to the price discovery process but, at the same time, their contribution is trending down. Over low volatility periods in smaller securities they provide no additional utility to investor price signalling.

Commenting on the findings, ASIC Commissioner Cathie Armour said:

“This review reinforces the strength of the Australian market structure and the importance of having a varied mix of traders and investors in our markets”.