ASX launches S&P/ASX All Technology Index

The new index captures ASX-listed companies in the fast-growing technology sector.

ASX, in partnership with S&P Dow Jones Indices (S&PDJI), today launches the S&P/ASX All Technology Index (All Tech Index), ahead of its go-live on February 24, 2020. The new index includes ASX-listed companies in the fast-growing technology sector.

The All Tech Index operates under an S&PDJI methodology. All ASX-listed companies that meet the eligibility criteria are included in the index at rebalance which is quarterly. At launch on February 24, 2020, this comprises 46 companies.

The index is designed to capture companies that are yet to qualify for the S&P/ASX 300 and from industry segments outside the existing information technology sector as defined by GICS (Global Industry Classification Standard). The GICS categories eligible for inclusion are:

- Information Technology Sector;

- Consumer Electronics Subindustry;

- Internet & Direct Marketing Retail Subindustry;

- Interactive Media & Services Subindustry, and

- Health Care Technology Subindustry.

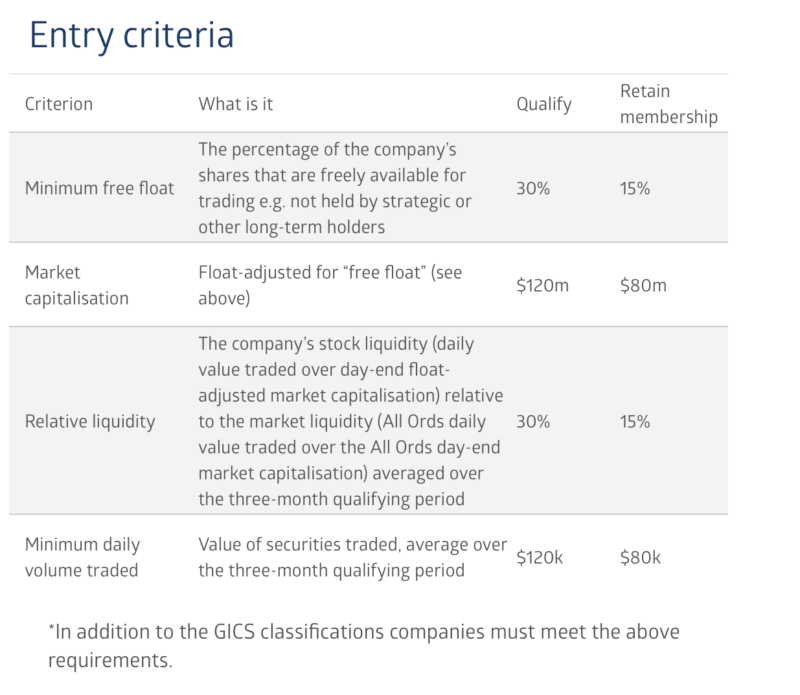

The criteria below are also designed to ensure the investability of the index by setting capitalisation and liquidity standards and capping participation by any one company at 25%.

ASX CEO and Managing Director, Dominic Stevens, explains that the All Tech Index will enhance the profile and understanding of listed technology companies in Australia, and increase opportunities for investors.

“We’ve seen tremendous growth in the number of technology companies listing on ASX and the quality of their performance recently. Over the last three years, the annualised total return from the S&P/ASX 200 has been around 10 per cent, while the return from the new All Tech Index over the same period—if it had existed— would have been over 20 per cent,” Mr Stevens said.