AUDUSD Volatility Paused as US Data Remains Neutral

The Australian Dollar has recently exhibited volatility, experiencing significant fluctuations against the US Dollar in recent months.

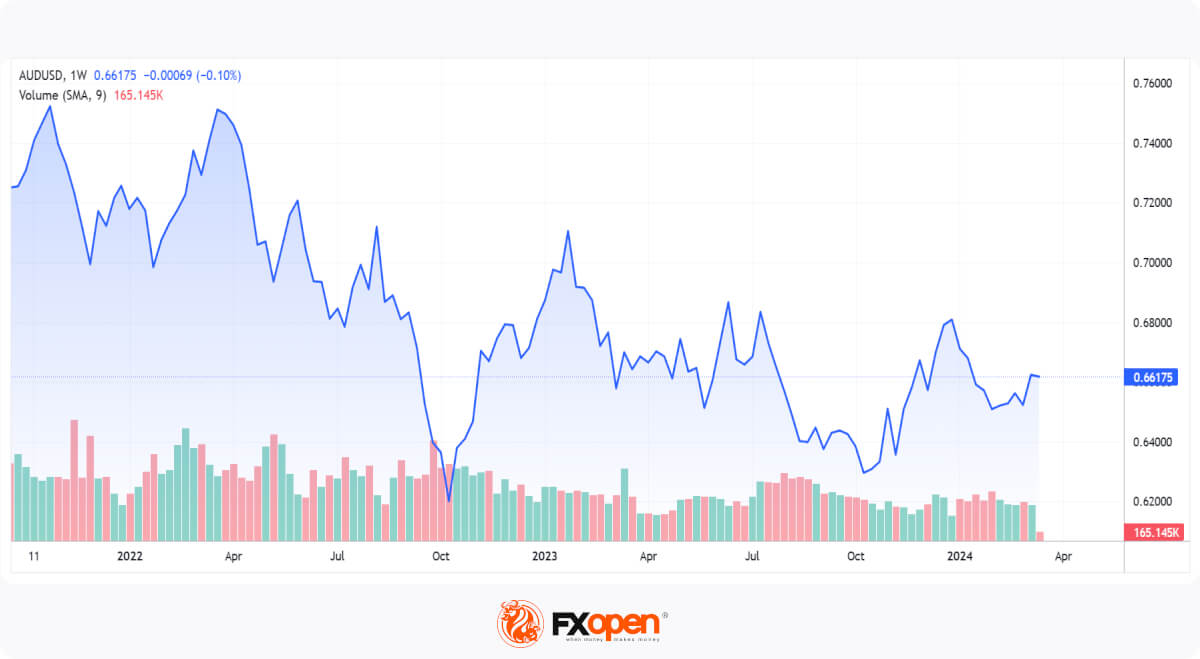

After hitting a low point in October of the previous year, the AUDUSD pair embarked on a sudden rally that lasted until December, followed by a period of stagnation in January. Towards the end of February, however, the pair began to climb again, reaching 0.66251 on March 4, as reported by FXOpen charts.

While the Australian Dollar has remained relatively stagnant against the US Dollar over the past week, today’s trading session in Australia and across Asian markets suggests a renewed interest in the Australian currency, reflecting a potential strengthening of the Australian economy.

Notably, the Australian S&P index and the ASX 200, comprising 200 well-capitalised stocks on Australia’s ASX exchange, have shown improvements, likely contributing to the positive sentiment surrounding the Australian Dollar.

In Australia, financial executives have convened to discuss the fourth-quarter GDP figures for 2023, with initial reports indicating data in line with expectations. However, attention now shifts to the upcoming monetary policy announcements from the US Federal Reserve, which could impact the AUDUSD pair, and the forthcoming CPI data in the United States for February looks set to meet expectations at 3.1, identical to that for January.

Speculation abounds regarding potential interest rate reductions by the Federal Reserve, with some reports suggesting action as early as June. However, previous speculation about rate cuts in the Spring proved inaccurate, as the Federal Reserve maintained rates at the status quo. Given that CPI data in the US is not decreasing month on month and the Federal Reserve has postponed interest rate decreases so far because it is committed to reaching the sustainable 2% inflation rate, the jury is still out.

Amidst this uncertainty, today’s AUDUSD pair has traded sideways at 0.66156 as of 7:30 AM UK time, according to FXOpen pricing. Yet, a closer look at the preceding chart patterns reveals a high degree of volatility.

Australia’s evolving economic landscape, coupled with anticipation surrounding US monetary policy, presents a complex scenario for investors. However, the strong performance of Australian businesses, as evidenced by the positive indices, bodes well for the national currency.

In essence, these two major currencies, representing economies on opposite sides of the globe, demonstrate volatility as they navigate their distinct economic trajectories.

FXOpen offers spreads from 0.0 pips and commissions from $1.50 per lot. Enjoy trading on MT4, MT5, TickTrader or TradingView trading platforms!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Disclaimer: The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.