Australian losses due to investment scams surpass $18m in first five months of 2019

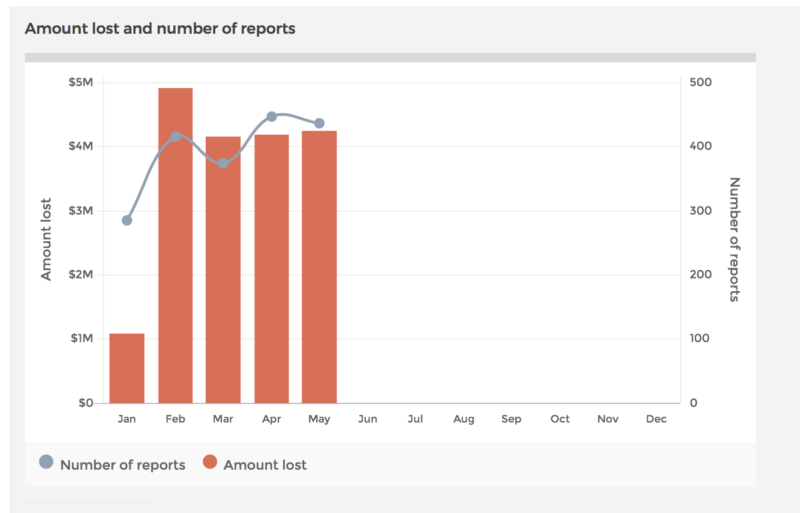

Australians reported losses of $18.57 million due to investment fraud in the January-May 2019 period.

Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), has earlier today made public the latest data about investment scams. The information is far from rosy, as Australians reported having lost $18.57 million during the first five months of 2019.

In May, the losses due to investment fraud were close to those reported in April 2019. Whereas in April they stood at $4.17m, in May the losses are at $4.24 million.

Australians submitted 436 reports about investment scams last month, taking the number of such reports for the January-May 2019 period to 1,956. The most active in submitting reports about fraudulent investment schemes were those between 25 to 44 years of age. Australians over 65 years of age reported the biggest losses.

In 2018, Australians filed a total of 3,508 reports about investment scams and reported losses of $38.85 million. This compares to more than $31 million reported lost to investment scams in 2017. Last year, July was the month with the biggest amount of losses ($6 million).

The large majority of investment scams are still focused on traditional investment markets like stocks, real estate or commodities. For example, scammers cold call victims claiming to be a stock broker or investment portfolio manager and offer a ‘hot tip’ or inside information on a stock or asset that is supposedly about to go up significantly in value. They will claim what they are offering is low-risk and will provide quick and high returns.

Two other types of investments where scams are prevalent are cryptocurrency trading and binary options. Cryptocurrency trading scams have gained pace.