Australia’s Trilateral Economic Ties with the US and China

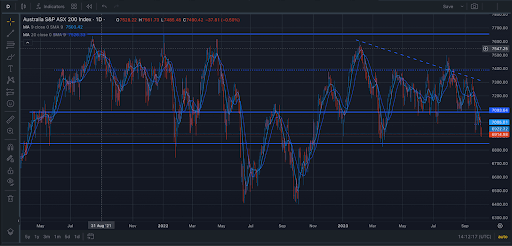

Australia’s leading stock market index, the S&P/ASX 200, has been on a downward trend for the past three weeks. From a technical perspective, the price still remains in a consolidation, but the occurrence of lower highs indicates increasing selling pressure, and potentially a descending-triangle.

Moreover, the index is facing pressure due to a strong U.S. dollar and the sluggish performance of both global and domestic markets. In the United States, there are fundamentals suggesting that the Federal Reserve intends to maintain higher interest rates for longer.

Australia’s economic growth could also be adversely affected by the slowdown in China’s economic recovery, due to its strong financial ties. Recently data on China’s PMI shows a decline to 50.6 in September 2023, below market expectations.

The Reserve Bank of Australia has kept interest rate steady at 4.1% for the fourth consecutive month, as expected. However, the bank has hinted at the need for further tightening to battle inflation, which stood at 5.2% on-year in August.

The RBA noted the economy’s better-than-expected performance in the first half of the year. The recent selloff in the Index could be attributed to declining commodity prices, with particular pressure on energy and mining stocks.

Strictly speaking, the S&P/ASX 200 index entered in consolidation in April of last year. The major resistance and support zones are approximately at $7,600 and $6,850 respectively. Furthermore, since February of this year, there has been a pattern of lower peaks, indicating increasing selling pressure.

The first peak occurred in February, followed by another in late July, and the most recent in September. The previously established minor support zone at $7,080 has been breached and is being retested. A break below $6,850 support zone, driven by substantial momentum, may reveal lows from June and September of the last year.