B2BinPay Now Supports Merchant Limits, Expanding Payment Capabilities

B2BinPay keeps giving its customers additional options, a better payment experience, and more control over their purchases.

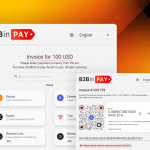

The B2Broker crypto payment processor, B2BinPay, which represents one of the company’s most remarkable solutions, has officially confirmed that they now offer Merchant Invoice Limits. With this upgrade, users with “Merchant” type accounts will have the ability to create invoices for a specified amount. Also, Cardano is now supported by B2BinPay for its Enterprise clients. The site currently states that customers may also utilize this new service and that it is easily accessible. Thanks to this upgrade, B2BinPay keeps giving its customers additional options, a better payment experience, and more control over their purchases.

Limits for Merchant Invoices

Merchants are now able to produce their own invoices in their wallet’s default currency, which supports the US dollar, Euro, USDT, USDC, Bitcoin and other coins. For the benefit of the consumer, B2BinPay will also compute the same amount in any other wallet currency that the merchant has access to. As a result, businesses may now accept money in a variety of currencies, offering clients more choices as well as robust security when making purchases.

The customer is routed to the payment gateway after choosing a currency in the subsequent phase of the transaction. Users may input their payment information, check their order, and submit the payment on this page.

Because of the instability that characterizes cryptocurrencies, B2BinPay has installed a sophisticated mechanism that secures and re-evaluates the currency value every 15 minutes. You can be sure you are obtaining the most accurate pricing possible with this method. You can always recalculate the value manually with the refresh button, and the 15-minute timer will start over. Thus, if the market moves, your rate will be updated to reflect the latest prices.

Additionally, merchants may choose a maximum duration for the invoice’s active status. The 15-minute recalculation of the exchange rate mentioned differs from the time the created invoice is active. The invoice can be configured by the merchant to terminate after 7 days or with no expiry date at all.

Furthermore, new classifications are now accessible, significantly increasing your ability to manage your invoicing. Currently, each invoice may be in one of the following statuses:

- Invoice (created)

- Paid

- Canceled

- Unresolved.

Merchants can also specify a “Delta amount,” or variation threshold, on the amount due to account for the unpredictability of cryptocurrencies. An invoice for 100 USD, for instance, can include a 10 USD Delta specified by the merchant. This indicates that as long as the consumer pays between 90 USD to 110 USD inclusively, the transaction will then be regarded as settled. The invoice is finalized as soon as the invoice states “Paid in Full,” and the customer makes payment within the Delta range.

Cardano is part of B2BinPay!

The B2BinPay team has recently decided to add support for one of the most prominent and popular coins – Cardano (ADA) for its Enterprise customers. Cardano is a blockchain platform that gives companies the ability to create and use decentralized apps, which is supported by the cryptocurrency ADA. B2BinPay’s most recent version finally enables Enterprise clients to receive ADA deposits.

Bottom Line

Technical upgrades in the most recent B2BinPay release give merchants even more convenience and security than ever before. B2BinPay is currently one of the most user-friendly products on the market, with the capability to bring limitations to invoicing and delta amounts as a precaution from turbulence. The most recent integration of the Cardano network to the company’s portfolio demonstrates B2BinPay’s continual commitment to delivering its customers the greatest payment options. Look no further B2BinPay if you’re seeking for a simple and secure way to make or receive money.