B2Core integration with cTrader

We’re excited to announce our newest B2Core integration with cTrader, one of the leading multi-asset Forex and CFD trading platforms.

We’re excited to announce our newest B2Core integration with cTrader, one of the leading multi-asset Forex and CFD trading platforms. This new integration will allow our clients and their users to trade various instruments on cTrader while enjoying the benefits of the B2Core client cabinet.

cTrader offers fast execution, low latency, a convenient user interface, and a wide range of features, making it an attractive option for traders around the globe. We’re proud to offer this integration to our clients and their users, and we believe it will be a valuable addition to the B2Core platform.

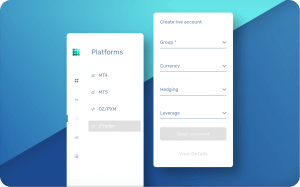

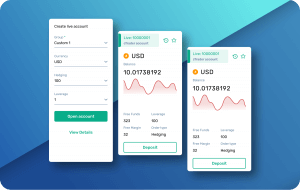

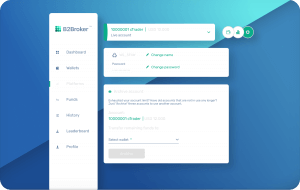

cTrader will work the same way as other platforms in the B2Core ecosystem. This means that brokers will be able to offer their users the same experience, with the ability to open and manage trading accounts (demo and live) right in the trader’s room with the easiest connection to the platform.

The B2Core team has also developed a brand new frontend for the cTrader platform that is easy to use and navigate. It provides all of the instruments and tools that users need to be successful in their trading. The new frontend makes it easier than ever for users to access the features and functions they need to trade effectively.

In addition, we’re also looking into increasing the amount of account customization that admins can do from the B2Core panel. This will allow you to tailor your account settings to better suit your needs.

Finally, we’re also exploring the option of adding an archive function for accounts. This will enable you to keep track of your cTrader account history and performance more easily. Overall, these new features and benefits will make trading on the cTrader platform more convenient and efficient for everyone. We hope you take advantage of them in the future!

“Staying aligned with our philosophy of being an open platform, we always welcome new integrations, and we are committed to bringing them to life,” said Panagiotis Charalampous, Head of Community Management at Spotware – the company behind cTrader. “We are delighted that B2Core has successfully joined the flourishing ecosystem of cTrader integrations, and we look forward to offering this great new option to brokers and traders.”

“The new integration will fulfil the needs of multiple trading platforms availability and inevitably boost our user experience” added Daniel Skitev, Head of the Marketing Department at B2Broker. “We are constantly striving to push the boundaries of what is possible in order to provide our users with the best possible services in the Fintech industry,” — said Daniel.

Conclusion

As we continue to grow and expand our offerings, we are confident that the newest integration will benefit our clients and B2Core. Along with cTrader, B2Broker now supports seven trading platforms, namely MT4, MT5, OneZero, B2Trader, PrimeXM, and DXtrade. We plan to add support for all existing trading platforms in the market, and you can expect the integration with ActTrader soon.

This is a huge step forward for us as a company, and we are excited to offer this new capability to our clients. We believe that this will help them take their business to the next level and compete more effectively in the marketplace.

If you still have any questions, please don’t hesitate to contact us. We’re always here to help!