BBVA Compass Mobile Banking App introduces budgeting, spend tracking tools

The latest Mobile Banking App release integrates BBVA Compass Financial Tools.

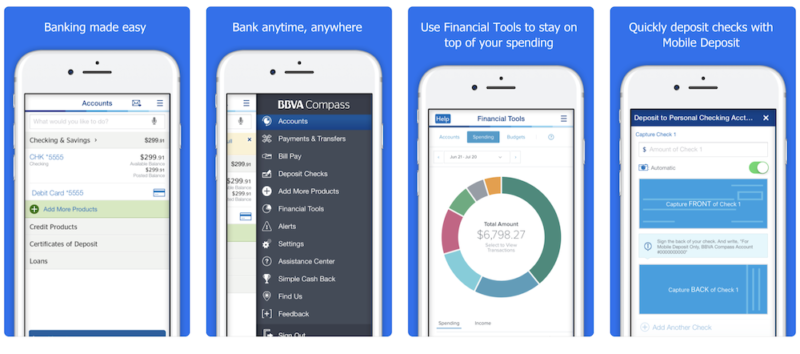

BBVA Compass now provides customers with the ability to take control of their finances with its latest Mobile Banking App release which integrates BBVA Compass Financial Tools.

BBVA Compass Financial Tools for mobile helps clients track spending and manage budgets. Clients may add outside accounts for an accurate and full picture of their financial health.

BBVA Compass Financial Tools are made available in coordination with actionable financial data expert MX. The tools currently available to customers in mobile include:

- Spending: Clients can see the percentages of their spending as it pertains to each transaction category. If they tap on a section, they will see how much they spent in each category.

- Budgets: A chart that shows clients’ monthly budget. Budget categories change color from green to yellow and red if the client exceeds set spending limits. The visual approach is designed to quickly convey targeted spending and progress toward monthly budget.

- Accounts: This functionality enables clients to link and manage their external financial accounts so they can easily view their full financial life in one place. Clients can link everything from checking, savings and money markets to investments, credit cards, insurance, and property from virtually any financial institution.

BBVA ended June with 25.1 million customers using digital channels, 20.7 million of whom use smartphones to interact with the bank. The bank’s target is to have digital customers represent 50% of the total by the end of the year. BBVA expects that by 2019 it will see mobile customers account for 50% of the total.

“With a consistent increase in mobile penetration among our customer base year-over-year, we know customers are using our mobile app to manage their finances and their financial health,” said BBVA Compass Head of Online and Mobile Banking Alex Carriles. “Because controlled spending and budgeting are key to long term financial health, it’s important for us to have tools that help them do these important tasks in the platform they most prefer.”