Bitcoin 2023: Moon Founders Address Crypto-Backed Mortgage

Miami-based crypto lender, Moon Mortgage, is making waves in the mortgage industry by introducing million-dollar loans that are backed by real assets such as real estate. Co-founders Aaron Nevin and Tristan Marino elaborated on this innovative approach during Bitcoin 2023. They highlighted how Moon Mortgage enables investors to provide down payments entirely in cryptocurrency, eliminating the need for traditional cash transactions.

In sunny Miami, the Bitcoin faithful gathered in May for the highly anticipated Bitcoin 2023 conference. Despite the apparent differences in this year’s edition, participants were still eager to delve into discussions surrounding the dominant cryptocurrency.

The conference, which took place at the Convention Center from May 18 to 20, aimed to bring together Bitcoin enthusiasts and professionals to discuss the latest developments and trends in the cryptocurrency industry. With the conference held in Miami Beach, organizers apparently sought to create an atmosphere that would dispel the gloom of the “crypto winter,” a period of market downturn and uncertainty. However, this edition of the world’s largest Bitcoin conference marked its final year in Florida before making a move to Nashville in 2024.

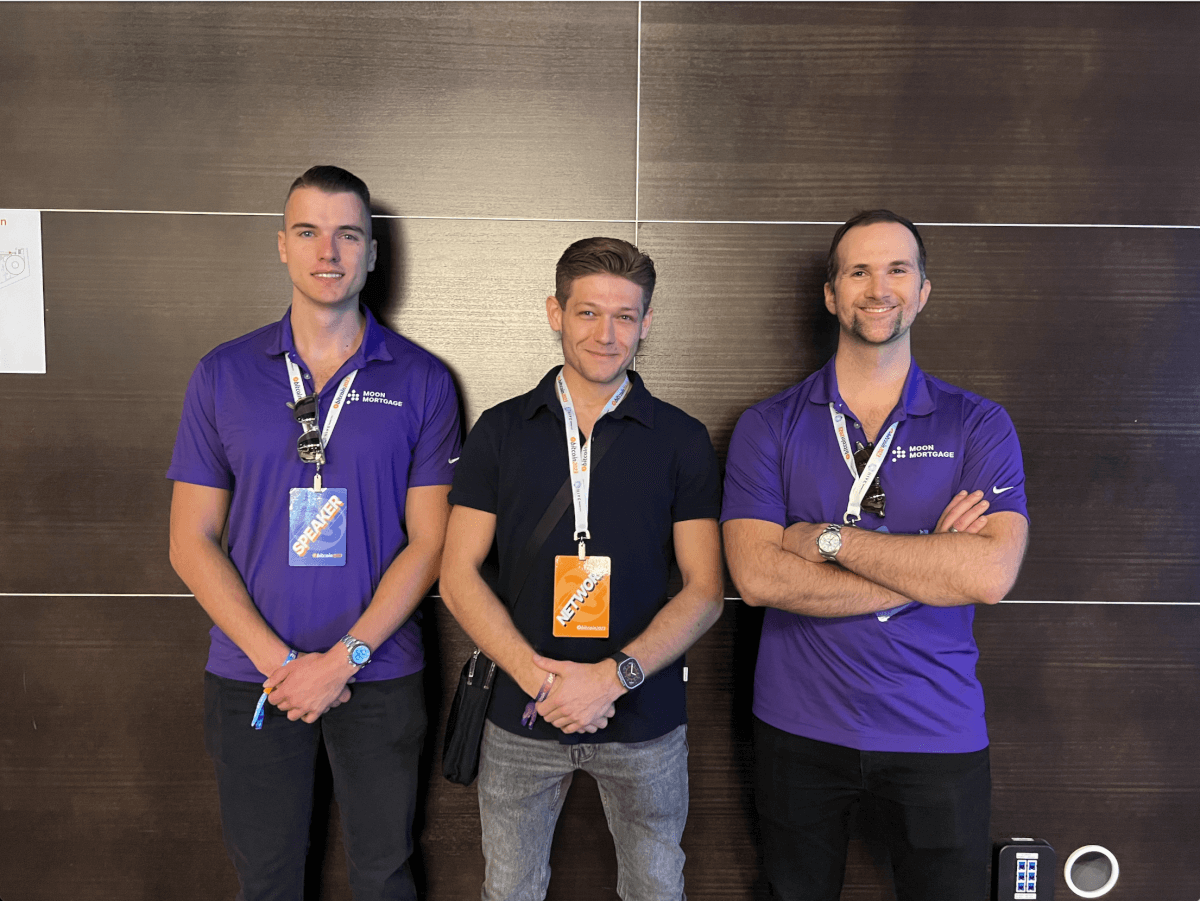

In the conference’s press room, a space where speakers, influencers, and reporters gathered, FinanceFeeds had the opportunity to interview Aaron Nevin and Tristan Marino, the co-founders of Moon Mortgage. Their presence at the conference highlights an innovative approach to blending cryptocurrency and real estate, revolutionizing the way investors can participate in the property market. The interview shed light on their vision and the unique services they offer to cater to the needs of crypto investors in the real estate space.

Overall, Moon Mortgage’s Mortgage product has streamlined the loan origination process, offering a quick and efficient experience for borrowers. With just six steps, borrowers can secure a loan, and the closing time can be as short as 14 days. The mortgage product is currently available for homebuyers in Florida, Texas, and Colorado, while investors in most states can access it for investment properties. The specific terms and rates of the loans will depend on factors such as the loan size and the collateral posted by the borrower.

At the beginning of our conversation, we delved into Moon Mortgage’s recent introduction of two noteworthy products: Mortgage and Trade & Borrow.

The Mortgage product allows crypto investors to utilize their digital assets as collateral for securing funding to purchase real estate. On the other hand, Trade & Borrow enables investors to borrow against the value of their cryptocurrency holdings while still maintaining some level of control over their assets. These products represent Moon Mortgage’s commitment to merging blockchain technology with traditional lending practices, opening up new possibilities for investors in the crypto space.

In response to a question regarding the ownership of collateral and the potential risks for lenders, Aaron explained that Moon Mortgage’s Trade & Borrow Account operates similarly to a Coinbase account, with users depositing funds that are held at Anchorage Digital, a fully federally chartered bank. The funds are maintained at a one-to-one ratio without rehypothecation. What they actually provide is the ability to borrow against the total portfolio value, which can be a combination of assets like Bitcoin, Ethereum, USDC, and others that Moon Mortgage supports.

Borrowers can borrow up to 40% of their total portfolio value as a cash-out loan and have the freedom to use the borrowed funds as they wish. Despite taking out a loan, borrowers can continue trading their digital assets. Regular monthly payments are required, but the borrowers maintain the ability to trade their assets.

Aaron’s response sparked our curiosity, leading us to inquire further about the concept of “some control” mentioned in relation to Moon Mortgage’s Trade & Borrow product.

Aaron explains that with the Trade & Borrow feature, borrowers are not able to withdraw the assets that have been used as collateral. However, they do retain the ability to trade those assets. For example, if they anticipate a market downturn, they can convert their Bitcoin holdings into cash as a way to hedge their bets and mitigate potential losses. So while they may not have direct access to the collateral, they still have the flexibility to make strategic trading decisions based on market conditions.

That’s a valid point to consider. While Moon Mortgage’s crypto services are facilitated through Anchorage Digital, a federally chartered bank, it’s important to understand that crypto assets are not FDIC insured. With this in mind, what advantages does this arrangement offer to the borrower?

Aaron emphasizes that the primary benefit for the borrower is the access to liquidity against their crypto assets. By partnering with Anchorage Digital for custodial services, which is widely regarded as one of the safest custodians in the industry, borrowers can leverage their assets in a secure manner. Anchorage Digital’s full banking charter for a crypto custodian sets them apart and provides a high level of trust and credibility. This allows borrowers to confidently use their crypto holdings as collateral for loans while still maintaining control over their assets. Overall, it’s a unique advantage that sets Moon Mortgage’s offering apart in terms of safety and reliability.

Shifting our focus, we delved into the core mortgage product provided by Moon Mortgage, which enables crypto investors to utilize their assets as collateral for real estate financing.

However, it seems that this service primarily targets high-value investors, as the minimum loan amount is set at one million dollars. We inquired about the rationale behind such a high price tag and sought an explanation for its establishment.

Aaron Nevin noted that the reason behind the high minimum loan amount is based on the mechanics of the product. When a client wants to purchase a million-dollar property, they would provide one million dollars’ worth of Bitcoin or Ethereum as collateral. In this context, the crypto assets act as an equivalent or guarantee for the down payment. To ensure the stability of the loan, on average they set a liquidation threshold at a 70% drawdown, though this can vary depending on the loan terms. For example, if the value of the Bitcoin collateral drops to 300k, it would be liquidated and held as cash, serving as the equivalent of a down payment.

Aaron further explains that Moon Mortgage has chosen to set the minimum loan amount at one million dollars as the company is in the process of establishing and building out this new market. By keeping the process straightforward and clean, they aim to gain the confidence of secondary debt buyers. However, Moon Mortgage plans to offer lower loan amounts in the future as the market matures.

To put it in perspective, he thinks of this initial approach as a roadster to a Model 3, where we start with a higher value entry point and gradually expand the offerings. In other words, at this stage, setting the threshold at one million dollars allows the company to build credibility and foster confidence in the market.

Moving on, we inquired about the expansion of Moon Mortgage’s crypto mortgage product to various states in the United States. We specifically asked about the states that are not included in the offering and the reasons behind their exclusion.

Aaron informed us that currently, New York is not included in their list of eligible states. The stringent requirements imposed by the BitLicense in the Empire State present significant challenges for Moon Mortgage’s operations. Nevertheless, he expressed the company’s intention to tackle the NY market in the future, indicating their desire for expansion and broader accessibility.

Our final question pertained to Moon Mortgage’s fundraising efforts and their success in raising $3.5 million in October 2022. We also touched upon their ongoing fundraising campaign.

When asked about the types of investors they are seeking and their plans for utilizing the funds, Aaron Nevin provided valuable insights.

He explained that the primary focus of the raised funds will be on expanding and enhancing their platform. With a growing demand that exceeds their current capacity, securing a larger line of credit will enable them to scale their product and offer more competitive rates to their customers.

In terms of investors, they are actively seeking strategic partners who share their vision and can contribute valuable support and resources to their growth trajectory.