BlackBull denies losing MetaQuotes license after Funding Pips closure

MetaQuotes, the developer behind the popular MT4 and MT5 trading platforms, is intensifying its scrutiny over brokers and proprietary trading firms servicing US clients. This shift in policy has already led to disruptions, most notably the sudden closure of trading services by the prop firm Funding Pips and swirling rumors about Blackbull’s MetaQuotes license status.

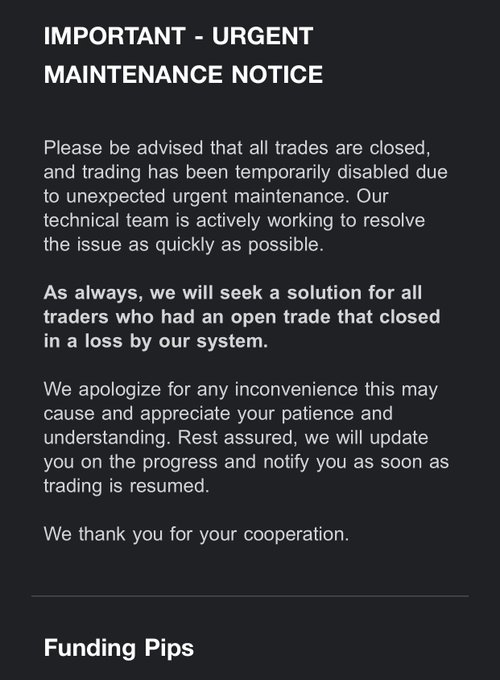

Funding Pips confirmed the industry whispers by announcing an “unexpected urgent maintenance,” following a storm of reports from traders about closed positions and inaccessible trades on MetaTrader.

For its part, BlackBull Markets was quick to dispel rumors of losing its MetaQuotes license, attributing current access issues for new MT5 mobile app users to temporary technical difficulties, promising a swift resolution. However, Anish Lal, chief business development officer of BlackBull Markets, said on X that MetaQuotes forced them to cut ties with Funding Pips.

The speculation about MetaQuotes’ crackdown gained momentum with the recent termination of True Forex Funds’ license due to regulatory concerns and its unauthorized acceptance of US clients. This move brought to the light MetaQuotes’ stringent stance on regulatory compliance, especially concerning the solicitation and trading practices with US customers.

The Commodity Futures Trading Commission (CFTC)’s red listing of True Forex Funds for offering regulated products outside US jurisdiction and allowing trading in CFDs – illegal in the US – also confirms the regulatory pitfalls facing firms operating in or targeting American markets.

The broader implications of MetaQuotes’ actions could be profound for numerous prop firms and brokers that rely on high leverage to attract traders but lack the backing of liquidity providers (LPs) to hedge their large volumes. This operational model, fraught with risks in any jurisdiction, becomes particularly precarious in the US, where regulatory scrutiny is intensifying.

MetaQuotes’ crackdown seems motivated by a combination of factors, including the operational risks posed by firms generating significant volumes of complaints in the US and the minimal financial benefit MetaQuotes derives from these entities. The company’s decision is further understood against the backdrop of pressure from US regulators, including threats to MetaQuotes’ presence in app stores if compliance is not ensured.