Brexit Ripples Continue

As the markets come to grips with Brexit, the ripples caused still continue to affect the markets with many unanswered questions still looming.

Wayne Ko, Head of Research & Education Fullerton Markets.

UK had revealed their intention; to leave EU. Uncertainty looms, Gold and Silver hit 27-month and 23-month high respectively. The financial market is never short of drama. Brexit won and Bremain lost. UK Brexit saga has entered into a new episode; “The Exit”.

“When will the UK government invoke Article 50 to initiate the exit process?” “How would the exit negotiations between EU and UK go?” “What are the implications to UK, EU and the rest of the world?”

Above are some of the common questions most people have in their mind. The tricky thing is no one really has the firm answers to the questions yet. Uncertainties overshadowed last week’s upbeat Manufacturing PMI and will continue to dominate the market. One thing for sure, Bank of England (BOE) is preparing for the worst and rate cut is on the table. We will have a clearer picture on how the rest of the Monetary Policy Committee (MPC) members feel on 14 July.

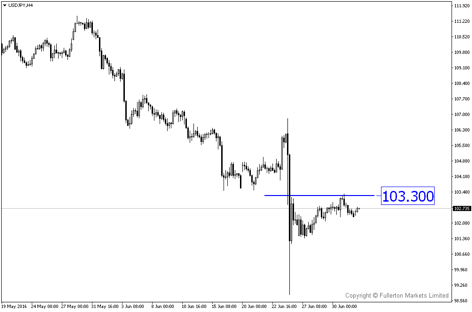

Amidst the unknowns, Central Banks around the world are also preparing themselves. Fed is unlikely to consider rate hike in the near future, possibly assessing the Brexit impact before charting its course. BOJ is expected to take some form of action, especially when the USD/JPY briefly dipped below the 100 level recently. ECB is also looking into loosening its QE rules.

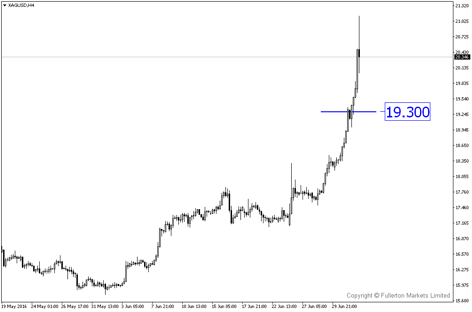

The biggest beneficiary is the bullion, celebrated on the news of Brexit triumphed over Bremain. Gold and Silver rallied more than 8% and 23% respectively in a week. Once again, Silver has proven to be more volatile and speculative than Gold. Judging from the major Central Banks’ reactions and directions, they are likely to support the gains of the bullion. Silver had a good run in the last few days, lookout for profit taking before jumping onto the bandwagon.

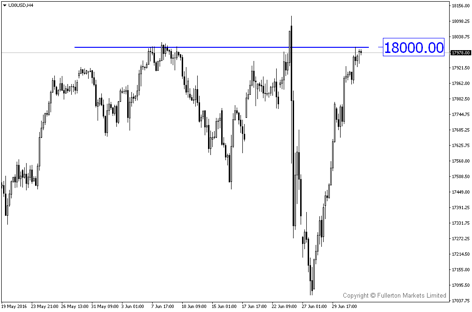

There are some key data releasing this week, UK PMIs and US jobs data. However, Brexit dwarfed these data, market may choose to focus on RBA rate statement and FOMC meeting minutes instead. We do not foresee any rate changes by RBA, but they may join the others in expressing concern over Brexit. FOMC meeting minutes is likely to dash any hope of rate hike before US Presidential election.

Our Picks

Silver (XAG/USD) – Uptrend to continue. Silver had a strong rally, profit taking may bring it back towards 19.30. Possible to buy at the dip.

USD/JPY – Slightly bullish. Bank of Japan is expected to take some actions, a persistent strong Yen hurt their exports and effort to stay away from deflation.

Dow Jones (U30/USD) – Slightly bullish. Dow Jones is near key level of 18,000. This week’s FOMC meeting minutes is likely to echo Fed’s reluctance to hike rate any time soon.

Top News This Week (GMT+8 time zone)

Australia: Cash Rate. Tuesday 5th July, 12.30pm. We expect figures to remain unchanged at 1.75% (previous figure was 1.75%).

Canada: Employment Change. Friday 8th July, 8.30pm. We expect figures to come in at 5.3K (previous figure was 13.8K).

US: Non-Farm Employment Change. Friday 8th July, 8.30pm. We expect figures to come in at 157K (previous figure was 38K).