BTCS gets 24m shares for cancelation for zero consideration after listing plans fail

BTCS has failed to list on a national securities exchange before the end of 2016 and to consummate the merger with Spondoolies-Tech.

BTCS Inc (OTCMKTS:BTCS), formerly known as Bitcoin Shop, Inc., has published a report with the United States Securities and Exchange Commission (SEC), notifying the regulator of the receipt of 24 million shares of Common Stock for cancelation for no consideration – the so-called “Escrow Shares”. These were placed in escrow by Charles Allen, BTCS’ Chief Executive Officer, Chief Financial Officer and Chairman, and Michal Handerhan, BTCS’ Chief Operating Officer and corporate secretary, in line with a securities escrow agreement dated February 19, 2016.

BTCS failed to list its Common Stock on a national securities exchange on or before December 31, 2016 and failed to consummate the merger with Spondoolies-Tech Ltd. on or before December 31, 2016. Then, the escrow agent returned the shares to the company for cancelation for zero consideration.

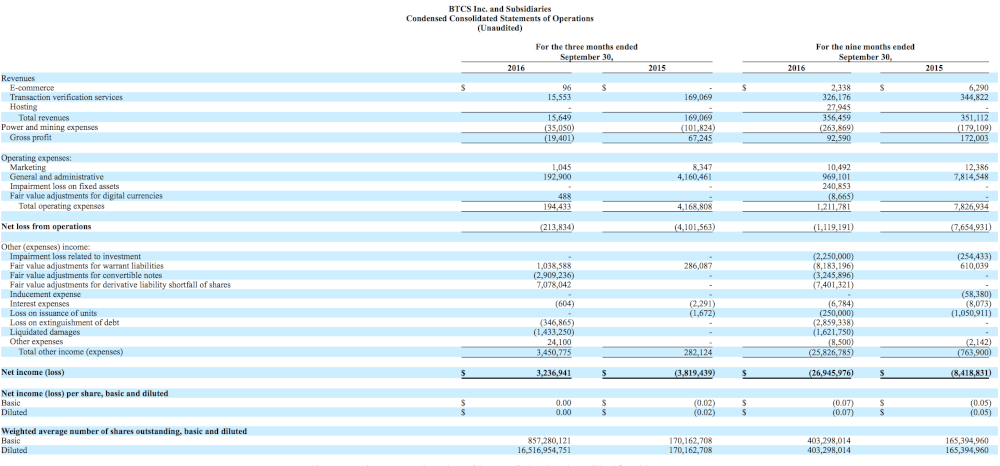

The failure of the company to list on a national securities exchange comes amid continued financial losses. For the nine months to September 30, 2016, BTCS reported a net loss of approximately $26.9 million. At that point, the company had no cash and cash equivalents outstanding and a working capital deficiency of about $24.3 million.

In September 2015, BTCS had signed a definitive merger agreement with Spondoolies-Tech Ltd. However, on May 4, 2016, a hearing was held in the district court in Beersheva, Israel during which certain parties sought appointment of a temporary liquidator for Spondoolies. As a result of the liquidation, BTCS stopped pursuing the acquisition of Spondoolies.

Last year was quite turbulent for BTCS. In July 2016, BTCS Digital Manufacturing (DM), suspended its North Carolina transaction verification services facility operations. A reduction in the block reward from 25 bitcoins to 12.5 bitcoins, along with the facilities cooling system failing, resulted in DM being unable to meet certain of its financial commitments. BTCS has subsequently ceased operations at DM. In August 2016, DM discovered that its facility in North Carolina was broken into and certain of its equipment and approximately 165 Bitmain transaction verification servers leased from CSC Leasing Company (CSC) were stolen.