cBridge Transaction Volumes on Track to Hit $1 Billion Milestone Just Months After Mainnet Launch

The transaction volume was $10 million in the first month of mainnet launch. cBridge is now clocking $20+ million every day! The new cBridge 2.0 could take it to a whole new level.

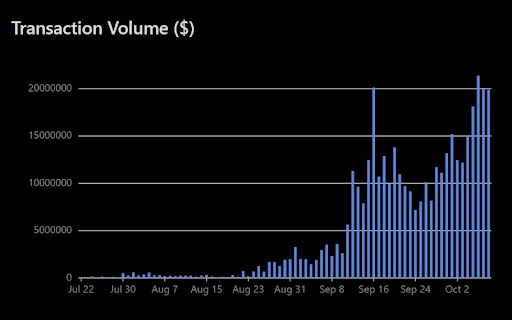

Layer-2 scaling platform Celer has seen explosive growth in transaction volumes on its cross-chain network cBridge since its mainnet launch on July 22. The daily transaction volume has shot up from $25,812 on July 22 to a staggering $20 million on October 08, according to cBridge analytics, as the platform is buzzing with user activity.

The cBridge network allows users to easily swap assets across multiple blockchains including Ethereum, Fantom, Optimism, Avalanche, Polygon, Binance Smart Chain, OKExChain, xDai, and many others.

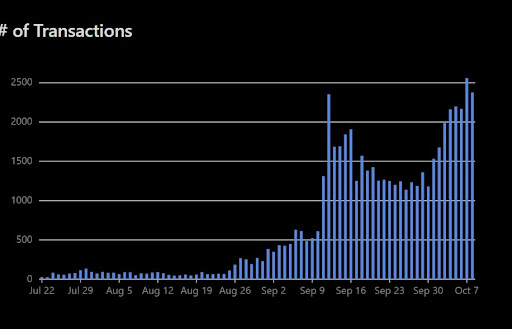

The number of daily transactions has also been increasing steadily – from just 28 on the day of mainnet launch to 2,375 transactions on October 08. The Celer community can expect much more considering the multi-chain network debuted less than three months ago.

On the back of steady growth in the number and volume of transactions, cBridge has processed $405 million worth of transactions, according to cBridge analytics. The total volume was just 10 million in the first month of launch. Fast forward a couple of months, and now it’s handling more than $20 million worth of transactions every day!

The cross-chain network is now on track to surpass the $1 billion total transaction volume in the first half of November, even if we assume a stagnation in volume growth. It’s just a matter of when not if.

cBridge 2.0 to Further Accelerate Growth

Celer Network announced the cBridge 2.0 on September 22, just a couple of months after the cBridge 1.0 mainnet launch. The 2.0 is a major upgrade that brings an even better user experience with lower costs, deeper liquidity, and a much wider choice of chains and tokens. It also brings improvements for other participants including stakers and validators, LPs, and developers.

cBridge 2.0 makes it easier to supply liquidity to the platform. Liquidity providers no longer have to run a node to become an LP. They can simply delegate their tokens to the Celer State Guardian Network (CSGN). The CSGN is a specialized Proof of Stake blockchain that monitors the transactions between Layer-1 and Layer-2 protocols and communicates between them.

Stakers and validators will, besides playing a role in governance, earn a share of the fees paid to the block producers facilitating users’ bridging requests. The cBridge 2.0 will also give developers a bunch of tools including the white-label frontend SDK to create cross-chain dApps.

Celer plans to roll out the cBridge 2.0 upgrade in a phased manner starting with the Phase One Testnet in October 2021. The phased rollout will give them plenty of time to thoroughly test and audit each component of the cross-chain bridge.

https://twitter.com/CelerNetwork/status/1446712812693118980?s=20

Wrapping it up

With the innovation-packed 2.0 upgrade, cBridge will be able to attract more users, developers, and liquidity providers. With the growing adoption of blockchain, DeFi, and NFTs, the transfer of value and data between multiple networks has become an integral part of the ecosystem. Developers and users have been flocking to the Celer Network because of its seamless user experience, dramatically reduced transaction costs, and features.