CFTC data shows flat growth in retail FX deposits for August

Data from the US derivatives regulator for August shows that all registered retail FX platforms added less than $3 million in clients’ deposits.

The less than 1 percent increase came as trading activity surged in other segments. This was amid a boom in retail investments during an unprecedented time for financial markets.

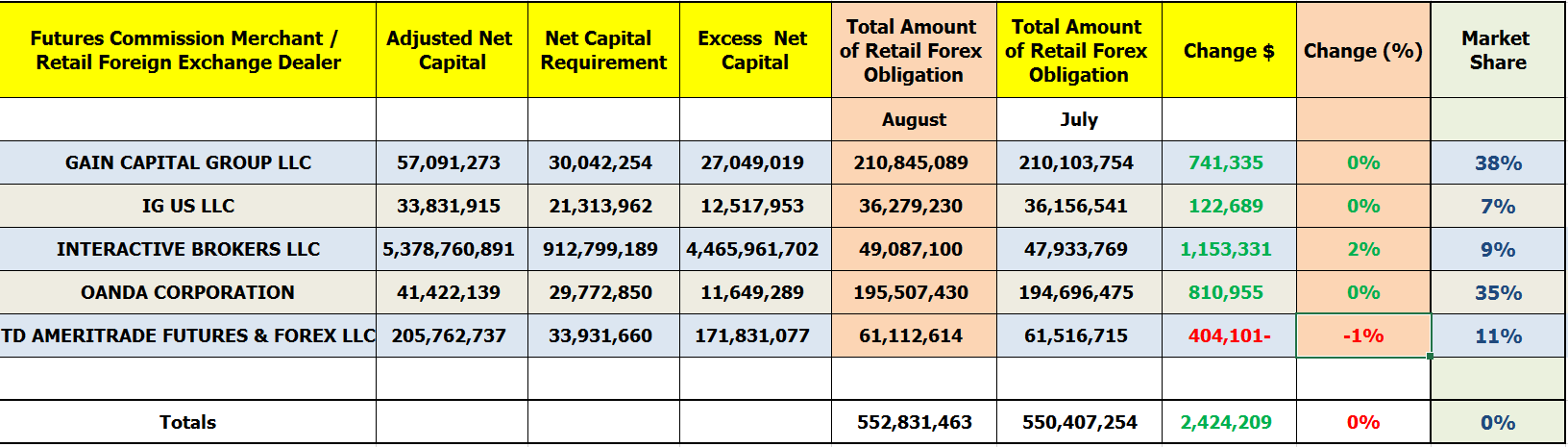

After consecutive increases in its market share, TD Ameritrade suffered a slight drop in retail deposits in August 2021. Specifically, the broker’s net balances decreased by $404,000, or 1 percent, to $61 million.

Other highlights from the CFTC’s monthly report shows that Interactive Brokers LLC (NASDAQ:IBKR) has racked up $1.1 million in additional deposits. This stood at $47.9 million in August 2021. IBKR recouped some losses after it was the worst performer in July, actually the only loser with an overall fall of $6 million to $47 million, compared to $54 million at the end of June.

Meanwhile in August, GAIN Capital saw an increase of nearly $741,000, while retail funds at OANDA Corporation rose by $810,000.

Additionally, IG US reported some minor changes in clients deposits, having risen by $122,000 or 1 percent month-over-month. The US arm of Europe’s largest spread better has been the best performer over the last year, after recording an overall rise of nearly 70 percent in traders’ deposits.

IG US has been taking market share away from traditional big players, currently closing in on with Interactive Brokers and TD Ameritrade. The company, however, still has a long way to go to challenge the likes of GAIN Capital and Oanda, which command nearly 74 percent of the US retail market.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending August 31, 2021. For purposes of comparison, the figures have been included against their July 2021 counterparts to illustrate disparities.