Coinbase launches futures trading on BTC, ETH, LTC, and XRP

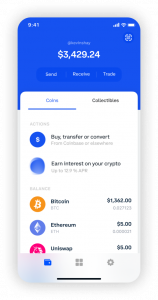

Coinbase Advanced has launched perpetual futures trading for eligible non-US retail customers. These open-ended futures contracts can be traded using the USDC stablecoin.

The trading options available to users include contracts for bitcoin, ether, litecoin, and XRP. While bitcoin, ether, and litecoin contracts offer up to 5X leverage, XRP offers up to 3X leverage.

Initially, this trading feature will be exclusively accessible via the Coinbase Advanced webpage, but mobile trading is set to be introduced soon. This move by Coinbase follows the recent approval by the Bermuda Monetary Authority (BMA) to allow the crypto exchange to offer perpetual futures for its international clientele.

Coinbase Advanced is touted as a platform for seasoned retail traders. These perpetual futures contracts enable traders to speculate on crypto asset price fluctuations without a defined expiry date. Moreover, to celebrate the launch, Coinbase has introduced a promotional low fee rate of 0% (maker) and 0.03% (taker).

In May 2023, Coinbase procured a class F license from the BMA, granting it permission to offer perpetual futures to non-US institutional clients. The new product addition will help traders take advantage of volatility, hedge risk and discover prices through options, which are generally simple and have no special or unusual features.

“As announced in the Phase II of our “Go Broad, Go Deep” strategy, we are dedicated to partnering with high-bar global regulators to build a crypto regulatory framework that allows crypto technology to continually drive innovation,” Coinbase said in blogpost.

The US-based publicly traded exchange launched its international derivatives exchange in Bermuda amid a deepening regulatory crackdown at home. The launch came after the company received regulatory approval from the Bermuda Monetary Authority as part of an aggressive expansion outside the United States.

After unveiling the plan in March, Coinbase announced the move in May, joining other prominent US-based firms that have already taken their business elsewhere due to an increasingly hostile regulatory environment.

The offshore entity, called Coinbase International Exchange, allows users outside the US to trade on both spot and derivatives markets. Bitcoin and Ether perpetual contracts were initially introduced as its first derivative contracts, but other products are expected to launch soon afterwards.