CQG to add XLS Trader to Integrated Client solution

Traders will be able to trade directly from Excel with CQG’s XLS Trader Excel Add-in.

Provider of high-performance trading, market data, and technical analysis tools CQG is planning a raft of enhancements for its Integrated Client (IC) solution. The series of new features to be added to CQG IC 2020 includes CQG XLS Trader and Detailed DOM Tool.

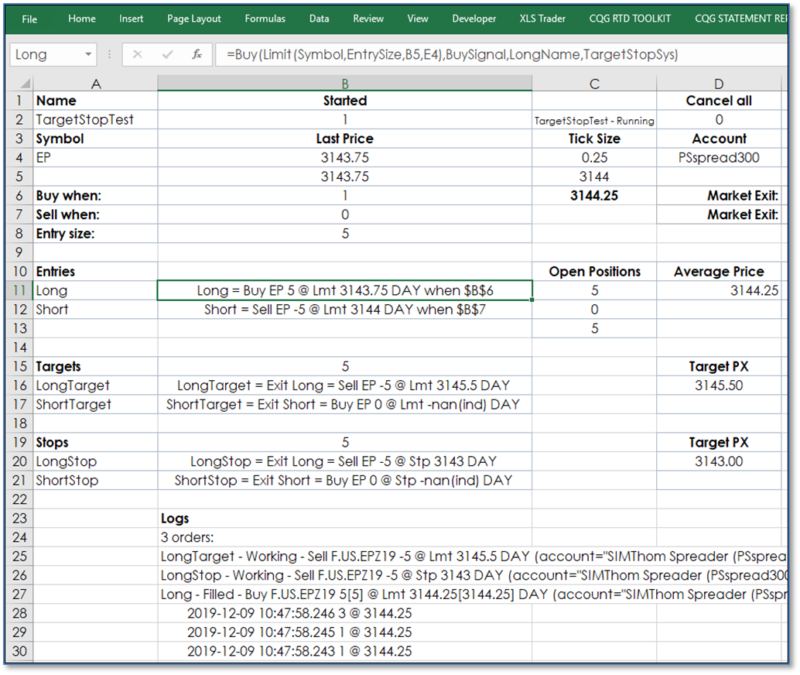

Users of the IC solution will be able to trade directly from Excel with CQG’s XLS Trader Excel Add-in. The Add-in connects Excel to one’s order routing functionality in CQG IC. Traders can pull into Excel market and study data using RTD calls, build their own trading model in Excel, and execute trades from Excel.

XLS Trader’s has over 70 user defined functions (UDFs) for placing and managing orders.

CQG’s new Detailed DOM feature offers full transparency into the Exchange order book by price. Traders can see their order’s place in the queue and the number of orders ahead and behind.

End-of-day data for global markets now included CQG continues to bring value with global end-of-day data now included as part of the standard subscription service.

Traders can access end-of-day data from 22 exchanges from around the world and, thus, gain an edge starting their trading day with insights into how markets in other regions finished out their trading sessions. Users can perform more sophisticated analysis including tracking correlations between similar markets for finding better trading opportunities.

CQG has been regularly updating its solutions. In CQG Desktop Version 5.3, for instance, session open price was added, as well as the ability to color-code page names in left bar. Also, the platform improved the experience when creating a page.

The platform also enabled linking between the Positions widget and HOT.