CQG QTrader 2020 offers detailed DOM tool showing order’s place in queue

The detailed DOM tool provides traders with full transparency of the order book by price and shows one’s order’s placement in the queue.

Provider of high-performance trading, market data, and technical analysis tools CQG continues to enhance the capabilities of its solutions, including CQG QTrader – a platform for professional traders. CQG QTrader 2020 offers Detailed DOM Tool, which gives full transparency of the order book by price and includes one’s order’s placement in the queue.

To enable this feature, open up the Trading Preferences/Trading Display for the trading application.

On the Trading Preferences/Trading Display in the Miscellaneous section in the bottom right-hand corner you check off the Show Detailed DOM Tool. Traders can choose to display:

- Show place in queue on the depth of market column;

- Show estimated place in queue if actual place in queue is not available from an exchange (The estimated place uses italic fonts in the trading interface);

- Show the number of lots ahead of your working order;

- Show the number of orders ahead of your working order;

- Show both the number of lots and the number of orders.

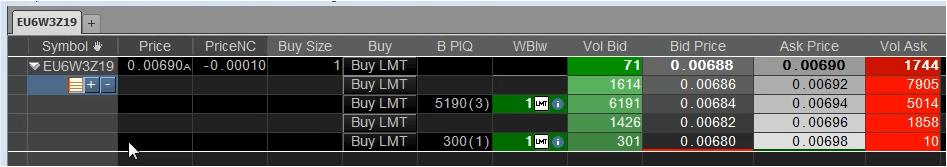

Clicking on the Detailed DOM Tool button will launch a new display showing the details of the best bid and best ask working orders queues. The depth of market column on the price ladder shows the actual number of orders and number of contracts ahead of one’s order in the queue.

With the Detailed DOM Tool open and if you select the price on the price ladder with your working order then the Detailed DOM Tool will display the orders in the queue at that price and where your working order stands in the list of working orders.

The example below is from the Spreadsheet Trader. Opening the Detailed DOM Tool allows users of the platform to see the best bid and best ask queues. Traders can select the price from the price ladder with their working order for place in the queue.

This functionality is available for all order routing interfaces except SnapTrader and Split Quote Board.