Crypto.com launches binary option-like crypto product

Cryptocurrency exchange Crypto.com has released a new product that mimics the attributes of binary options trading, promising the opportunity to earn predetermined amounts based on the price of cryptocurrencies at specific points in time.

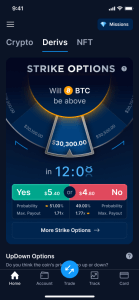

Crypto.com is launching the new crypto derivatives product for its U.S. customers through its smartphone app. The new product, called Strike Options, offers a fast-paced form of trading with contract durations as short as 20 minutes.

Users can predict whether the underlying asset’s price will go up or down, selecting either a “Yes” option if they believe it will increase or a “No” option if they think it will decrease. Starting with a low initial cost of $10, these options are designed to be accessible to a wide range of traders.

Crypto.com’s new product is regulated by the Commodities Futures Trading Commission (CFTC) and currently offers Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). It may appeal to the same type of people who traded binaries in the past or even those playing poker online.

The company plans a staged rollout of Strike Options, with U.S.-based customers being notified of the product’s availability in their region. This gradual approach allows Crypto.com to gauge user response and adjust as needed, it said.

Strike Options differs from traditional options trading, which involves a variable payoff depending on the underlying asset’s price relative to the strike price at expiration. In contrast, Strike Options provide a fixed payoff based on a straightforward ‘yes’ or ‘no’ proposition regarding market movements.

Per the corporate statement, the new derivatives offer several advantages, including the ability to profit irrespective of market direction, well-defined risks, and a simplified decision-making process. Traders can select Strike Options at varying strike prices, giving them the flexibility to choose the level of risk and potential outcome that suits their trading strategy.

Although another instance of integration with mainstream finance is a cause for celebration, binary options are an inherently risky trading method. The proliferation of cryptocurrencies as binary options is not a fresh idea as traditional binary options platforms were aware of this popularity when cryptocurrencies were experiencing a boom. Seeing these trends play out, some native crypto firms have put their heads together to offer a similar product.