Crypto lender Celsius taps Rod Bolger as CFO amid regulatory scrutiny

Celsius Network, a cryptocurrency lending and borrowing platform, appointed veteran banker Rod Bolger as its new chief financial officer (CFO).

The new hire comes as the crypto lender is shaking up its senior ranks, having recently added Aslihan Denizkurdu as COO and Tushar Nadkarni as chief growth and product officer. The duo brings deep experience in financial services and consumer technology, respectively.

Rod Bolger, 55, is taking over as CFO after he parted ways with Royal Bank of Canada in September 2021, ending a decade-long tenure. He held a similar role at Canada’s largest bank for more than five years, part of a lengthy career that dates back to 1989.

As CFO at Celsius, Mr. Bolger will be responsible for ensuring that the finances of the crypto lender can continue to accelerate growth, capitalizing on the expanding worldwide demand for its solutions. Reporting to CEO Alex Mashinsky, he will be tasked with finance functions including controllership, tax, internal audit, financial planning and analysis, treasury and investor relations.

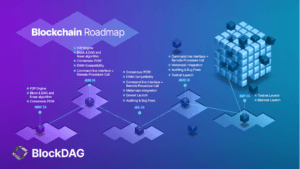

“Celsius Network`s mission of bringing the next 100 million people to financial freedom on the Blockchain rails involves building a bridge between TradFi and CeFi as well as paving roads between the 200 different Blockchain’s that exist in the digital asset space. Rod is not just a world class CFO but a master builder, which will be critically important as we grow Celsius and CelsiusX to lead the Crypto revolution and show the world that doing good – and then doing well – is the best business model,” said Alex Mashinsky, CEO of Celsius.

Crypto lenders are navigating regulatory hurdles

Crypto lenders face increasing pressure as US regulators want to better police their products, which pay customers rates higher than most banks’ saving accounts.

The SEC is reportedly investigating Celsius Network as a part of a broader scrutiny against cryptocurrency lending platforms. Until now, the regulator did not accuse the firm of any wrongdoings or brought charges yet, rather it is checking if their DeFi and lending products should be registered as securities.

Another crypto lender, BlockFi, was ordered to pay roughly $100 million to settle charges of offering unlicensed interest-bearing accounts for retail investors.

Earlier in September, the US regulators signaled a big change in policing cryptocurrencies and the growing Defi sector after they blocked Coinbase from launching a new crypto lending product. The SEC officials have increasingly been talking about a need to crack down on these products, which are essentially unregistered interest-bearing accounts, the agency claims.

The New York Attorney General’s Office also ordered two cryptocurrency lending platforms, which were reportedly Nexo and Celsius, to stop operating in the state. She also sent three other platforms letters with questions about their operations.