Crypto: Spot and Derivatives trading volumes on the rise. Binance down, CME Group up

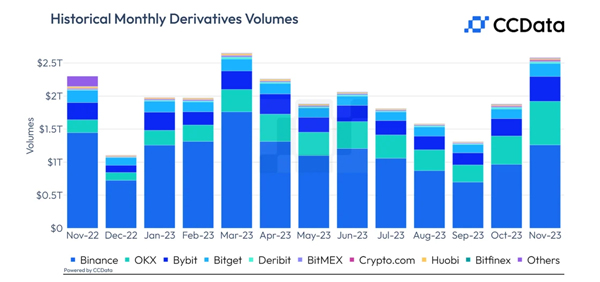

Binance was the largest derivatives exchange by monthly volume, trading $1.26 trillion. However, OKX and Bybit outperformed other exchanges, recording increases of 53.8% and 42.9%, respectively.

CCData Exchange has reported that centralized exchanges experienced their highest combined spot and derivatives trading volume since March 2023.

This rise in trading volume coincided with bullish trends in major cryptocurrencies, such as Bitcoin and Ethereum.

Binance market share is down, CME Group on the rise

Key findings from the report include:

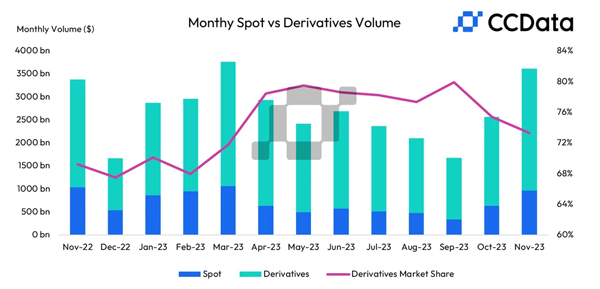

- Significant Increase in Trading Volumes: Spot trading volume on centralized exchanges rose by 52.8% to $965.8 billion, and derivatives trading volume increased by 37.3% to $2.58 trillion. These figures mark the highest trading volumes since March 2023.

- Binance’s Market Share Decline: Despite a monthly increase in trading volumes, Binance’s market share continued to decline, falling to 43.4%. This marks the ninth consecutive month of decline for the exchange. However, with Binance settling US charges, there’s potential for market share recovery.

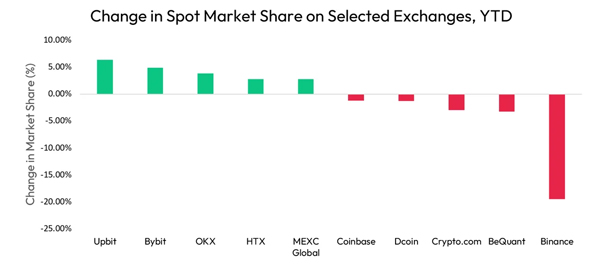

- Record Highs for OKX and Upbit: Both OKX and Upbit achieved all-time high trading volumes, with combined spot and derivatives volumes rising to $731 billion and $431 billion, respectively. Their market shares increased to 20.2% and 11.9%.

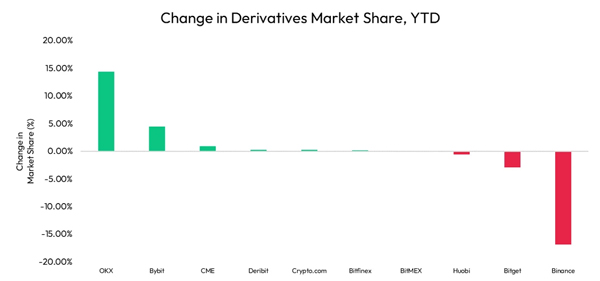

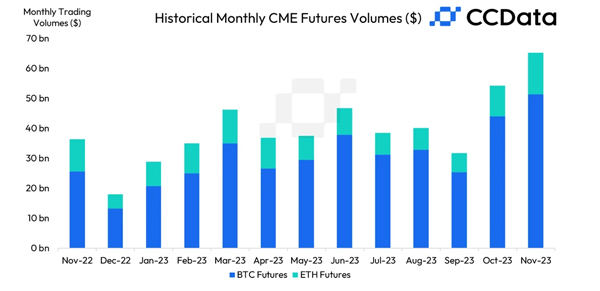

- CME Leads in BTC Futures Open Interest: CME’s open interest for BTC Futures rose by 20.9% to $4.11 billion, surpassing Binance as the largest derivatives exchange by open interest. This is CME’s first lead in BTC futures trading since October 2021, indicating growing institutional interest in Bitcoin.

- Overall Derivatives Dominance: Derivatives trading represented 73.3% of the total crypto market volume in November, slightly down from 75.4% in October.

- Binance’s Performance: Binance was the largest derivatives exchange by monthly volume, trading $1.26 trillion. However, OKX and Bybit outperformed other exchanges, recording increases of 53.8% and 42.9%, respectively.

- Spot Market Share Dynamics: Upbit, Bybit, and OKX have gained the most in spot market share year-to-date, while Binance, BeQuant, and Crypto.com experienced the largest declines.

- Derivatives Market Share Trends: OKX and Bybit saw the largest increases in derivatives market share, while Binance observed the most significant decline, marking its lowest derivatives market share since October 2020.

- CME’s Derivatives Trading Volume: The CME exchange recorded its highest derivatives trading volume since November 2021, with BTC futures trading volume rising by 16.6%.