Crystal Blockchain Report: $12.1 billion worth of crypto-assets stolen since 2011

Crystal Blockchain is a globally distributed team of world-class blockchain analysts, has released its bi-annual report Crypto & DeFi Hacks & Scams Report.

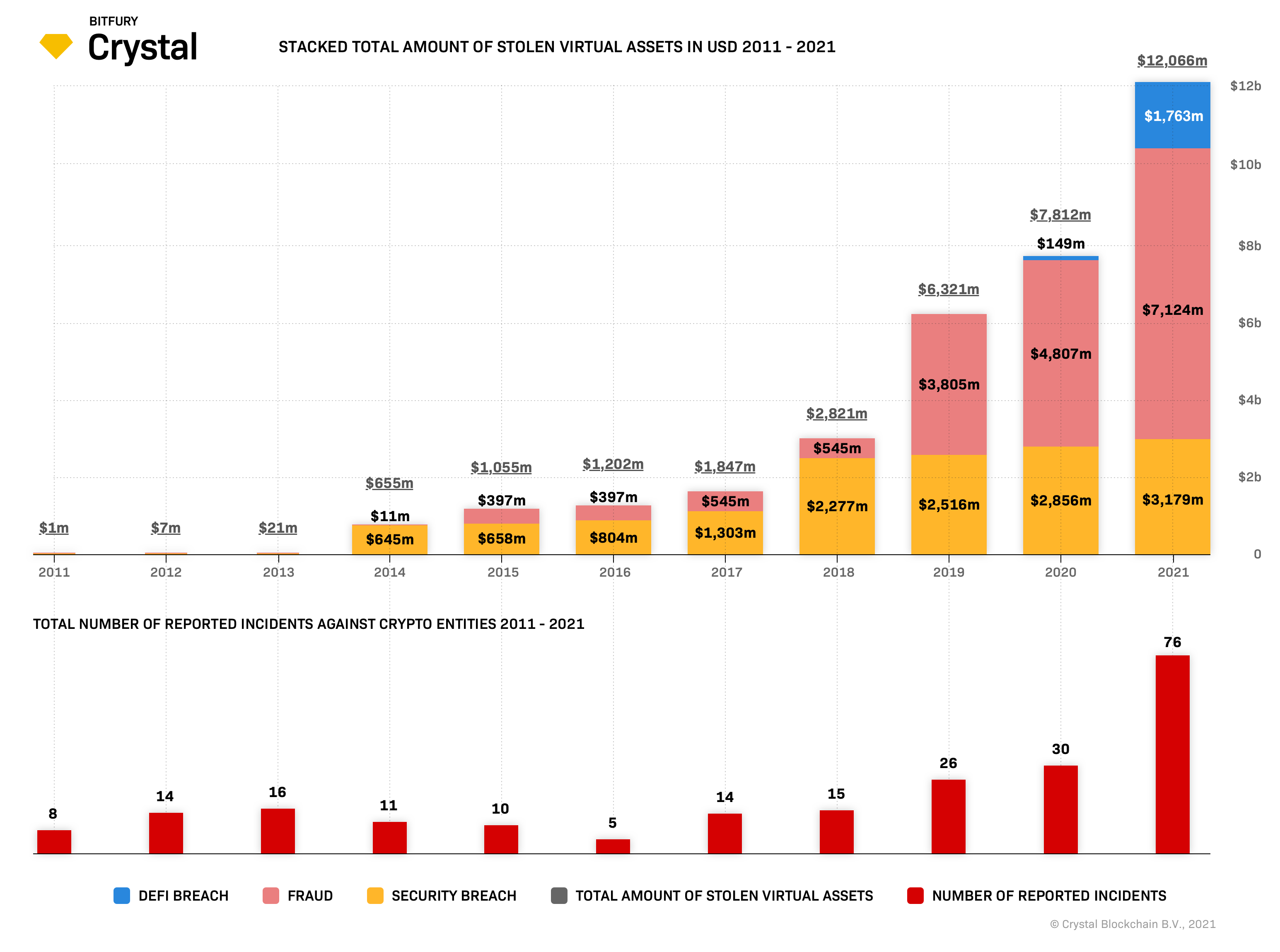

Crystal Blockchain is a globally distributed team of world-class blockchain analysts, has released its bi-annual report Crypto & DeFi Hacks & Scams Report. According to the research, there were 120 security attacks, 73 attacks on DeFi protocols, and 33 fraudulent schemes that have so far resulted in the theft of approximately $12.1 billion worth of crypto assets in total between 2011-2021.

The report states that over $1.7 billion was stolen from DeFi protocols. According to Crystal’s experts, this can be explained by the fact that the technology is new and still has a lot of vulnerabilities. The biggest DeFi breach to date occurred in 2021 to Poly Network, a DeFi initiative, targeted by a hacker, or hackers, who stole more than $614 million in tokens (worth noting that the majority of these funds have been returned).

A leader in the laundering of dirty bitcoins is BTC-e (indicted for money laundering in January 2017), which managed to launder over 200,000 BTC over several years. According to the Crystal database, over a third (39%) of all stolen BTC funds were distributed via Fraudulent Exchanges, defined as exchanges that have been involved in exit scams, illegal behaviour, or who have had funds seized by the government.

Key takeaways from the 2021 Crypto & DeFi Hacks & Scams Report by Crystal:

- The most popular method of crypto theft has been the infiltration of crypto-exchange security systems.

- So far, $3.18 billion has been stolen through security breaches, $7.12 billion has been stolen through scams, and $1.76 billion through DeFi hacks.

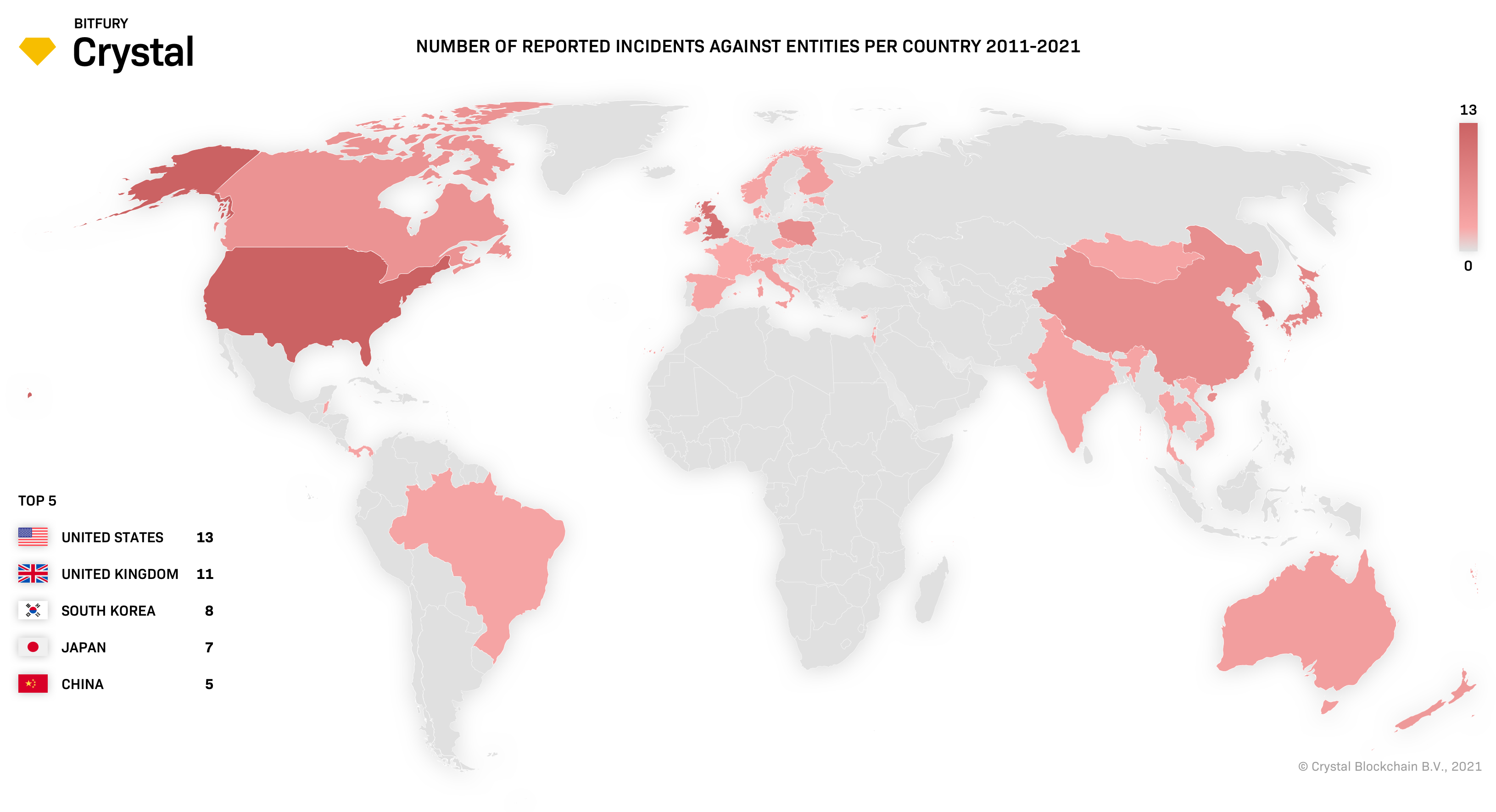

- The most common locations for exchange security breaches are the US, the UK, South Korea, Japan, and China.

- In 2020–2021, DeFi hacks started trending and continue to grow.

- Ransomware is on the rise, with the most noticeable attacks in 2021 being on JBS (paid $11m to REvil ransomware) and Сolonial Pipeline (paid $7m to DarkSide).

- Scams using NFTs are also trending, with the market cap for NFTs having jumped by 1785% so far in 2021. Growing adoption inevitably leads to more bad actors in the space.

“Distributing up-to-date Security Breach and Fraud information helps highlight the current situation in the cryptocurrency world and shows how compliance services are essential for progress in the industry” – Marina Khaustova, CEO at Crystal Blockchain.

The latest report is available on the Security Breaches & Scams Page on our website.

CTA Contact us for your investigations at [email protected]

About Crystal Blockchain:

The company designs blockchain solutions for virtual asset service providers and regulatory agencies. Crystal is making it harder for cybercrime gangs to profit. Should a ransom be paid, the company can track what happens to this crypto — by scrutinizing blockchain records to determine where funds end up and making it harder for criminals to launder stolen funds via the blockchain.