CySEC has change of heart: revises stance on CIF licenses withdrawn

The Cypriot financial regulator has demonstrated some startling swiftness in revising its stance on CIF licenses withdrawn – it took CySEC a weekend to decide to give back authorisations suspended on Friday.

Sometimes the ways a regulator operates and makes its authoritative calls are mysterious… The Cyprus Securities and Exchange Commission (CySEC) has suffered a change of heart over the last weekend, which by chance included the Fools Day. It is not yet clear whether the Cypriot regulator decided to play a prank to the public or not but it has just published announcements saying it is withdrawing the suspension on a couple of licenses suspended last Friday.

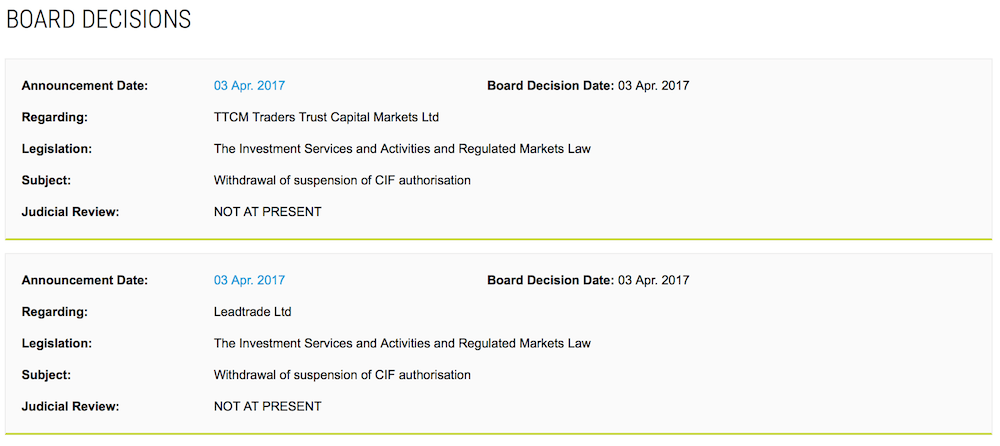

It took CySEC a weekend to realize that at least two of the companies affected by the Cyprus Investment Firms (CIFs) licenses withdrawal – TTCM Traders Trust Capital Markets Ltd and Leadtrade, are now compliant with legal requirements. On Friday, the regulator claimed that four companies – the two just mentioned, as well as Dragon Options and Gametech, are suspected of breaching legal provisions concerning own funds and capital adequacy ratio. Today, CySEC says TTCM Traders Trust Capital and Leadtrade have rectified the problems.

The designation “suspended” next to Dragon Options has also disappeared. The designation remains in place against the name of Gametech at the moment of publication of this article. For how long? Only CySEC knows.

The latest swift revision of CySEC’s mind on law violations by several companies raises questions on whether the regulatory proposals regarding binary options will indeed be implemented. Maybe they will be changed over the next weekend?