CySEC proposes various leverage caps for different retail client categories

CySEC is proposing to prohibit the marketing, distribution and sale of leveraged CFDs on crypto assets to retail clients, unless they fall within the upper tier of the positive target market.

The Cyprus Securities and Exchange Commission (CySEC) has earlier today published its proposals for national measures that reflect the product intervention measures introduced by ESMA about a year ago. Such a move has been largely expected as other national competent authorities (NCAs) in the EEA have already taken similar steps.

But CySEC’s announcement provides a surprising twist, as the Cypriot regulator wants to vary leverage caps for CFD trading depending on the type of retail investors. Put otherwise, some retail investors will see even harsher leverage restrictions than the ones introduced by ESMA, whereas others may see the restrictions relaxed.

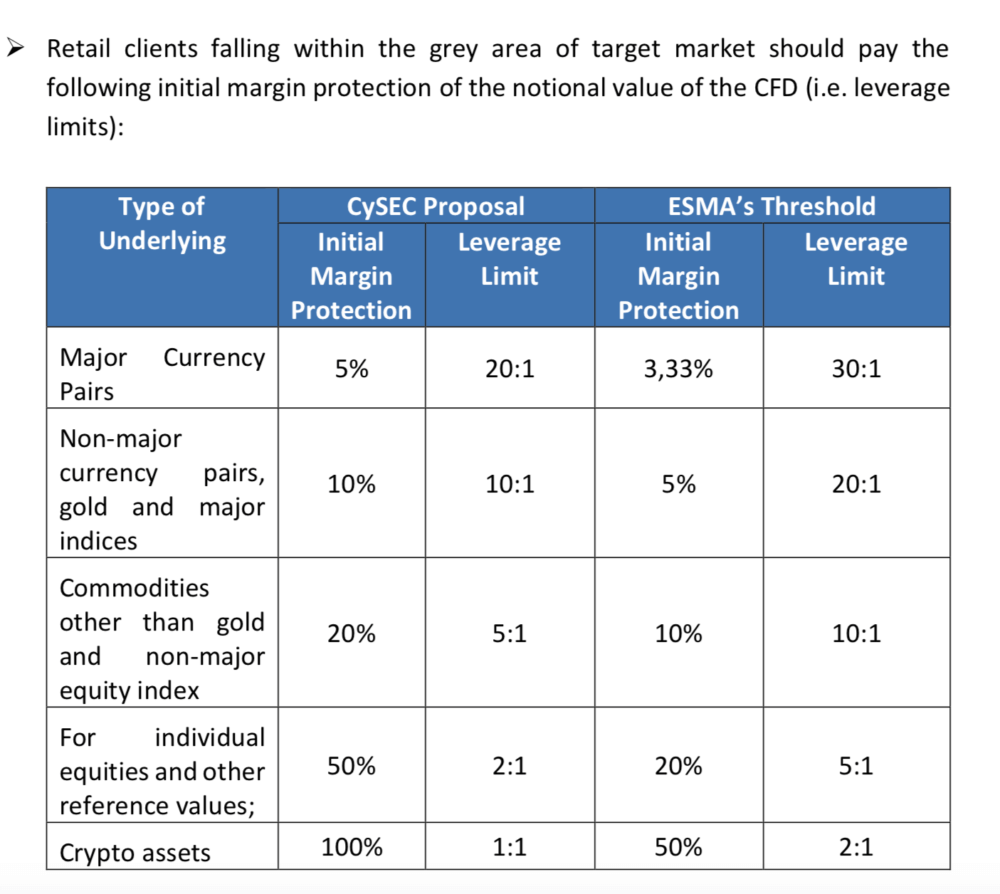

According to CySEC, the ESMA Decision on CFDs does not distinguish between different subcategories of retails clients. MiFID II does not distinguish between different subcategories of retail clients either, but introduced the notion of target market. CySEC expects CFD providers will not sell such products to clients falling within the negative target market. However, CySEC cannot rule out the possibility that sales of such products might appear in the case of retail clients falling within the grey area of target market (i.e. those not falling neither within the positive target market nor within the negative target market).

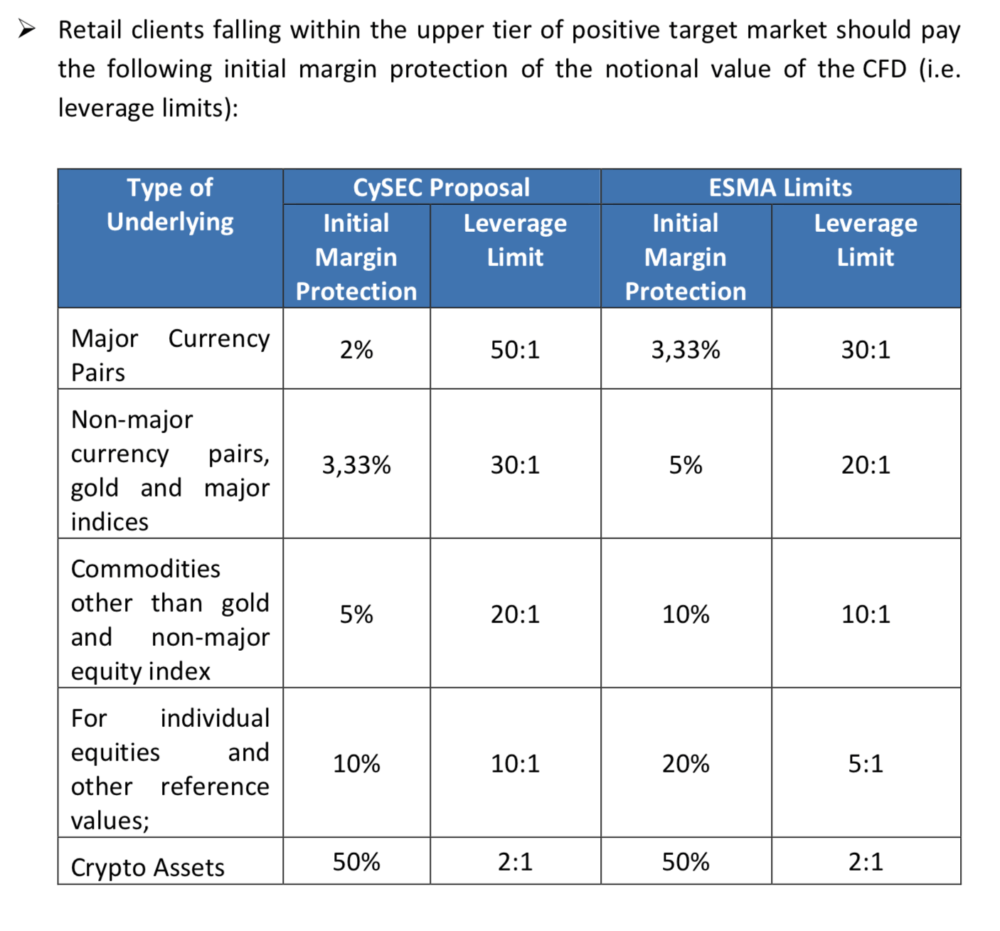

CySEC also acknowledges that the term “retail client” encompasses different types of investors, with different levels of knowledge and financial position and the persons falling within the positive target market does not necessarily share the same level of knowledge and financial position.

The Cypriot regulator explains that, in determining the suitability of CFD products during the customer due diligence process, each retail client must be categorised by the firm within a specific target market – either ‘positive’ or ‘negative.’ Retail clients who fall in the ‘grey’ area of target market (fit neither within the positive target market nor within the negative target market) could be vulnerable to being offered leverage that exceeds their knowledge, financial position and risk appetite.

Accordingly, CySEC is proposing to introduce stricter leverage limits for retail clients falling within the ‘grey area’ of the target market, and affording slightly higher leverage limits for retail clients falling within the upper tier of the positive target market.

CySEC is proposing to prohibit the marketing, distribution and sale of leveraged CFDs on crypto assets to retail clients, unless they fall within the upper tier of the positive target market to prevent exposure to excessive risk caused by the extreme volatility of the instrument.

Finally, CySEC plans to adopt permanent National Product Intervention Measures on Binary Options, which will be the same as ESMA’s measures, without any pubic consultation on the subject matter. An official statement will be issued once the measures are formally adopted.

Interested parties may submit their comments to the CySEC Policy Department by email at [email protected] .

The submission of comments should be made no later than 14 June 2019 . The subject of the email should have the following form:

“Consultation Paper (2019 – 02) – [insert the Name of Organisation, Legal or Natural Person submitting the comments or views]”