Data Comfort, Brexit Worries

Better than expected UK data boost confidence. Earlier expected date of invoking Article 50 worries the market. Where will the pound be heading?

By Wayne Ko, Head of Research & Education at Fullerton Markets

Last week, UK CPI YoY came in at 0.6% versus consensus of 0.5%. Claimant Count Change dropped 8.6K as opposed to an expected increase of 5.2K. Average Earnings showed slight improvement at 2.4% compared to the previous month 2.3%. Retail Sales sealed the game on Thursday, came in at 1.4%, far exceeded the forecast of 0.1%. As the saying goes, the game is not over until the final bell is rang. UK Prime Minister, Theresa May was said to be in favour of triggering formal talks to exit European Union earlier in 2017 last Friday. The comment sent the pound tumbling, wiping off 50% of the gains made since the start of the week. Should we be looking to buy or sell the sterling?

The only key data UK has for this week is their Second Estimate GDP. We expect the actual figure to be close to the market’s expectation of 0.6%. The possibility of invoking Article 50 in the first quarter of 2017 is likely to haunt the sterling in the near term. However, the sterling weakness may be countered by an equally weak dollar as well. Market is not seeing any hope of rate hike before November, even though some Fed officials have presented their hawkish views. The annual Jackson Hole Symposium, attended by central bankers, finance ministers, market participants and academics from around the world, is held this week. Fed chairperson, Janet Yellen is also scheduled to speak in the symposium. Investors will be looking for more clues to gauge the possibility of Fed rate hike this year and possible actions from other policy makers.

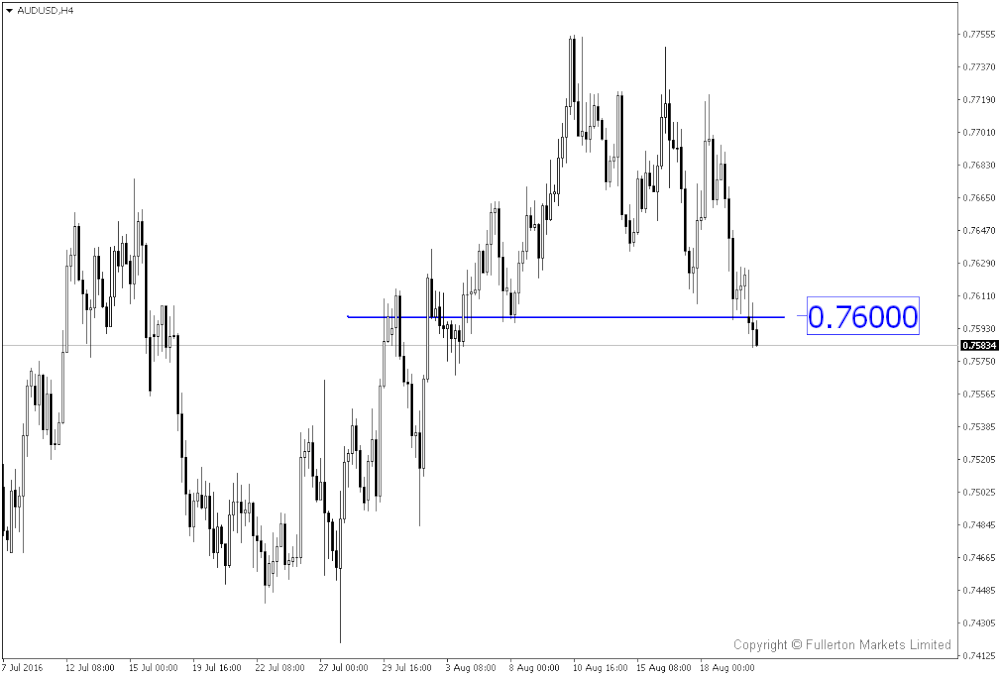

Both the Aussie and Kiwi maintained their strength even after rounds of rate cut. Last week, we saw favourable job data from both countries. The increase in Aussie numbers were mainly contributed by part-time jobs and full-time jobs actually declined. Kiwi received extra boost from the GDT Index (diary prices), which rose 12.7%, the most in 10 months. Data are not enough to push the Aussie and Kiwi further, as we saw both of them retreat from the key resistance of 0.77 and 0.73 respectively. We believe the key underlining reason is both the central banks are still open to further easing. A persistently strong currency will hinder them to achieve their inflation targets, thus investors are cautious in buying higher.

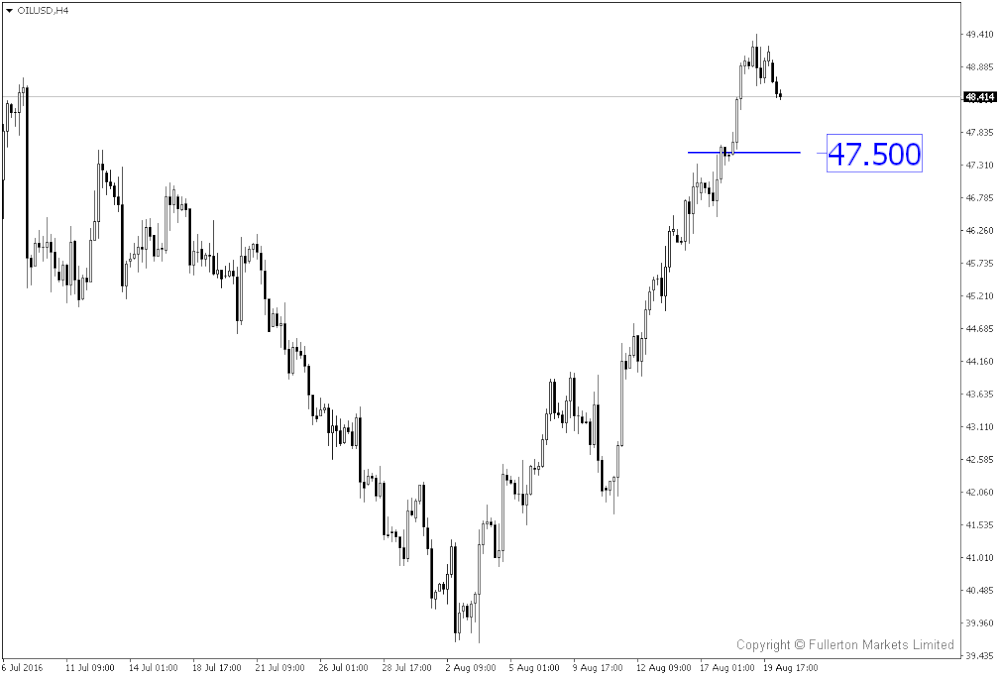

Speculations of Oil production freeze deal are back, as we see WTI heading towards $50 a barrel. We do expect such “hopefulness” to continue until next month’s informal discussion. The downside risk is disappointment, as what we saw in the first quarter of this year.

Our Picks

AUD/USD – Slightly bearish. Price has broken the round figure of 0.76. The bearish momentum may continue. Upside risk is dovish comments by Fed during Jackson Hole Symposium.

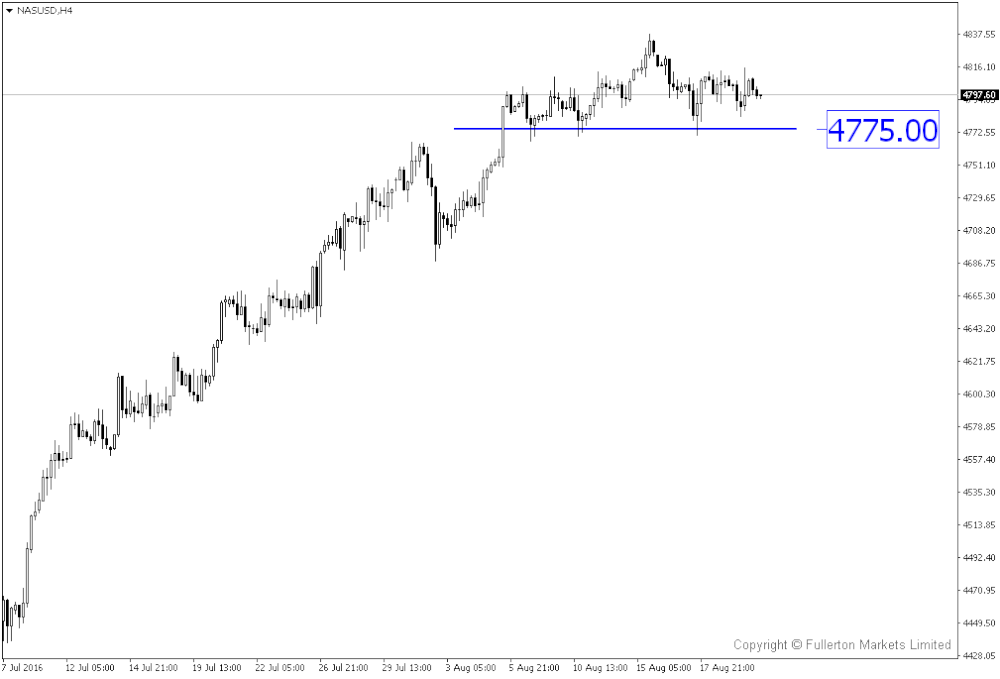

NAS/USD (Nasdaq) – Ranging. We expect the Nasdaq to be trading sideways this week until Jackson Hole meeting. The nearest Support is around 4775.

OIL/USD (WTI Oil) – Slightly bearish. Oil has rallied sharply on production freeze speculations. We suspect profit taking may kick in soon to take the price towards 47.50.

Top News This Week (GMT+8 time zone)

Europe: German Ifo Business Climate. Thursday 25th August, 4pm. We expect figures to come in at 108.9 (previous figure was 108.3).

UK: Second Estimate GDP q/q. Friday 26th August, 4.30pm. We expect figures to come in at 0.6% (previous figure was 0.6%).

US: Prelim GDP q/q. Friday 26th August, 8.30pm. We expect figures to come in at 1.2% (previous figure was 1.2%).