DeFi active wallets surpass 500K in October, says DappRadar

Blockchain analytics firm, DappRadar has published its October Dapp Industry Report, which shows how certain segments within the dapp industry appears to have found consolidation levels.

The report shines a spotlight on how the industry recovers after it has felt the brunt of a widespread turmoil in the cryptocurrency market. Notably, it reveals the number of daily Unique Active Wallets (UAW) that interact with blockchain dapps rose 7 percent on a monthly basis to 2.01 million on average. This increase demonstrates the industry’s resilience during uncertain times once again, the report states.

Despite the bearish trend in the industry, there are a few silver linings that keep users optimistic about the future direction of the dapp industry. Most notably, Layer-2 protocols Arbitrum and Optimism increased their unique active wallets by 501% and 83.31%, respectively. Additionally, Binance’s BNB Chain increased its daily average UAW this month by 9.41%, surpassing half million. That was the highest activity we’ve ever registered since April.

Also on the positive side, the decentralized finance (DeFi) industry is experiencing an overall uptick in activity as the crypto market recovers slowly. DeFi dapps show signs of recovery with a 7% increase in terms of daily average UAW month-over-month (MoM). The total figure reached above half a million UAW for the first time since June.

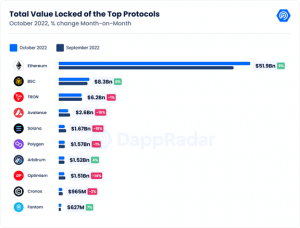

Another point of strength was the total value locked (TVL), the basis for measuring the efficiency of dApps, which increased by 5.3% from the previous month and presently sits at $83 billion.

Even though NFT is still suffering when analyzing trading volume and number of sales, which declined by 30% each, the number of unique traders climbed by 18% to 1.11 million.

Meanwhile, Ethereum remains the most popular DeFi chain with $51 billion TVL, a 9.52% growth from September. But relative to other protocols, its dominance decreased from 69% in September to 61.97% in October. BNB is once again the runner-up with $8.3 billion in TVL, an 8.57% growth from the previous month as the recent BNB Chain exploit didn’t affect the metric.

Nevertheless, the decline in cryptocurrency activities remains visible elsewhere. The DappRadar reports makes a note that the blockchain gaming sector has seen its number of UAW decrease by 2% (898K) from the previous month, and its dominance decreased too, dropping to 45%. Additionally, Ethereum remains on a downward trend, and this month the number of unique active wallets decreased by 4.53% and now has a daily average UAW of 70,768.

The DappRadar report depicts the factors that are affecting the blockchain ecosystem, using metrics and data to create an understanding of the latest trends. The report sums up different market scenarios to provide a basic overview of the market with respect to DeFi, NFTs, gaming and everything in between.