Discovering CapitalBear: A Comprehensive Broker Review

In this review, we delve into the trading environment, conditions, services, and fees to provide you with a comprehensive overview of Capital Bear’s offerings.

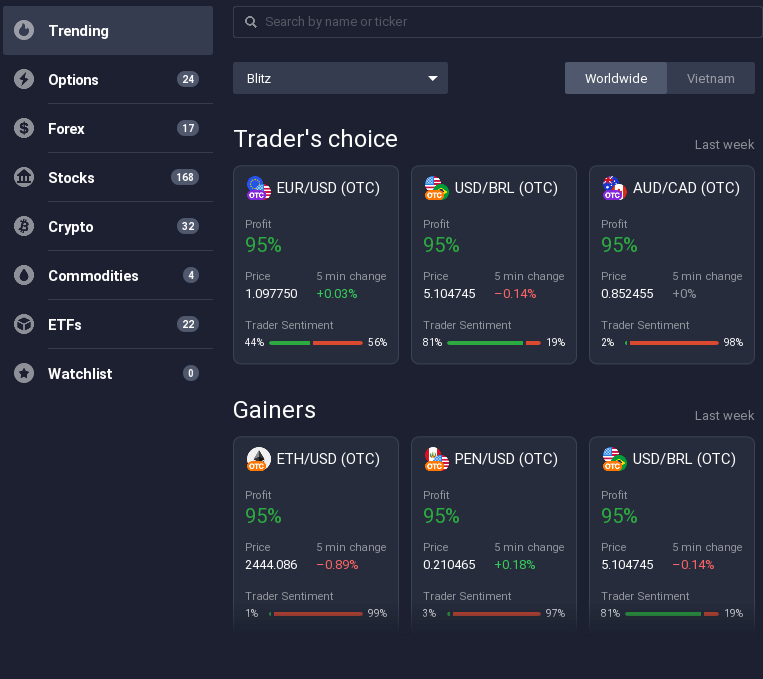

CapitalBear is a reputable player in the financial market that positions itself as “the platform for beginners” and offers a wide range of trading instruments. From binary, digital, and 5-second options to CFDs encompassing Forex, stocks, crypto, commodities, and ETFs, CapitalBear caters to a diverse range of investment preferences.

CapitalBear Highlights

- $10 minimum deposit

- 200+ assets to trade

- Simplified proprietary trading platform

- Free $10,000 demo account

- Multilingual 24/7 support

- Multiple deposit and withdrawal options; quick cashout via e-wallets and local banks

- Competitive commissions and 0% fees on deposits

- Multiplatform access: web, desktop, Android

Minimum Deposit: A Low Barrier to Entry

CapitalBear boasts one of the most accessible entry points in the market, allowing traders to start with a minimum deposit of just $10. Moreover, the minimum deal size stands at a mere $1, making it an incredibly affordable option for beginners or those with limited capital.

Assets and Trading Conditions

CapitalBear offers diverse trading conditions across various instruments:

- Forex: Popular currency pairs, including majors, minors, and crosses. Multipliers range from x300 to x500, offering potential leverage for increased profits.

- Binary Options: Contracts with expiration times ranging from 1 minute to 1 month and a potential profit of 95%.

- Digital Options: Contracts with expiration times from 1 to 15 minutes offer unlimited potential returns, making them an attractive choice for traders seeking higher-risk, higher-reward opportunities.

- 5-Second Options: The shortest contract type with an expiration time of only 5 seconds and a potential profit of 95%.

- Stocks: CapitalBear offers access to over 150 stocks of the world’s largest companies, with multipliers ranging from x2 to x20.

- Commodities: Oil, gold, and silver with multipliers from x20 to x50.

- Crypto: Over 20 popular cryptocurrencies with multipliers ranging from x3 to x100.

- ETFs (Exchange-Traded Funds): Similar to classic stocks, ETFs represent a collection of assets traded in bulk. Traders can engage in ETF trading with a multiplier of x20.

Trading Experience with the CapitalBear Platform

Unlike many brokers, CapitalBear operates on its own proprietary platform instead of relying on the popular MetaTrader engine. The CapitalBear platform offers a simplified and uncluttered interface, which can be particularly advantageous for beginners.

Key features of the CapitalBear trading platform

The CapitalBear trading platform has received many prestigious awards due to its outstanding features. Firstly, it integrates extensive trading features into a simple interface, making it accessible even to those without trading experience. Secondly, it’s cross-platform and available on Windows, macOS, Android, and the web. Traders can conveniently perform all actions directly from the chart, with easy navigation and access to tools, widgets, controls and tooltips.

- Customizable Traderoom: Traders can set the desired chart layout (up to 9 charts at a time), colour scheme, language, chart type, and other settings, ensuring a personalized and immersive trading experience.

- Notifications & Alerts: Set the desired price levels and receive notifications when the price reaches the preset level.

- Comprehensive Deal Tracking: Traders can conveniently view their full trading portfolio, including current profit and reports on all open and pending positions. The Trading History section allows for detailed performance analysis.

- Technical Indicators and Widgets: 100+ technical indicators available. Traders can save their favourite multi-indicator presets and even create custom indicators to align with their unique strategies. Widgets like traders’ sentiment, high and low values, trades of other users, news, and volume can be applied for enhanced analysis.

- Fundamental Analysis Tools: The platform grants access to market news, economic calendars, and earnings calendars.

- Responsive Support: In case of any issues, traders can seek assistance by using the live chat box within the platform.

- Risk Management: Traders can place Stop-Loss and Take-Profit orders to exit a trade whenever the time is right.

CapitalBear Accounts: Demo, Real, and VIP

Upon registration, CapitalBear provides traders with both a Demo and a Real account.

Demo Account comes preloaded with $10,000 in virtual coins. It allows users to explore the platform’s features and test strategies without limitations. The Demo account is replenishable and does not have an expiration date. No account verification is required to access and trade on the Demo account.

Real Account grants access to the live market and requires verification of identity, address, and payment method.

VIP Account offers exclusive features to those who made a larger initial deposit. VIP account holders enjoy benefits such as increased profitability on select assets and personalized account management.

CapitalBear Deposits and Withdrawals

CapitalBear offers a wide range of deposit and withdrawal options: VISA/Mastercard, international payment systems like AdvCash, Neteller, Skrill, WebMoney, Perfect Money, and local payment systems.

Withdrawals are processed through the same payment method used for depositing funds. For example, if a trader used a bank card for the deposit, withdrawals must be made to the same bank card. It’s important to note that withdrawals cannot exceed the amount deposited within 90 calendar days from the last deposit.

CapitalBear’s Fees and Commissions

CB applies competitive commissions: zero fees on all deposits, one free withdrawal per month (2% commission applies for each subsequent withdrawal), and swaps ranging from 0.01% to 1.7%.

24/7 Customer Support with Multilingual Assistance

Exnova provides round-the-clock customer support via email at [email protected] and through live chat. The support team is proficient in multiple languages: English, Spanish, Portuguese, Vietnamese, Korean, Thai, and Filipino.

CapitalBear’s Recognitions and Awards

The CapitalBear platform has been recognized with several prestigious awards in 2022:

Best Binary Options Provider Global 2022 — International Business Magazine

Best Binary Options Platform Global 2022 — Global Business Review Magazine

Best Trading App 2022 — FX Daily Info

Final Thoughts

CapitalBear stands out as a reputable broker offering a wide range of trading instruments, such as binary/digital/5-second options, CFDs on stocks, crypto, commodities, ETFs, and Forex.

With a minimum deposit of just $10 and a low barrier to entry, it provides an affordable option for beginners and those with limited capital. The platform’s simplified interface makes it accessible even to traders without prior experience.

Additionally, the proprietary trading platform, competitive commissions, zero deposit fees, and multilingual customer support contribute to a user-friendly and immersive experience for traders of all backgrounds.