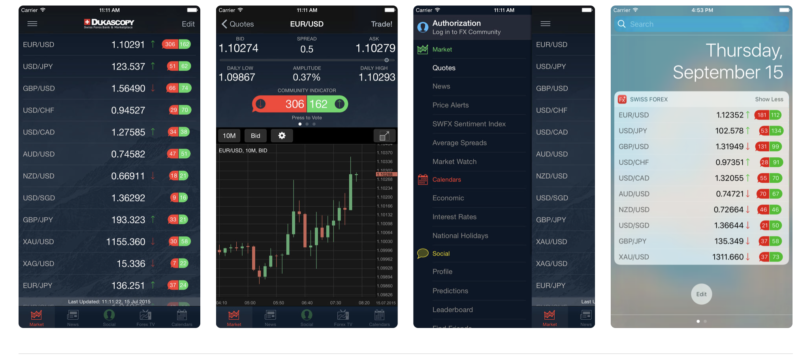

Dukascopy adds new chart drawings to Swiss Forex and JForex Trader mobile apps

The latest versions of the apps for iOS devices offer a number of new chart drawings, such as Fibonacci Expansions.

Swiss online trading company Dukascopy Bank SA has recently updated its Swiss Forex and JForex Trader mobile apps for iOS devices, with the focus being on charting enhancements.

The latest versions of the applications add several new chart drawings:

- Fibonacci Fan Lines (trend lines based on Fibonacci retracement points);

- Fibonacci Fan Arcs (percentage arcs based on the distance between major price highs and price lows);

- Fibonacci Retracements (ratios used to identify potential reversal levels);

Fibonacci Time Zones (indicators of time periods where the price of an asset experiences a certain movement);

Fibonacci Expansions (plot possible levels of support and resistance).

Let’s recall that Dukascopy’s Swiss Forex application provides its users with up-to-date Forex information. Traders get access to a variety of FX tools including quotes, charts, news, calendars and even video reviews provided by Dukascopy TV studio.

The app also offers Economic Calendars with customizable push notification alerts, as well as Apple Watch support (quotes, chart, daily high/low).

The JForex Trader app aims to replicate all the main features of the Dukascopy platforms, including live, secure and persistent connection with server, as well as competitive FX spreads, and access to ECN liquidity. Traders can make use of instant order execution and a variety of trading orders (including stop / limit / bid & offer ).

Another of Dukascopy’s mobile applications that has been updated recently is Dukascopy Connect 911. The most recent version of the solution offers introduces the bank’s Bot. The app makes available all of Dukascopy’s mobile banking in one chat with the chatbot. This covers accounts, cards, payments, exchanges and investments.