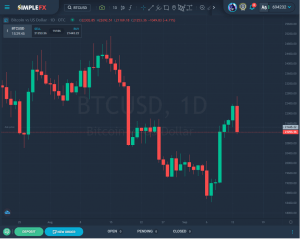

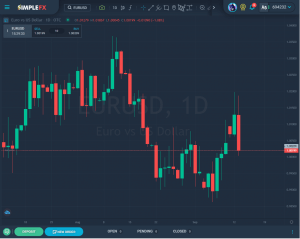

Euro, Bitcoin Fall as USD Raises on CPI Higher Than Expected

USD has had the worst run in a few days as the markets were waiting for the customer inflation data. On Tuesday, customer prices climbed more than expected, by 8.3% year to year in August; the news triggered a sell-off. EURUSD is down 1%, and BTCUSD lost 4%, as bulls are fighting to defend $21k support.

USD has had the worst run in a few days as the markets were waiting for the customer inflation data. On Tuesday, customer prices climbed more than expected, by 8.3% year to year in August; the news triggered a sell-off. EURUSD is down 1%, and BTCUSD lost 4%, as bulls are fighting to defend $21k support.

Higher inflation means that the Fed is not done yet with rate hikes. The cheap money is not coming back to the financial markets soon.

The Labor Department reported that the CPI rose 0.1%, while analysts expected a 0.1% drop. It may seem very little, but this is how fragile the markets are in the second half of 2022.

The US Dollar has been winning for the past few months. A weaker dollar caused cryptocurrencies and stocks to rise. At the same time, oil prices have been decreasing as the war in Ukraine seems to change tides with a successful offensive from the defenders pushing Russian forces away.

However, the optimism is still threatened as yet another armed conflict has just started with Azerbaijan attacking Armenia in the disputed Nagorno-Karabakh region. The Russian Federation has traditionally backed Armenia, and it seems Azerbaijan decided to benefit from Moscow’s prolonged involvement in the Ukraine invasion.

SimpleFX traders could benefit from both price moves, as they could short (sell) oil and dollar and open long positions on the hot assets. The platform has recently attracted many ethereum holders with their unique Stake&Trade accounts. They allow users to stake any amount of ETH in their pool, earn interest rate (added to the account every day), and, what’s more, use the locked funds for trading. SimpleFX users cannot only stake their tokens but also hedge their long position on Ethereum with well-timed leveraged shorts.

To celebrate the upcoming merge and transition of Ethereum blockchain to proof-of-stake, SimpleFX has launched a special limited-time offer where traders can get a $150 gift for depositing to Stake&Trade accounts now.

What does rising inflation mean?

We have observed a unique situation in recent months. It was USD against all other currencies and asset classes. Market sentiment swings from the enthusiasm that equities and crypto have reached the bottom, and it’s time to buy crypto stocks. If inflation stays high and the interest rates need to remain high, it could stifle the economy.

The US Dollar has been on a losing streak for the past few days. This has caused many people to wonder what is causing this decline and what it means for them and their wallets. In this article, we will explore the causes of the dollar’s decline and some of its effects. Finally, we will offer some tips on how you can benefit from this trend.

One of the most commonly cited reasons for the US Dollar’s recent decline is concerns about the US economy and its prospects. Other factors that have been blamed include rising interest rates in different countries and trade tensions between the US and its partners.

People worldwide are facing the challenge of protecting their money against inflation. For years they have been investing in stocks and cryptocurrencies. Now they face a double threat – inflation and declining asset prices. The only way out is to trade actively. Apps like SimpleFX allow you to profit whenever the price of bitcoin, gold, USD, Tesla, or other symbols goes up or down. Well-time trades can help you multiply your funds, while negative balance protection and adjustable leverage allow traders to diversify the risk and achieve a stable return on their capital. Give SimpleFX a try now.