Exclusive: Wayne Marcel explains FIO Protocol amid fight against fraud on NFT markets

It’s been 12 years since Satoshi Nakamoto released the white paper that introduced Bitcoin to the world.

Despite the spectacular efforts to build out the infrastructure, networks, and tools required to ensure secure and smooth transactions, much remains to be done.

One example is the sea of plagiarized NFTs on marketplaces such as OpenSea, which acknowledged that plagiarism or spam amounted to 80% of NFTs created for free on its platform. Identifying the original NFT and artist is hard to do given the nature of long complex anonymous addresses consisting of letters and numbers that can be subject to man-in-the-middle attacks.

Enter the Foundation for Interwallet Operability (FIO), whose NFT signatures solve this problem by providing authorship, stopping fraudsters, and protecting buyers.

Finance Feeds spoke with Wayne Marcel, Head of Business Development at FIO Protocol, to learn more about the startup and its naming solutions on offer.

What is the FIO protocol?

The FIO Protocol is a decentralized layer that bridges the gap between crypto endpoints. It integrates into existing products as a usability layer that creates an improved, stress-free user experience for all blockchain tokens and coins by providing a layer of data and confirmations about transactions on other blockchains. Users of the protocol are able to replace all of their long-string wallet addresses with one human readable FIO Crypto Handle in the format of username@domain. This makes sending and receiving cryptocurrency as easy as sending an email. User can also send FIO payment requests. The Crypto Handles also allow NFT creators to verify authenticity by mapping a FIO NFT Signature to NFTs created on any chain. Additional use cases are being created each day, as we recently partnered with gaming platforms as well.

Could you go into detail about FIO Crypto Handles?

A FIO Crypto Handle is a human-readable wallet identifier that replaces the need to copy and paste long-string wallet addresses. Users can map all of their public wallet addresses to a single FIO Crypto Handle. FIO is interoperable with all chains and cryptocurrencies. The Crypto Handle is in the format of username@domain. Users are able to register any Crypto Handle that is not already taken. Users can register custom domains, such as surname, brand or company name, or anything else available.

Could you go into detail about FIO NFT Signatures and why they are important?

Using a FIO Crypto Handle, creators of NFTs can map a digital NFT Signature for NFTs created on any blockchain. This allows buyers and sellers in the future to verify authenticity by verifying not only that there is a FIO NFT Signature, but also that signature is the Crypto Handle that the creator made public they were signing with. A FIO NFT Signature also stores a cryptographic hash of the NFT metadata helping to protect the permanence of the NFT.

Why should data associated with the image be stored as a cryptographic hash of that off-chain data?

Many NFT collectors and even some creators do not realize that in many cases the image, video, or other metadata for an NFT are not stored on a blockchain, but in turn point to a URL or other file location. Storing a cryptographic hash on the FIO blockchain when mapping an NFT Signature helps protect the permanence of the NFT as the owner can verify its authenticity.

Could you go into detail about features such as FIO Requests and FIO data?

FIO requests allow a user to request any cryptocurrency from another party, including being able to include data such as referencing an invoice or including the reason for the request. The recipient of the request can open up the request and easily approve it, which will then send the cryptocurrency requested without the need to copy and paste the sum and address.

What is the FIO Contributors DAO?

FIO Contributor Decentralized Autonomous Organization helps FIO Protocol contributors organize to help make all blockchain interactions across every crypto application easy, less risky & joyful. The FIO Contributors DAO allows anyone to propose a project for the FIO Protocol. Interested parties can make a proposal to the steering committee giving details of the project, the benefit for the FIO Protocol, and associated budget needs. This allows the FIO Protocol to be project focused instead of managing employees, hence the realized model of a DAO.

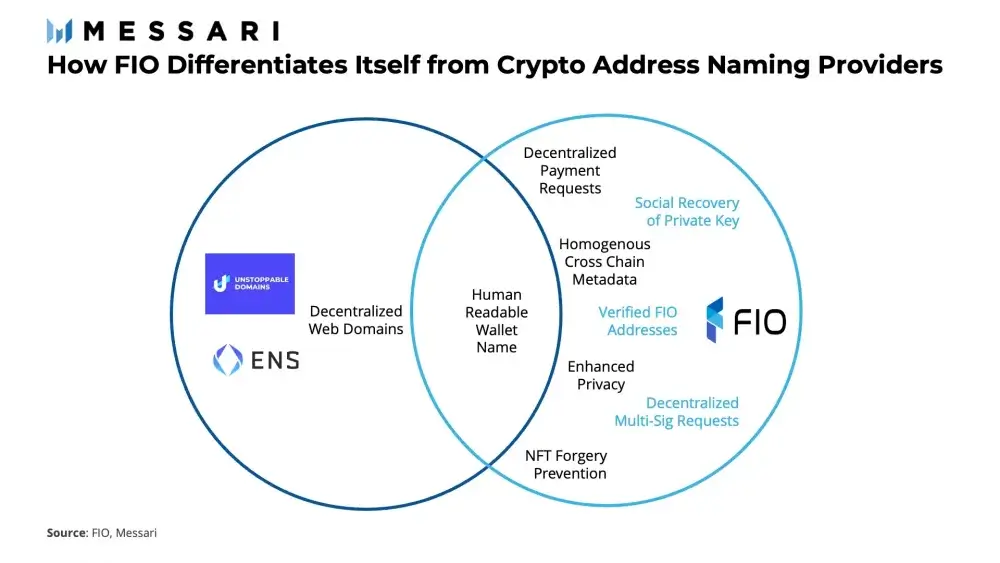

What is the difference between FIO Protocol and other wallet naming solutions?

Unlike other naming solutions, FIO Protocol is interoperable with all chains. Users also have the ability to customize a FIO crypto handle more than other options. FIO Protocol is hosted on its own chain as opposed to others which are smart contracts not built on their native chains. Decentralized requests, cross-chain data, and NFT forgery prevention are not offered by other naming services. Attached is a graphic published in a recent Messari report showing a comparison to the top 2 potential contenders to FIO.

If 80% of NFTs on OpenSea are plagiarized and identifying the original NFT is challenging, why should we bother adopting the technology?

Besides our protocol being a perfect fit to solve this issue, NFT adoption will continue to grow and evolve. NFTs are more than just art and collectible digital images, NFTs will revolutionize many existing industries as NFT utility catches steam. NFTs can represent ownership, membership, access, such as tickets, and even property titles. Having a decentralized solution to easily verify authenticity is crucial.

Wayne Marcel is the Head of Business Development for the Foundation for Interwallet Operability (FIO), who has been managing, teaching, and coaching high performing teams for over 20 years. In 2016, his passion for helping and teaching people was merged with his passion for technology as he dove into learning about cryptocurrency and blockchain. He published a book in 2018 called “From No Crypto To Know Crypto” and hosted over 140 educational podcast episodes under the same name. Since then, he has dedicated himself to working with projects that make using cryptocurrency easier for all.