Exnova broker review

Exnova is a relatively new broker with a handsome set of trading instruments such as binary and digital options, as well as CFDs of Forex, stocks, crypto, commodities, and exchange-traded funds (ETFs).

Let’s find out more about Exnova in terms of trading environment, conditions, services, fees, and regulation.

Minimum investment

A low barrier to entry is one of Exnova’s obvious advantages — one can start with a minimum deposit of $10 or the equivalent in account currency. The minimum deal size is just $1. This is one of the cheapest starts in the market.

Trading platform

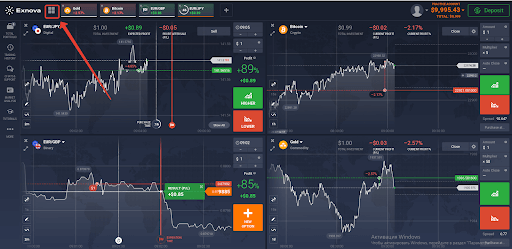

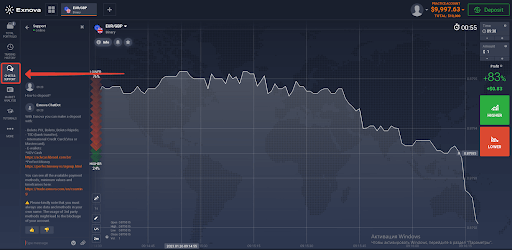

Exnova doesn’t run on the MetaTrader engine and offers to trade on its proprietary platform. Compared to MT, it’s more simplistic and uncluttered and might be easier to understand by the less experienced traders.

Let’s see what’s inside the Exnova trading platform.

- Customizable charts. Users can run up to 9 charts simultaneously, which makes it easy to control multiple deals at a time. You can configure the chart layout in the upper left corner of the traderoom.

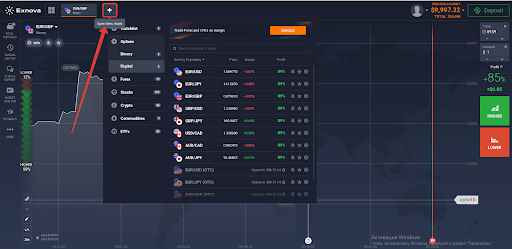

- Over 250 assets. Find the assets for instruments like binary/digital options, Forex, stocks, ETFs, and commodities. You can add a new asset by clicking on the “+” button on the upper panel of the platform. The platform will show you some characteristics of the asset, such as its price, price change, and profitability.

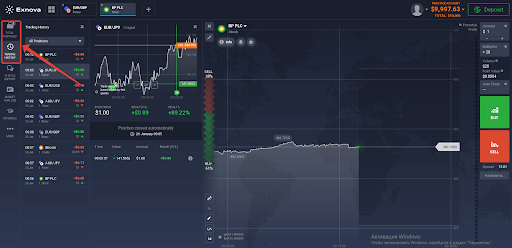

- Deal tracking. View the full trading portfolio with your current profit and reports on all your open and pending positions and analyze your performance in the Trading History section.

- Fundamental analysis tools. The platform gives access to market news and two types of calendars: economic and earnings.

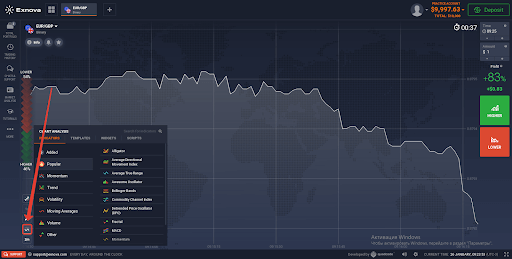

- Technical indicators and widgets. Exnova’s platform features 100+ technical indicators in different categories. You can save your favorite multi-indicator presets and even create the custom indicators depending on your strategy. You can also apply widgets like traders’ sentiment, high and low values, trades of other people, news, and volume.

- Support. If something goes wrong, you can drop a line into the live chat box and get the problem solved without leaving the platform. Usually, the support replies instantly.

- Profile settings. Here you can manage your personal details, change language, withdraw funds, etc.

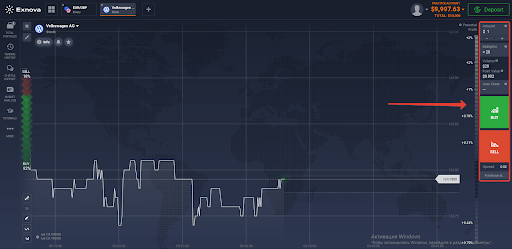

- Order settings. Here, you can specify the investment amount and configure the risk management settings (Stop-Loss and Take-Profit) depending on the instrument. Once all the presets are made, you can click “Buy” if you believe the price will go up, or “Sell” if you think the price will go down.

Trading conditions

| Instrument | Assets | Conditions |

| Forex | Popular currency pairs: majors, minors, crosses | Multipliers from x300 to x500 |

| Binary options | Contracts with expirations from 1 minute to 1 month | 95% profit |

| Digital options | Contracts with expirations from 1 to 15 minutes | Unlimited potential returns |

| Stocks | 150+ stocks of the world’s largest companies | Multiplier x2 – x20 |

| Commodities | Oil, gold, and silver | Multipliers from x20 to x50 |

| Crypto | Over 20 popular cryptocurrencies | Multipliers from x3 to x100 |

| ETFs (Exchange-Traded Funds) | Many different assets traded in a bulk similar to classic stocks | Multiplier x20 |

Margin trading

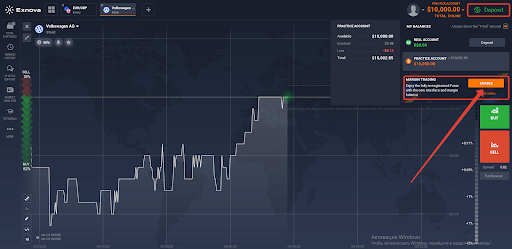

Exnova allows you to trade on both margin and “standard” engines. Margin trading means trading with leverage, i.e. borrowing funds from the broker to increase your investment amount and get higher profits — of course, only in case of a correct prediction.

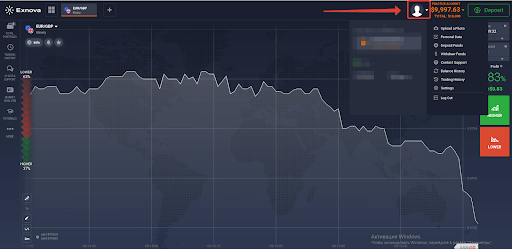

You can switch to the margin engine from the account settings menu in the upper right corner.

Note that along with the potentially higher profits, margin trading implies a higher level of risk.

Accounts

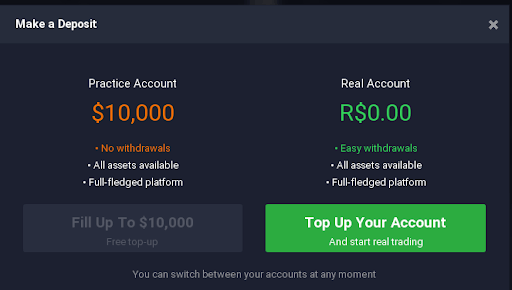

Upon registration, you get both Demo and Real accounts automatically.

- Practice (Demo) account is charged with $10,000 in virtual coins that you can use for training. You can use it without limitations: it’s replenishable and doesn’t have an expiration date. You don’t need to verify your account to trade on Demo.

- Real account gives you access to the real market and requires verification of identity, address, and payment method.

- VIP account requires a larger initial deposit and gives the account holder exclusive features, such as increased profitability on certain assets and a personal manager.

Deposits and withdrawals

Traders can deposit and withdraw via VISA/Mastercard, international payment systems like AdvCash, Neteller, Skrill, WebMoney, Perfect Money, etc., as well as local payment systems like Boleto, PIX, etc.

Deposits are free and can be made in any currency — the platform will convert it to the account currency automatically.

The fastest way to deposit is via e-wallets. Deposit and withdrawal requests are processed instantly on the broker’s side, yet there might be delays on the payment system’s side.

Important note: traders can withdraw only to the payment system that was used to deposit funds. If the deposit method was a bank card, withdrawals must be made to the same bank card in the amounts not exceeding the amount deposited within 90 calendar days from the last deposit.

Platforms

Exnova is available on desktop and web and has an Android app. Unfortunately, there’s no iOS app.

Fees and commissions

| Deposits | 0% |

| Withdrawals | 1 free withdrawal per month and a 2% commission on each consecutive withdrawal (yet no more than $30). |

| Spread | Varies depending on the asset |

| Swap | 0.01% – 1.7% |

| Inactivity | $10 per month for dormant accounts that have been inactive for 90 days in a row. |

In what countries does Exnova work?

Exnova operates in Brazil, Colombia, Mexico, Chile, Peru, and Ecuador.

Regulation

Exnova is operated by Digital Smart LLC., with Company business number 898 LLC 2021 and registered at: First Floor, First St. Vincent Bank Ltd Building, James Street, P.O. Box 1574, Kingstown VC0100, St. Vincent and the Grenadines.

Customer support

Round-the-clock support is available via email [email protected] and in live chat. The support is multilingual, so traders can address their questions in their native tongue.

Bottom line

Exnova is a good choice for trading CFDs on stocks, Forex, commodities, crypto, ETFs, and options.

Pros:

- $10 minimum deposit and $1 minimum investment

- Free $10,000 demo account

- Good-looking trading platform with easy UI

- A decent set of tradable assets, including rare ones like binary and digital options

- Multilingual 24/7 support

- Multiple deposit and withdrawal methods, including the local ones

- Competitive commissions

Cons:

- No MT. If you’ve been working with Metatrader before, you’ll have to adapt to a new interface.

- No iOS app, so if you pursue mobile trading from an Apple device, Exnova is not your option

- Limited account options: only one universal live account option + demo and a possibility to upgrade to VIP in case of a good trading track record.

Risk Warning

Whenever you go online to trade, you put your capital at risk. Always balance your financial abilities with the amounts you invest and never risk more money than you can afford to lose.

It is strongly recommended to use risk management tools like Stop-Loss and Take-Profit orders on each of your deals. Educating yourself and having enough practice on the demo account can improve your performance and cut losses — yet no strategy and no amount of training can guarantee positive outcomes in every single deal.