Weekly FX Recap: Facing the awful truth; there is no “spoon”

We often fight reality and often fail to appreciate its beauty. How many times have you wished you have more? Let’s think more money. More time; we always seem to want more resources in our hands.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

We expect things to happen quickly and we expect circumstances to change. We are one of a kind, satisfied yet complaining all day without any strategy or action plan to improve our now, constantly dreaming and talking about a future that we may never experience.

This happens, because our societies actively promote entitlement, such a destructive concept that evokes the use of, in my opinion; one of the most damaging words in the English dictionary; deserving. However, the trick is to do wonders with almost nothing. Only then, you are going to rise to greatness when the odds are against you and still, you make it happen. That’s empowering.

Life is very gray, no black and white as the general perception dictates. You have to be ruthless in your focus. Of course, having more resources always provide a reliable source of peace and tranquility, is that what you want? If you do, be aware that it comes at a high price and responsibility.

Competition grows by the minute; it is not going to change anytime soon. Getting ready and the sooner you face it; the sooner you are going to understand the awful truth about life: there is no spoon. Take little steps to improve, give birth to a new you only then your reality will improve.

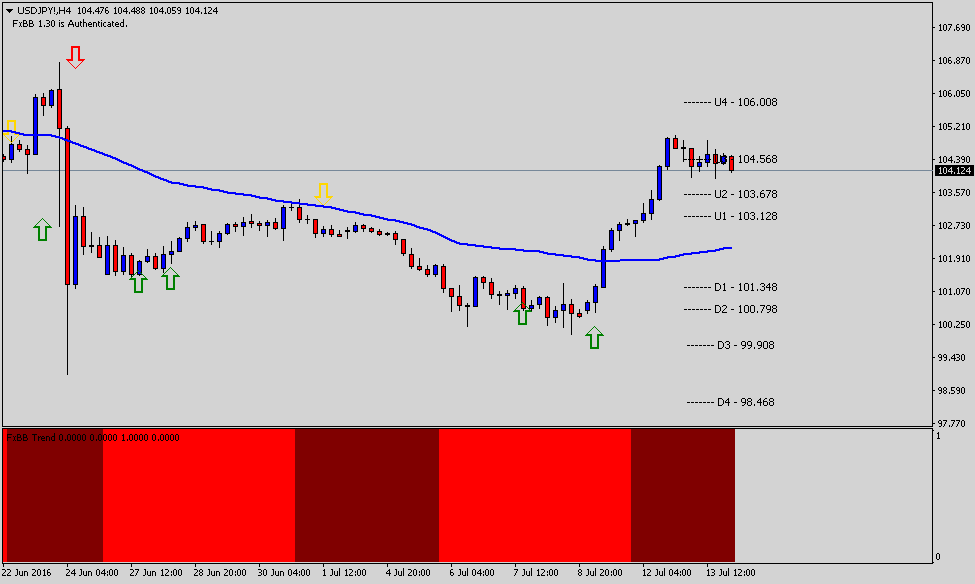

USDJPY: Thought you were out on Round 2!

H4 – Resistance: 106.00 Support: 99.90

Oh, I love rumors; don’t you? First off, let’s begin with the Japanese Yen, lots happening around this pair and yen crosses over the last couple trading sessions. It ‘s hard to deny how Abe and co keep trying a solution that has not provided any positive outcome in terms of inflation or consumer activity.

Think it was Steve Jobs that said once: “It is important what we don’t do as much as what we do.” If we were to judge the situation; it is about to get worse. On the technical view “shorting” the dollar against the Japanese yen has been profitable and the easiest way to hedge your retirement portfolio.

Traditional portfolio managers use options to protect their client’s allocations. However, FX spot offers the same protection with more straightforward strategy and the most significant; it is cost effective. We are coming back to this idea later.

On the four-hour timeframe, USDJPY traders played the risk-on recovery process post-Brexit, but something is not right. In less than 4 days the pair gained +450 pips with a small break around 103.80, conditions haven’t changed, and it needs a close and open above 106.00 to attract buyers to make a push higher.

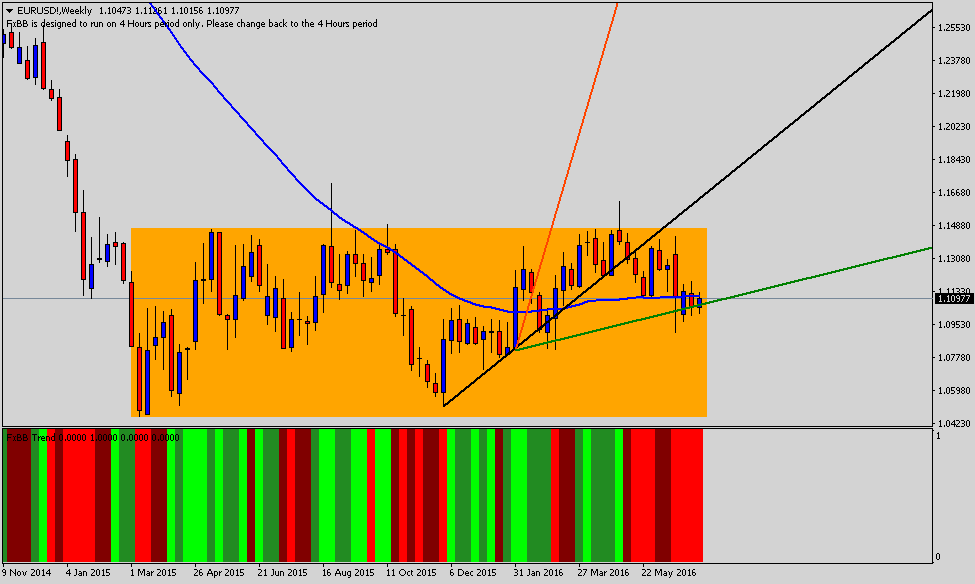

EURUSD: Comatose 101

Weekly – Resistance: 1.1431 Support: 1.0968

Timing is important in trading, wait…timing is crucial in everything we do. Although QE somehow was useful (we can debate this idea) to the BoE in the past, market conditions have changed tremendously since the last time they loaded the boat. This time, the results may not be as good as they expect.

Looks like a “U” recover, but it can easily be a “W” if Carney plays the wrong hand. The next move can perfectly be the euro’s last chapter. The Single Currency, brave and bold, cannot compete with being spread across the Eurozone. It is a brilliant idea, but there is no more room for freebies.

The Euro was not valued it as they needed to. Hey! We are going to experience the consequences as a whole.

On the technical view, nothing changed. We still trade the bullish trend that started late November 2015 with different pullbacks that many thought were the beginning of a move towards 1.050. However, the market was just adjusting by taking out stops and drawing massive liquidity to set the pair price.

Prices need to break the 50 SMA on the weekly chart and open it to have any fighting chance. Over the last four weeks, buyers have protected the downside and added more long positions around 1.0968; pay close attention to that level, as if it breaks; it’s a non-stop ride towards 1.0423.

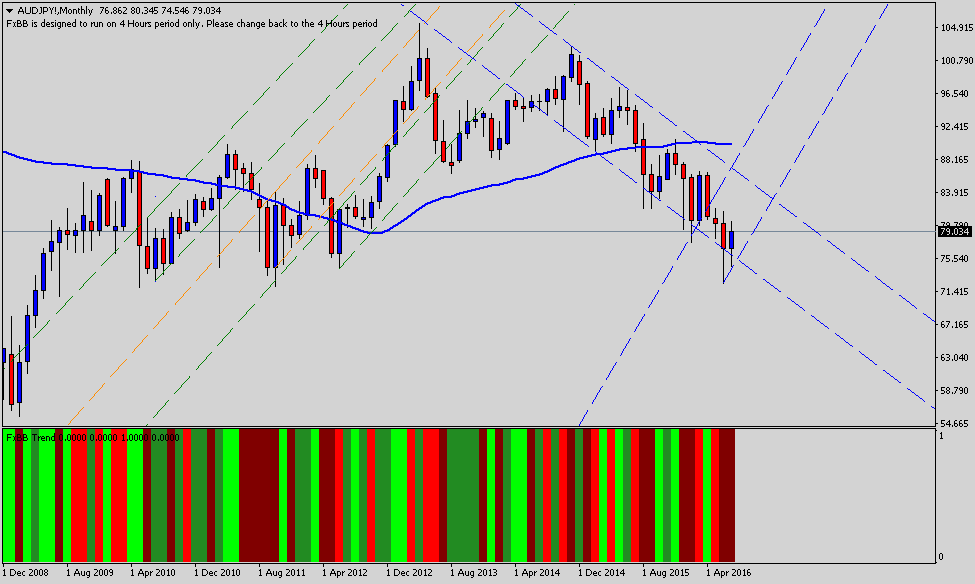

AUDJPY: Risk-On, but for how long?

Monthly – Resistance: 89.75 Support: 72.84

Want to share a more dynamic view of this cross based on a historical pattern? On the technical view, there are no doubts we are trading a bearish trend, however, take a close look to your left those are only 3 different scenarios that I found.

Each time the Australian dollar / Japanese Yen trades close to 0.72 cents, it rallies around +1700 pips. Review the chart and you will see that the same conditions for a similar trade are being created today.

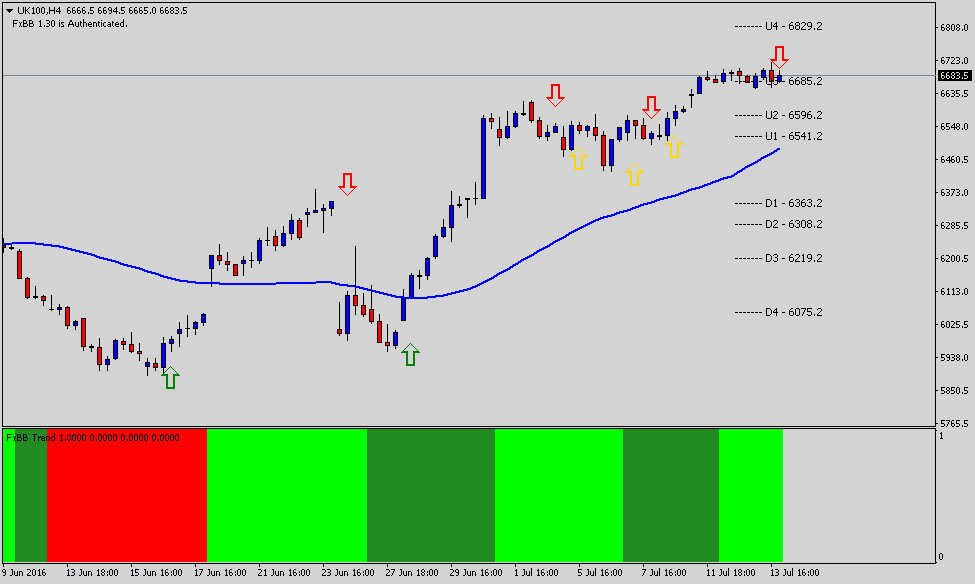

FTSE 100: Is this a joke?

H4 – Resistance: 6829.2 Support: 6308.2

Have you heard the latest? Disney issued debt paying as low as 1.85% in the short-term notes and long-term only 3.0%, fantastic! Hold your horses, because things aren’t exactly the same in Europe where Deutsche Bahn did the opposite becoming the first of many non-financial entities and issued short-term debt priced at 0.006%

Don’t get me wrong, but what is 0.006? I have been looking in-out my pockets and still cannot find that 0.006 coin. If you have one, please mail it to me.

I do not mind sharing; I had to close my shorts on FTSE 100, still, have a short in gold; more next week on that one. For now, it’s evident the index is trading way above pre-Brexit uncertainty, but let’s face the awful truth; corporate profits are far from the current index value.

Then, Who is buying? I am not…are you? Short-term I expect the index to find support around 6440.50, as it made a new high for 2016, it is going to attract more buyers on dips.

And before I go, Yes; I said it. FX Spot serves to hedge your retirement portfolio (not only to speculate and trade to become the next Soros) as equity indexes were trading at record highs all you needed was to establish a short position on correlated assets.

You see Yen crosses mimic equity index as we move to Risk-on, both tend to go up and vice-versa. Think about it, but the most important as I shared with you at the beginning: Changing the game is impossible, what you need to do instead is to adapt and improve your skill set, once you do that you will understand…there is no spoon.

Happy days for Risk-on trades, but as everything in FX; it may not last long.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.