Weekly FX Recap: Love Rumours; because Facts Could Be Misleading

Several variables affect the financial markets at any given time and yet the most powerful tool to disrupt pricing seems to be the good old rumour.

By José Ricaurte Jaén, Senior Algo Trader at The Guardian Advisors & TradersDNA

Value investors get better than expected earnings per shares (EPS) readings confirming their instincts about that company stock loaded with all sorts of star analysts’ targeting the sky; above and beyond. Later, farm producers, add more Orange Juice (OJ) futures contracts as the front month trades at a premium, because that weather report just came out and the sun rises and sets the conditions for a good crop.

Astute central banker, Graeme Wheeler, shares another long speech where the only term that resonates is “overpriced” which is the fancy technical word to express; this currency is too high. And yet, nobody cares as you they’ve all heard that being said before to scare buyers, and are quick loading the boat with a few extra positions.

So far business as usual. Hey, things ain’t that bad as they seem. But, if you have been in any industry long enough you know that all it takes is a bad boy, a cold breeze; a dirty rumor. Suddenly, the sell-off is initiated, and all your positions are in red leaving you wondering (at least in the short-term) what went wrong, after all, you had the facts.

Speculation is an art that only a few have managed to truly master and then carried out with flawless execution. But, Isn’t the rumour a modern evaluation tool? Yes, because it breathes authenticity providing to those bold and brave a second chance even the ultimate opportunity to allocate the necessary risk to make fortunes.

In essence, a rumour, is just another opportunity in disguise. How it affects you is up to you. You know the game, sell the rumours and…

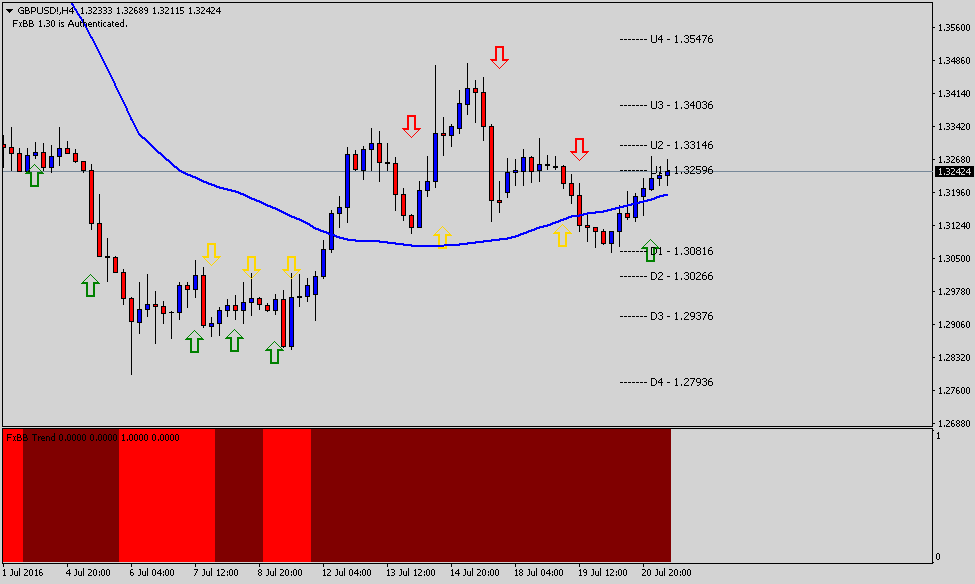

GBPUSD: The British never give up!

H4 – Resistance: 1.3407 Support: 1.3026

Days after the vote, the New York Times published an article; “Brexit Does Not Mean Game Over…” and it had something else in there, I cannot recall nor do I particularly want to. There is a “band” and one of the lead members decides to leave. What happens next?

There is no need to be dramatic or to exaggerate building a negative momentum, but the music effectively stopped on June 23rd. The show must go on and it will.

On the Technical View, short-term inside the long-term bearish trend, there are plenty opportunities to add risk as the support 1.3086 is well-guarded by bulls. However, even if prices trade back around D3 (1.2937), the downside risk is limited.

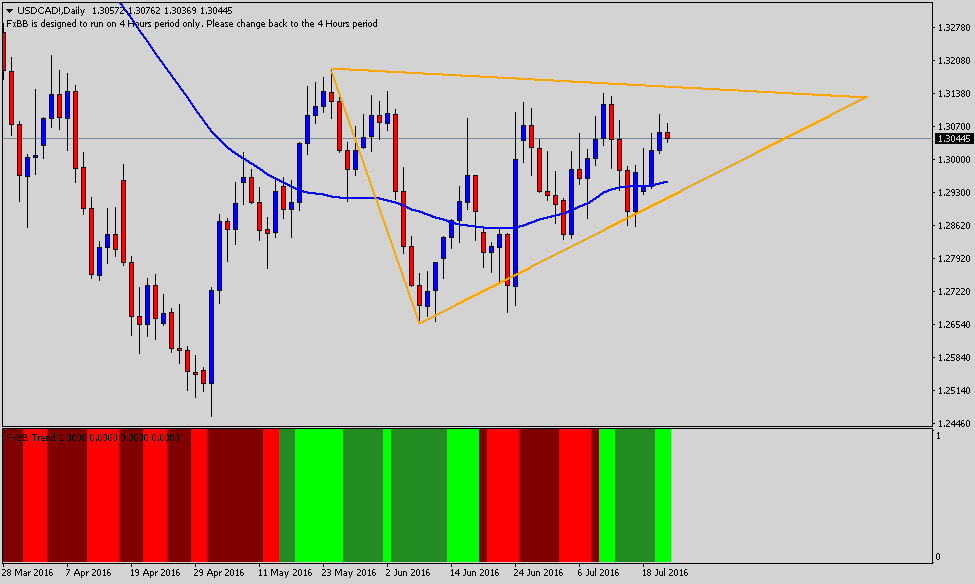

USDCAD: Sort of bullish…

Daily – Resistance: 1.3152 Support: 1.2889

You may find this funny, but in 2016 the best-performing currency pair for basket trading has been the Loonie. (well, probably after crashing from 1.4610)

Not going to elaborate too much on the rhetoric. However, the Russians need crude to start trading above the $50.00 a barrel. Well, maybe is not something they require, the drilling industry as a whole is having a rough time as the always scary term “default” made a tremendous comeback another fancy technical name to say: I’m broke, and I am not going to pay you.

On the Technical View, not much has changed on the daily chart; we see evidence validate further upside towards 1.3200 and above. However, the bullish triangle shares clues that can lead to a sell-off sponsored by technical traders.

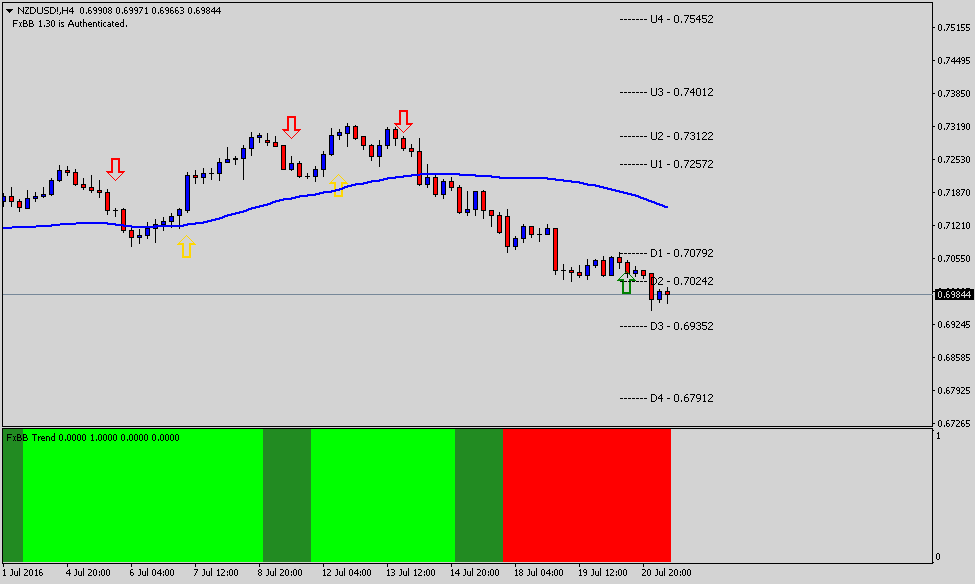

NZDUSD: Just wait and see who wins.

H4 – Resistance: 0.7252 Support: 0.6786

Talking about rumors,the Kiwi’s trading behavior is the perfect case study to explain the power of leaking information and later do something different. Speculators have been selling the New Zealand Dollar expecting a rate cut on August 11th when the next Reserve Bank of New Zealand (RBNZ) Monetary Policy meeting takes place.

Not happening! Again, you have been played. Of course, short-term it is a profitable trade and no doubts you cannot turn your back on a good rumour, why should you refrain from following the savvy herd; right?

As the exchange rate dropped from highs 0.7320s, there is no more reason for Wheeler to activate his magic tools because the job is done and after “someone” leaked the rate cut rumour, the Kiwi may easily trade as low as 0.6791 in the days ahead of the meeting.

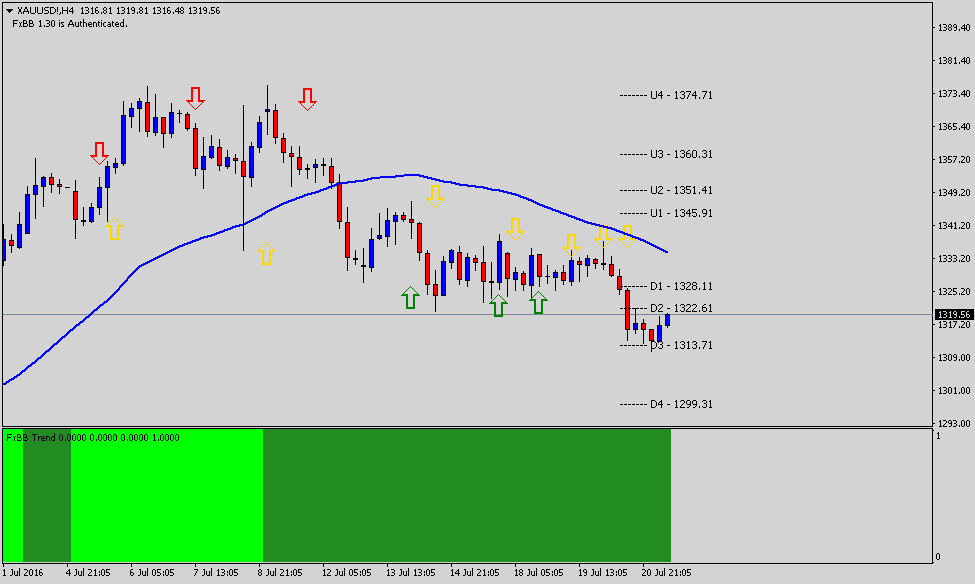

XAUUSD: Gold bugs are adding more, but where is the bottom?

H4 – Resistance: 1345.93 Support: 1299.33

“Strong the character is for the Gold bug; add new long positions you have as the price goes down.” Master Yoda…if he was advising Gold traders.

I bet you 1000 words that most financial newsletters are loading all the historical price patterns and calling gold coin sellers with all the logical reasons to make you buy more gold; fine go ahead and buy more.

There is nothing wrong with buying the physical; I repeat, buy physical with a long-term perspective even make it an important part of your net wealth for your kids. However, if you are playing the art of the short-term trading, ensure that you have plenty equity in case things trade lower.

On the Technical View, expect a full pullback trading back at 1345.91, but I do not mind as the next stop one way, or another is close or below the support 1299.31.

José Ricaurte Jaén is a Professional Derivates Trader and Associate Editor at Tradersdna in London. Back in 2006, he started his career as a Junior Stock Broker at Thales Securities; Saxo Bank’s first white label partner in Latin-American. José’s background experience is in technical analysis, multi-currency trading and asset allocation. During 2008 and 2012, managed as a Senior Stock Broker, 38M AUM allocating funds in Corporate Bonds in Japan and Canada.

He published unique trading content for well-known regional newspapers: Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

Recently José Ricaurte has been creating, and co-managing a new trading academy in Panama with Principia Financial Group and publishing his FX trading column on FX Street ES; Laberinto de Divisas. Also, on a weekly basis, he publishes his Weekly FX Recap on Finance Feeds. Over the last 4 years, he has been working as Senior Sales Trader at Guardian Trust FX, where he designs and manages dynamic trading strategies using his algorithm; Osiris EA.