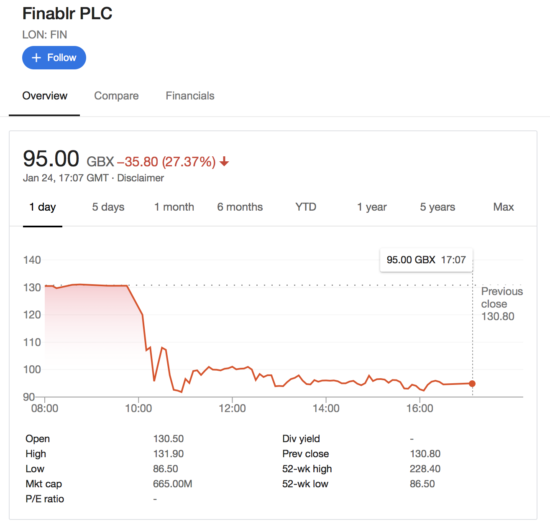

Finablr issues statement regarding share price move

Finablr has received notification that 56.03% of the company have been pledged by BRS Investment Holdings 1 Limited as a security for borrowings raised by BRS Ventures & Holdings Limited.

Finablr PLC (LON:FIN), a provider of cross-border payments, FX and payment technology, today issued a statement regarding its share price reaction in connection to the announcement of the pledge associated with the holding of BRS Investment Holdings 1 Limited’s (BRS) shares.

Finablr received notification on January 24, 2020 that 392,220,890 shares, representing 56.03% of the company, have been pledged by BRS Investment Holdings 1 Limited as a security for borrowings raised by BRS Ventures & Holdings Limited. Those borrowings date from 25 March 2016 and were used to refinance an acquisition facility borrowed by BRS Ventures & Holdings Limited in connection with the acquisition, by its subsidiary UTX Holdings Limited, of Travelex Holdings Limited on 29 January 2015. The original amount of the borrowing has been reduced by sums received by BRS Investment Holdings 1 Limited, BRS Investment Holdings 2 Limited and BRS Investment Holdings 3 Limited from the IPO of the Company on 20 May 2019 and other cashflows of entities belonging to the BRS Group.

Finablr insists its operations continue to function as normal. The recent cyber incident at Travelex is in the course of being resolved, Finablr says, adding that the issues have no impact on 2019 results and also are not expected to have a material impact on the Group’s performance in 2020.

The Company has sought clarification from BRS, of which the Company’s Co-Chairman Dr B. R. Shetty and Board member Mr Binay Shetty are principal holders, about the pledge disclosures announced this morning. BRS has reassured Finablr around the level of security represented by its shareholding in Finablr and the discussions that it has had with its banking group around repayment/refinancing of the loan as well as the other collateral sources should these be required.