Financial Commission says clients sought $3.35M from broker members in Q1

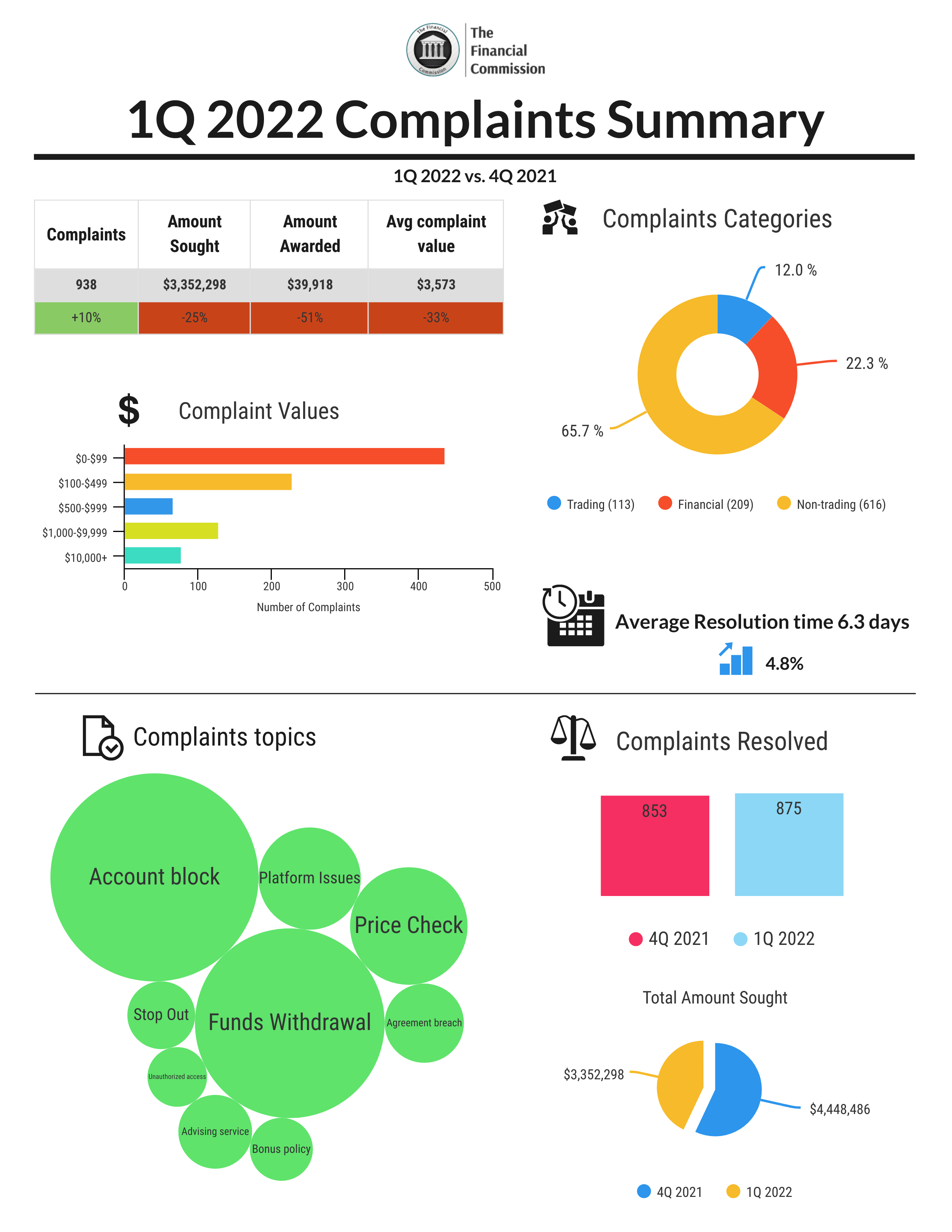

The Financial Commission received a record of 938 complaints in the first quarter of 2022, but the amount it recovered for broker member customers decreased from a quarter earlier.

According to its latest quarterly report, the self-regulator made progress across some of its key business drivers. Specifically, the number of new complaints increased 10 percent quarter-over-quarter as compensation sought from broker members rose 57 percent to $3.35 million.

Likewise, Financial-related complaints increased by 40 percent, which indicates a significant rise in disputes related to funds withdrawal. At the same time, complaints listed in the most valuable category ($10K+) jumped 70 percent in 1Q 2022. The number of resolved complaints increased 3 percent from the previous quarter, it says.

The enforcement report further reveals that the majority of complaints the commission received in 1Q 2022 were related to non-trading issues with 65 percent of the total, while trading related disputes accounted for 12 percent and financial claims were 209 or 22 percent. The most popular topics for complaints dealt with funds withdrawal agreement breach, price check and account blocking.

Other highlights show the amount of total compensations awarded to broker member clients in the first quarter decreased to $39.918. Further, the value of the average complaint dropped 33 percent to $3,573.

FinaCom said the dispute resolution time improved in the January-March quarter, which reflects the speedy processing despite a period of record numbers of processed complaints and the complexity of submitted cases. Specifically, the average timeframe of resolving the complaint was shorter by nearly 5 percent to 6.3 days from 7.1 days in 2021.

Elsewhere, the commission remained steadfast in improving its core business in 2021 with the launch of additional services for broker members. Among other things, the organization expanded its international presence by 19 percent as compared to 2020 with the addition of 12 new approved broker members to its membership ranks. Moreover, it certified the offering of a new education provider and 2 collective investment platform providers.

During the year, new partnerships were formed with fintech providers, including Delkos RAZR and Your Bourse as part of value-added services for broker members. The organization also provided members with the opportunity to enhance business practices by partnering with GetID and FinWizard HR consultants.

Finally, the Financial Commission saw higher adoption for its dispute resolution service in Asia, Latin America and Europe with new complaints from these regions growing 98 percent, 87 percent and 20 percent respectively, while complaints from the Middle East grew substantially by 357 percent in 2021.