Firms report 4.29m complaints received in H1 2019, FCA data shows

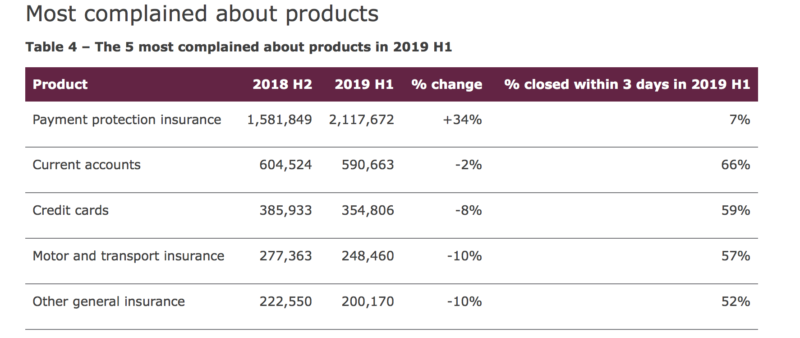

Excluding PPI complaints, the most complained about products remain current accounts, credit cards and motor and transport insurance.

The UK Financial Conduct Authority (FCA) has earlier today posted data about complaints reported by financial services firms to the regulator during the first half of 2019.

Firms received 4.29 million complaints in the first half of 2019. Payment Protection Insurance (PPI) complaints accounted for 49% of all complaints received during this period. Excluding PPI, the volume of complaints received by firms amounted to 2.18 million in H1 2019, down by 6% from 2.32 million reported in H2 2018. This is the lowest volume of complaints received, excluding PPI since new reporting rules came into effect in 2016.

Excluding PPI complaints, the most complained about products are current accounts (14% of reported complaints), credit cards (8%) and motor and transport insurance (6%).

The average volume of complaints received per 1,000 accounts for banking and credit cards has decreased to 4.2, compared to 4.6 in H2 2018. This was also the case for home finance, which decreased from 9.6 to 8.7 complaints per 1,000 mortgage accounts.

For investments, the total redress paid in the first half of 2019 amounted to £35.7 million, up from £32.1 million paid in the second half of 2018. For banking and credit cards, the total redress paid increased by 18% from £133 million in H2 2018 to £157 million in H1 2019. During this time, the total redress paid for complaints about home finance decreased by 19% and the total paid for complaints about decumulation and pensions decreased by 14%.

Average redress per upheld complaint about banking and credit cards increased by 25% between H2 2018 to H1 2019, from £164 to £204. Average redress for upheld complaints about investments also increased, from £727 to £894.