Fraud is prevailing type of crime in the UK – survey

The typical victims of fraud are from higher income households and individuals in managerial and professional occupations, results from CSEW show.

In the face of the efforts pledged by the Serious Fraud Office and other UK athorities to combat fraud, the rates of this type of crime are increasing in Britain. According to the latest edition of the Crime Survey for England and Wales (CSEW), fraud was the prevailing type of crime in the year to September 2016.

The CSEW is a face-to-face survey in which people resident in households in England and Wales tell of their experiences of a range of offences in the 12 months prior to the interview.

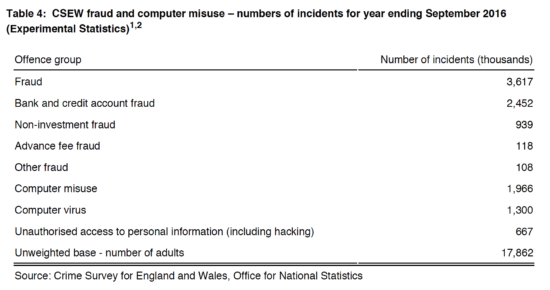

During that period, there were 3.6 million fraud and 2 million computer misuse offences. Concerning fraud, the authors of the survey note that people are often not inclined to share information about their experiences due to psychological factors like shame. Moreover, the typical victim of fraud comes from a high-income household and holds a managerial position.

The CSEW survey shows that the most common types of fraud experienced were “Bank and credit account” fraud (2.5 million incidents, or 68% of the total), followed by “Non-investment” fraud – such as fraud related to online shopping or fraudulent computer service calls (0.9 million incidents, or 26% of the total).

Excluding fraud and cyber crime incidents, the people surveyed reported 6.2 million incidents of crime for the 12-month period to September 2016. Along with cyber crimes and fraud, the total grows to massive 11.8 million.

The extent of this trend was recently underlined by the City of London police, which named binary options the “fastest-growing iteration of investment fraud”. Much of the industry operates out of Israel but is regulated in Cyprus, which permits companies to offer their services throughout Europe but largely escape the regulatory grip of domestic watchdogs.

The UK Gambling Commission oversees just seven binary options operators that have “key equipment”, such as servers, in the UK. The average fraud claim against binary companies in Britain is more than £20,000.

CSEW shows that two-thirds (66%) of fraud incidents in the year to September 2016 involved initial loss of money or goods to the victim, independent of any reimbursement received. Where money was taken or stolen from the victim, in just under two-thirds of incidents (61%) the victim lost less than £250.