FSB develops framework for financial stability implications of crypto-assets

FSB’s report outlines the metrics that it will use to monitor crypto-asset markets.

Crypto-assets are once again high on the agenda of global regulators, as the Financial Stability Board (FSB) today published a report on the work of several standard-setting bodies on crypto-assets.

The FSB has developed a framework, in collaboration with Committee on Payments and Market Infrastructures (CPMI), to monitor the financial stability implications of developments in crypto-asset markets. The report published today outlines the metrics that the FSB will use to monitor crypto-asset markets as part of the wider assessment of vulnerabilities in the financial system.

The FSB believes that, at present, crypto-assets do not pose a material risk to global financial stability, but supports vigilant monitoring given the speed of developments and data gaps. The objective of the framework set out by the FSB is to identify any emerging financial stability concerns in a timely manner. That is why it includes risk metrics that are most likely to highlight such risks, using data from public sources where available. Supervisory data about crypto-assets are potentially more reliable and could complement data from public sources, the FSB notes.

The Board has selected the metrics for the monitoring framework based upon several criteria, including comparability over time and across jurisdictions, ease of access and repeatability, degree to which the metric is anchored in data, and analytical effort to compute.

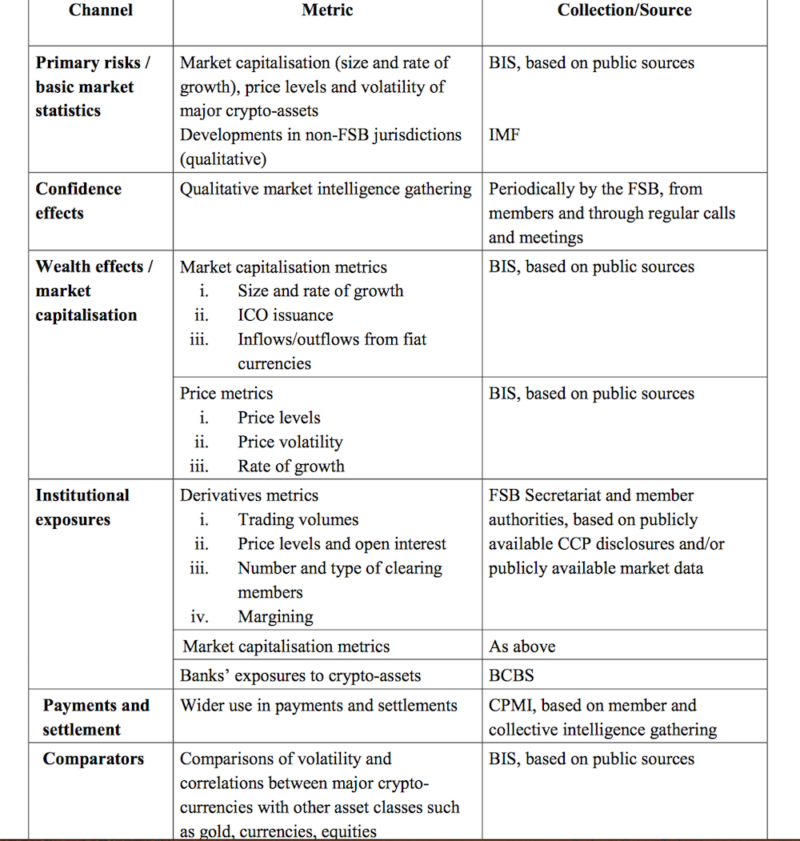

The monitoring framework focuses on metrics to assess the transmission channels from crypto- asset markets to financial stability.

Monitoring the size and rate of growth of crypto-asset markets is seen as crucial for the understanding of the potential size of wealth effects, in case a decline in valuations occur. The use of leverage, and financial institution exposures to crypto-asset markets are important metrics of transmission of crypto-asset risks to the broader financial system.

Confidence effects related to price volatility in crypto-asset markets may be important too, but are more difficult to measure except through qualitative market intelligence, the FSB says. Furthermore, the impact of fraud on confidence effects may be very important. The use of crypto-assets for payment or settlement is another transmission channel to keep an eye on.

The FSB stresses that the proposed monitoring metrics are mainly based on public data and, hence, it should be stressed that the quality of the underlying data can vary, and might not always be satisfactory. Moreover, market-related figures, such as metrics on prices, trading volumes, and volatility may be manipulated by prohibited practices like “wash trading,” “spoofing,” and “pump and dump”. Moreover, the proposed metrics may not fit all types of crypto-assets equally.

Nonetheless, the FSB believes that the proposed metrics offer a useful picture of crypto-asset markets and the financial stability risks they may present.

You can view the full list of metrics in the picture below.