FTX, Alameda, FTX.us file for bankruptcy, Sam Bankman-Fried resigns

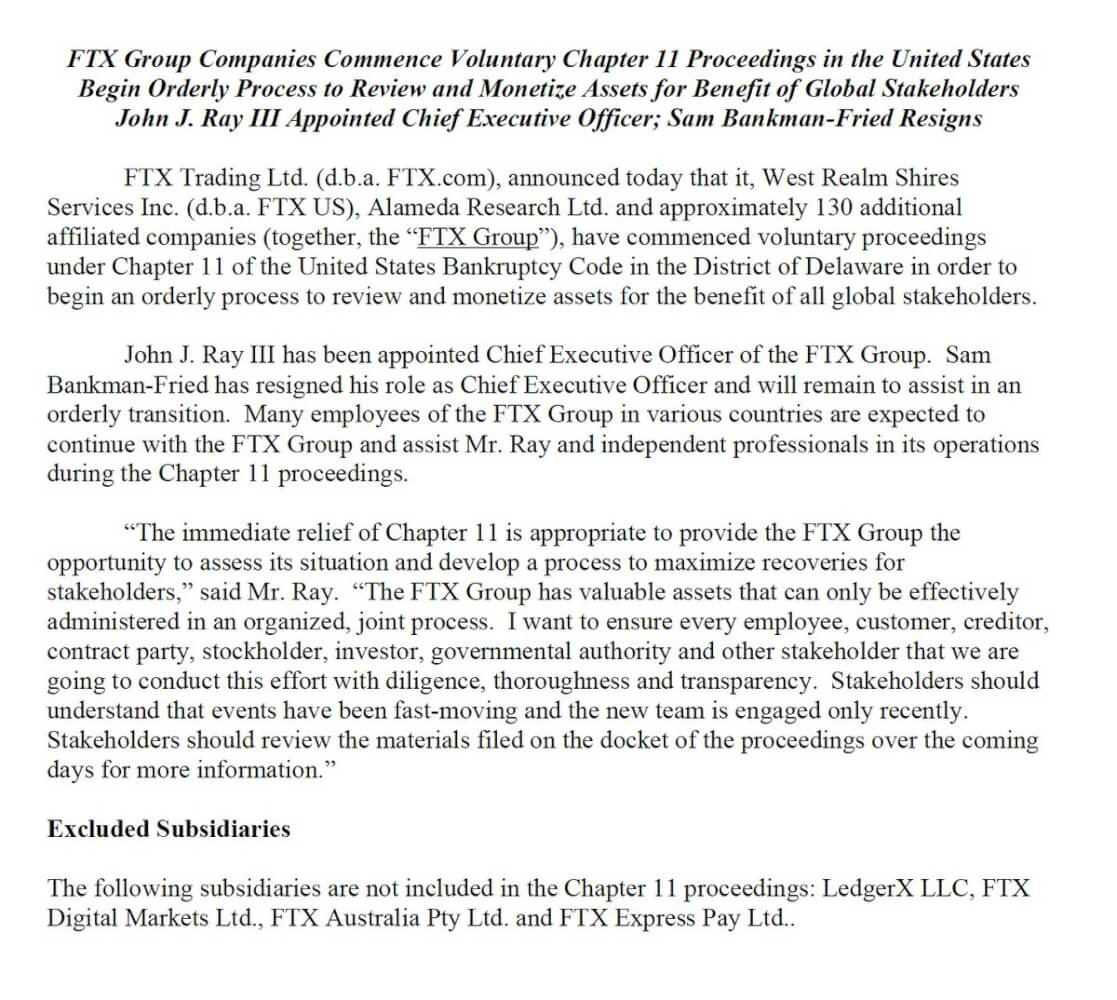

The world’s second biggest crypto exchange, FTX filed for Chapter 11 bankruptcy protection on Friday afternoon as it grapples with a liquidly crunch and customers’ huge withdrawals triggered by a run-on-the-bank-like crisis. The founder and chief executive officer, Sam Bankman-Fried, is also stepping down.

The company, once valued at $32 billion earlier this year, said its crypto trading arm, Alameda Research, and US business, FTX.us, as well as 130 additional sister companies are part of the bankruptcy proceedings.

FTX’s bankruptcy filing said the company is currently unable to timely fill liabilities in the range of $10 billion to $50 billion, owed to more than 100,000 creditors, though it has assets in the same range.

Meanwhile, Sam Bankman-Fried has resigned but the 30-year-old founder of the exchange will remain to assist in an orderly transition. FTX appointed John Ray III as its new CEO and many employees are expected to stay on to manage day-to-day operations at the company. Bankman-Fried indicated that he wishes to appoint Stephen Neal as the firm’s new chairman of the board.

“The immediate relief of Chapter 11 is appropriate to provide the FTX Group the opportunity to assess its situation and develop a process to maximize recoveries for stakeholders,” said the new FTX chief, Ray.

“The FTX Group has valuable assets that can only be effectively administered in an organized, joint process. I want to ensure every employee, customer, creditor, contract party, stockholder, investor, governmental authority and other stakeholder that we are going to conduct this effort with diligence, thoroughness and transparency,” continued Ray.

Per leaked reports, FTX’s downfall stemmed from Bankman-Fried’s efforts to save other crypto firms, which ultimately left his trading unit in financial hole of up to $8 billion as customers rush for the exit. Concerns about the world’s second largest cryptocurrency exchange’s financial health reportedly triggered huge withdrawals in just three days.

However, the crisis only surfaced last week by reports that the balance sheet of Alameda Research was loaded with billions of dollars-worth of FTT tokens. The revelation implied that any volatility in the price of the exchange’s native FTT token could endanger the crypto hedge fund also owned by Bankman-Fried.

Stuck without a buyer, Bankman-Fried apologized to his staff and the crypto community, saying he had “fucked up” in his calculations and in his communications during the crisis. Now, the 30-year-old CEO is searching for alternative backers after Binance pulled out of the deal, citing its due diligence on FTX and reports about US investigations into the company.