FX volumes rebound 14pct at Refinitiv in September

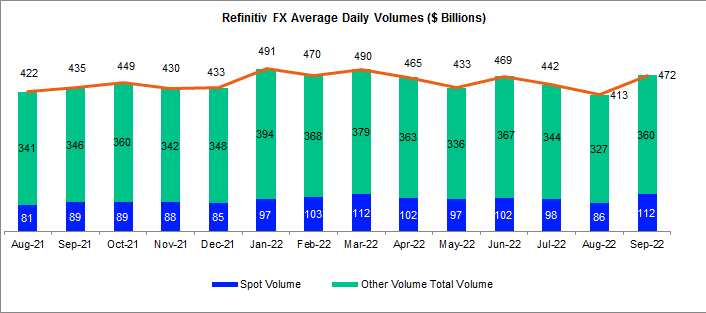

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $472 billion last month on the company’s main FX trading services.

September’s ADV figure is the highest in six months, namely since currency volumes peaked out at $490 billion in March 2022.

Foreign exchange trading volumes across Refinitiv Matching and FXall platforms were up 14 percent from $413 billion in August 2022. The figure was also up by 8.5 percent from $435 billion in September 2021.

Spot FX volumes at Refinitiv, still partly owned by Thomson Reuters, held up much better than other volumes, which include swaps and options. The institutional venue reported $112 billion was FX spot, representing a 30 percent increase over the monthly interval when compared to $86 billion in August 2022. Over a yearly basis, the spot turnover outpaced its counterpart of September 2021, which came at $89 billion.

Stronger activity in other transaction types, including forwards, swaps, options and non-deliverable forwards (NDFs), contributed to the monthly rebound, having clocked in their best month since June. The figure averaged at $360 billion daily, which is up 10 percent from $327 billion in the previous month.

Refinitiv’s figures reflect the trend observed in the monthly figures from many of the major trading platforms which have seen record-breaking volumes in the first quarter before turning to suffer lackluster activity. But after several flat months, the latest metrics from major institutional spot FX platforms show the FX market has bounced back with hefty jumps in daily trading volumes.

Refinitiv has recently struck up a strategic agreement with FXCubic, a trading technology provider for institutional and retail brokers, to integrate its Elektron as a service into their ecosystem.

Depending on their business model and market conditions, Refinitiv Elektron offers partners an ultra-low latency order routing and pricing engine, also giving the institutions the opportunity to connect to a wide range of liquidity providers. This includes cross-asset market and pricing data, providing 9 million prices updates per second over 84 million instruments and 2.5 terabytes of real-time pricing daily.