FXCM expects “significant cost savings” from US market exit

The wind-down of FXCM US retail FX operations is set to generate substantial cost savings, according to the broker.

Further to last week’s reports that FXCM Inc (NASDAQ:FXCM) is leaving the US FX market, following regulatory action, and is selling its US retail FX client base to Gain Capital Holdings Inc (NYSE:GCAP), there has been a small update regarding the financial situation of FXCM’s US operations and the transfer.

Several hours ago, FXCM announced that none of the costs associated with its US retail Forex activities will be transferred to GAIN.

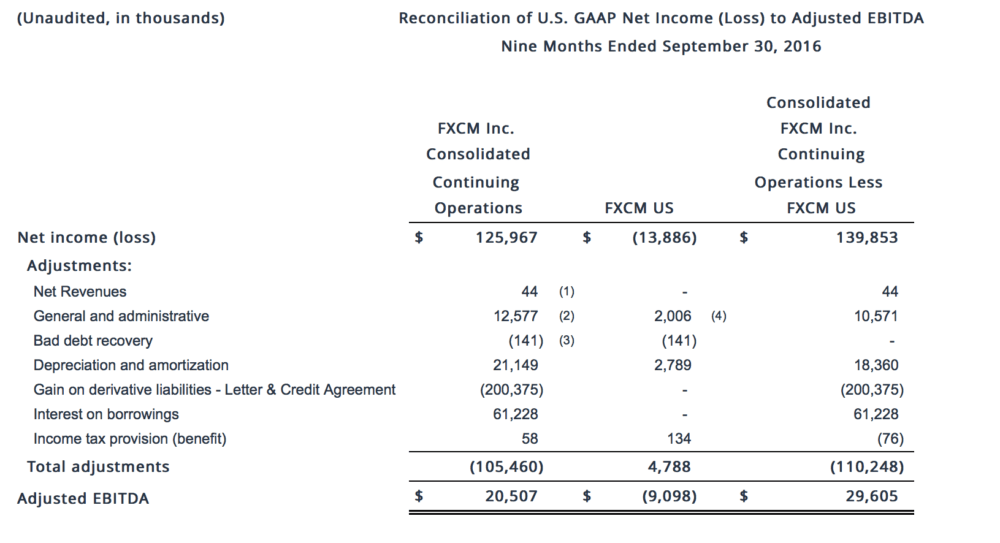

In fact, FXCM expects “significant cost savings” from the disposal of its US retail FX business. The broker quotes its metrics for the first nine months of 2016, which show that FXCM US incurred a $13.89 million net loss in the period, whereas the consolidated FXCM Inc continuing operations generated a net income of $125.97 million.

The announcement ends with an upbeat note on how the increased focus on the global business will improve profitability. This is a claim we’ve already noticed in comments by FXCM international branches (FXCM UK and FXCM France, for instance) in social media. Still, these claims have to materialize. Moreover, we have yet to see whether and how overseas regulators react to US regulatory findings regarding FXCM.

Concerning the GAIN-FXCM US deal, let’s stress that GAIN is making no upfront payment for the US clients of FXCM. The sum GAIN will pay depends on the trading activity of clients acquired.

Under the terms of the agreement, GAIN Capital will pay $500 for each transferred client account from which at least one new trade is executed during the first 76 calendars days of the 153-day period after the closure of the purchase agreement. The sum two times smaller – $250, for an account if at least one new trade is executed during the period from the 77th day through the 153rd day.

The deal needs a raft of regulatory approvals to proceed.