FXSpotStream reports best ADV in 4 months

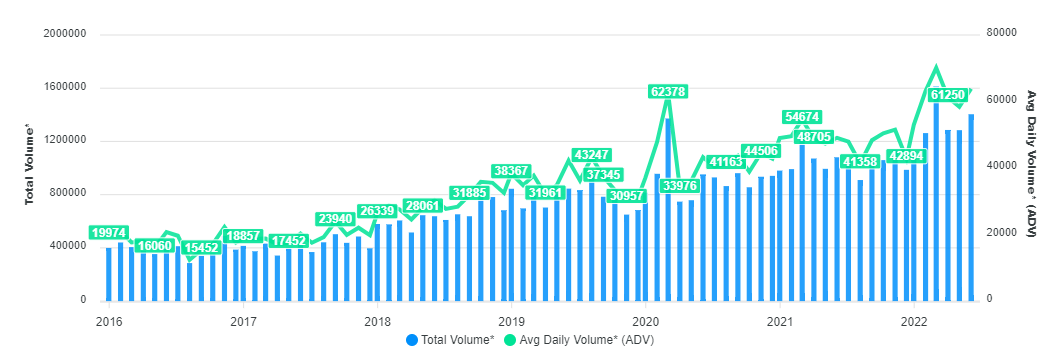

Activity on FXSpotStream’s trading venue, the aggregator service of LiquidityMatch LLC, was stable last month as the total monthly volumes across its streaming and matching products dropped to $1.34 trillion.

Specifically, July’s total turnover was lower by -4 percent from $1.404 trillion in the previous month. Across a yearly timetable, the figure reflected an advance by 28 percent relative to 2021’s figure of $1.01 trillion.

July’s average daily volume (ADV) was reported at $64 billion. It marks FXSpotStream’s second-highest month ever, only preceded by the all-time high set back in March at $70.11 billion.

Additionally, the ADV metric was slightly higher on a monthly basis from $63.8 billion in June. It also increased 33.6 percent year-over-year when compared with $49 billion in June 2021.

After record-high active client additions and average daily turnover in a pandemic-marred markets, FX platforms saw muted growth in July.

The high volatility helps FX platforms shine when the market is anxious and trading activity is high, but low volatility then hurts when things settle down. With nobody having a clue so far, other institutional FX platforms, including Cboe FX, also reported lower trading activity.

A drop in trading activity

The total monthly volume across FXSpotStream’s streaming and matching products was comfortably above the $1 trillion mark in 2022. The activity got off to a strong rebound as the financial markets kicked off the year in high gear, with a multitude of factors helping steer volumes across several venues.

These difficult conditions could become increasingly common as investors brace for plenty of hurdles as conflict between Russia and Ukraine has been causing knock-on effects globally, which pumped up FX hedging trades.

FXSpotStream provides a multibank FX aggregation service for spot FX trading. The platform operates as a bank-owned consortium that provides the infrastructure to facilitate the route of trades from clients to liquidity providers.

FXSpotStream has recently upgraded its offering with the deployment of a new low-latency architecture. The vendor says their upgrade contributes to a faster trade, adding that it involves a comprehensive overhaul of the existing infrastructure in place for the company’s liquidity providers and clients. This allows them to optimize every step of the tick-to-trade loop between FSS’ trading infrastructure and the trading venue.

FXSpotStream’s offering is a client-to-bank platform, with each liquidity taker required to create individual credit relationships with participating banks. This differs from other multi-dealer platforms, such as FX ECNs like Hotspot and EBS Markets that operate with centralized order book systems for their participants.