FXSpotStream reports highest ADV in six months

Trading volumes on institutional FX platforms surged in September as traders increased their bets on central bankers’ policy with evidence mounting that inflation and economic growth are not yet losing momentum.

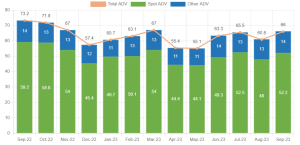

FXSpotStream’s trading venue, the aggregator service of LiquidityMatch LLC, reported its operational metrics for September 2023, which moved higher on a monthly basis. Specifically, September’s average daily volume (ADV) was reported at $65.9 billion, the highest figure in six months. The ADV metric was up 8.4 percent from $60.8 billion in August 2023, but was down 10.2 percent year-over-year when compared with $73.4 billion in September 2022.

Meanwhile, September’s total turnover came in at $1.38 trillion, which was down from $1.39 trillion in the previous month. On a yearly timetable, the figure was down from a record of $1.61 trillion in September 2022.

FXSpotStream was in the news recently after it appointed the global head of EBS, Jeff Ward, as its permanent chief executive officer. Jeff will assume the CEO role effective January 1, 2024, responsible for leading the strategic direction of LiquidityMatch and its subsidiaries, including FXSpotStream LLC.

Jeff formerly ran CME Group’s Electronic Broking Services (EBS), a wholesale electronic trading platform used to trade on the foreign exchange market (FX) with market-making banks. It was originally created as a partnership by large banks and then became part of CME Group.

He takes over responsibilities from Alan Schwarz, co-founder of FXSpotStream, who left the firm in February as part of a planned changeover. Schwarz, who has served as the CEO for over 11 years, chose to keep the specific reasons for his departure private.

Schwarz co-founded LiquidityMatch/FXSpotStream in 2011 after leaving Icap, where he had previously worked for more than seven years as the General Counsel for the Americas. During his tenure, FXSpotStream’s average daily volumes grew from slightly over $18 billion to $63.5 billion thanks to the addition of new liquidity providers and clients to the platform.

Prior to joining EBS, which was later acquired by ICAP in June 2006, Jeff Ward had an extensive background in commercial banking. He held executive-level positions at ABN AMRO, working in locations such as San Francisco, New York, and Amsterdam. His career began at Citibank in New York in 1992, where he was involved in the cash management and securities processing business.