FXSpotStream volumes rebound to $1.27 trillion in May

Trading volumes on institutional FX platforms surged in May as traders increased their bets on central bankers’ policy with evidence mounting that inflation and economic growth are not yet losing momentum.

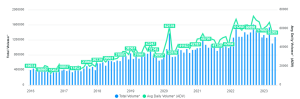

FXSpotStream’s trading venue, the aggregator service of LiquidityMatch LLC, reported its operational metrics for May 2023, which moved higher on a monthly basis. Specifically, May’s total turnover came in at $1.27 trillion, which was up 15.4 percent from $1.10 trillion in the previous month. On a yearly timetable, the figure was virtually unchanged from $1.27 trillion in May 2022.

The total monthly volume across FXSpotStream’s streaming and matching products was comfortably above the $1.2 trillion mark throughout 2023. The activity got off to a strong rebound as the financial markets kicked off the year in high gear, with a multitude of factors helping steer volumes across several venues.

Meanwhile, May’s average daily volume (ADV) was reported at $55.5 billion. The ADV metric was up from $55.3 billion in April 2023, but was down 5 percent year-over-year when compared with $58 billion in May 2022.

FXSpotStream was in the news last month when it appointed Jeremy Rose to the role of senior VP and head of liquidity management.

Jeremy’s crucial role involves overseeing and optimizing the liquidity solutions at the multibank foreign exchange (FX) aggregation service provider that offers clients access to liquidity from multiple global banks.

Jeremy Rose brings more than two decades of experience to his role. He previously served as head of active trading relationship management for more than seven years at Thomson Reuters. With a career dating back to 2001, he possesses a strong background in finance and treasury operations, with a deep understanding of liquidity management principles and practices.

FXSpotStream operates a 24/5 service, enabling clients to trade major currency pairs and select emerging market currency pairs during global trading hours. The platform supports various trading protocols, including FIX API, GUI, and third-party order management systems, to accommodate diverse client needs.

Jeremy will be responsible for developing and implementing liquidity management strategies, closely monitoring client positions, and forecasting future requirements. To that end, Jeremy will collaborate with various teams within FXSpotStream, such as finance and risk management, to establish effective liquidity policies and procedures.